机构洞察-摩根大通-交易宽松周期

机构洞察:摩根大通交易宽松周期

据摩根大通称,“典型的降息周期并不总是积极的,尽管在过去 5 个降息周期中,我们看到 SPX 在 1 个月、3 个月、6 个月和 12 个月的基础上走高。这是对这个周期的预期吗?是的,因为我们认为设置与 1995 年的降息周期最相似,而不像 1998 年、2001 年、2007 年或 2019 年。在过去五个宽松周期中,SPX 在下个月上涨 2.5%,在六个月内上涨 6.1%,在接下来的十二个月内上涨 4.5%。NDX 在这些时间范围内的回报率为 6.4%、8.6% 和 18.6%,RTY 为 3.3%、3.1% 和 4.9%。作为参考,以 1 个月为基础,SPX 在过去的平均回报率为 +0.77% 30 年;NDX 平均为 1.33%,RTY 平均为 0.77%。SPX 每年平均年回报率为 +10.1%,NDX +19.1%,RTY +9.0%。重读此文,数据偏向看跌,但结果范围很广,12 个月 SPX 回报率从 +22.3% 到 -17.8%”

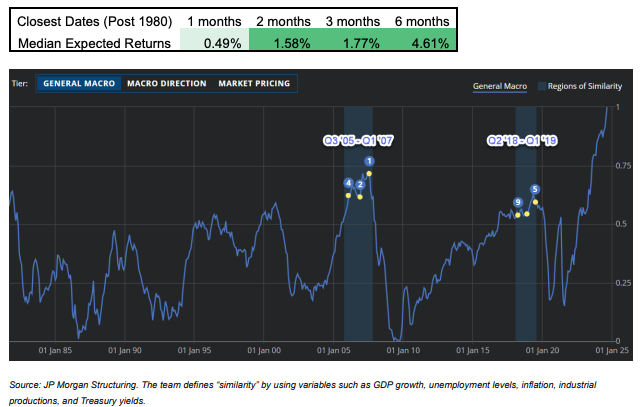

定量历史比较以下信息来自 JP Morgan Structuring 及其时间旅行者工具,该工具旨在查找与当前市场状况的历史比较。他们发现最接近今天的时期是 2005Q3 – 2007Q1 和 2018Q2 – 2019Q1。选择 1980 年后与今天最相似的日子,以下是预期回报。对于有兴趣探索时间旅行者的客户

BULL vs. BEAR

• BULL CASE – (i) Macro data that is supportive of the Soft Landing / No Landing narrative which could look like NFP ~150k with dovish CPI MoM; (ii) Consumers are re-engaged boosting the economy to above-trend growth, reflecting positively on earnings growth (iii) Positive fund flows more than offset negative seasonality; (iv) Improved investor sentiment and macro outlook leads to increased earnings outlook for 24H2 and FY25; (v) Fed cuts lead to multiple expansion; (vi) AI / TMT leads with participation from Cyclicals/Value

• BEAR CASE – (i) NFP has a negative surprise; (ii) CPI has an upside surprise; (iii) Fed disappoints; (iv) Negative seasonality triggers a correction, or worse; (v) US Election surprise triggers volatility; (vi) Elevated bond vol, potentially from Fed path uncertainty, pushes credit spreads wider and weighs on Equities; (vii) Fed cutting cycle triggers something akin to the JPY carry unwind.

US MARKET INTEL VIEW – Tactically Bullish. Following the playbook of at/above trend GDP growth combined with positive earnings growth and an accommodative Fed translates to a bullish view of stocks. Adding some color, this cutting cycle may be most similar to the 1995 cycle, and I view these ‘maintenance cuts’ as coming at a time with still strong household and corporate balance sheets. Further, the reduction in pressure on consumers from lower rates may translate to macro data that inflects higher as soon as this month, from a solid base illustrated by a 2% GDPNow estimate. Earnings delivery remains robust, with 91% of SPX having reported we saw 5.2% revenue growth, 10.8% earnings growth, and 12% profit margins compared to expectations of 4.5%, 8.5%, and 11.8%, respectively. Lastly, while the magnitude and cadence of the Fed’s easing cycle is up for debate, it will begin cutting this month and history suggests that is a positive for stocks when the macro environment is in its current state.

RISKS – (i) Positioning – while aggregate positioning has seen a rebound from the turmoil of early August, we have not seen HFs chasing this rally as they have been selling into strength, let’s see if their bearish view is rewarded; (ii) Seasonality – this century, September has been the worst month of the year averaging -1.7% return (54% hit rate) followed by Q4 being the best time of the year averaging +4.2% (79% hit rate) but if you look at only the last five years, the SPX averages -4.2% (80% hit rate) and Q4 averages +9.8% (100% hit rate). 2024 has not followed 5- year nor 10-year seasonal trends with each month ex-January delivering either a directional or magnitude surprise; (iii) US Election – election years tend to extend the negative September seasonality into October due to policy uncertainty. That both candidates and their policies are known to markets may reduce this effect; (iv) Geopolitics – the situations in both the Middle East and Ukraine have been largely ignored by Equity markets but keep an eye on events that draw either the US or Turkey (NATO) into either conflict. Bullish commodity bets may be the most prudent hedges.

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。