ADP Data Paves the way for Dovish NFP Surprise, Sparking Dollar Bid

US companies cut jobs in December for the first time in 8 months as the wave of coronavirus-related winter restrictions hit services sector, promising a harsh winter for the US economy.

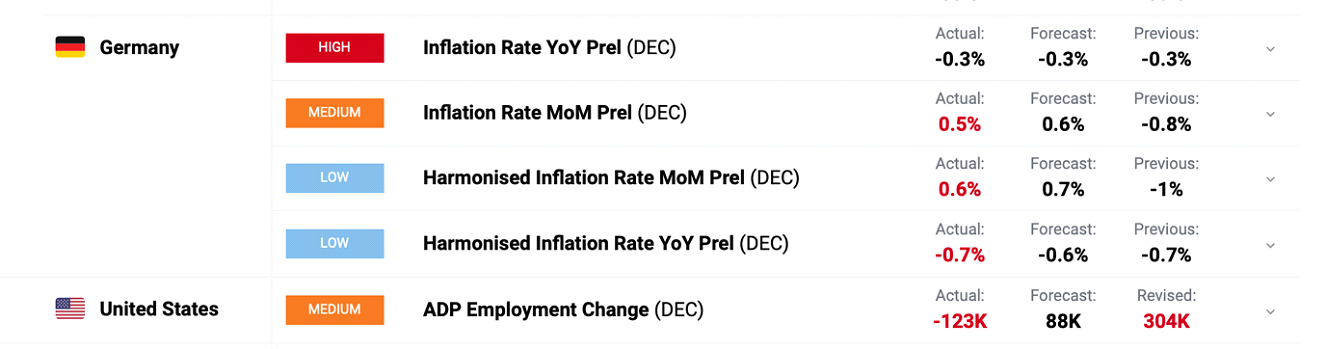

The ADP report released on Wednesday showed that the economy was losing jobs in almost all sectors. The number of jobs was reduced by 128 thousand. The consensus forecast was +88 thousand. The service industry has predictably suffered more damage than manufacturing. Nonetheless, the market chose to ignore the weak statistics, treating the weakness as temporary and focusing on government support, which was approved in December. Its size is almost $1 trillion.

The Fed meeting minutes released yesterday showed that officials are worried about the prospects for the labor market and believe that it will face challenges in the near future. For the market, this means that the Fed has confirmed its intentions to keep the rate near zero for at least 2 more years. Nevertheless, negative statistics are accumulating on the American economy (it is worth recalling the sharp drop in consumer confidence in December, the increased number of layoffs indicated by Challenger, etc.), which may raise the question of the of stock markets overbought, where valuations have priced in quite optimistic forecasts of the US economic recovery and which are subject to correction with respective negative data surprises.

The ADP report has disappointed markets tilting expectations towards of a downside surprise in the NFP report due on Friday.

The data on German economy for December also disappointed the markets. Inflation slowed down to 0.5% against the forecast of 0.6%:

PMIs in the manufacturing and non-manufacturing sectors fell short of expectations in December, urging investors in European assets to wait and reassess the ability of the European economy to recover from lockdowns. EURUSD slid below 1.23 as weak US data limits risk appetite bringing US investors home.

Data on inflation in the Eurozone in December which release is due today, may weaken the euro in the short term, the pair's targets are correction to the level of 1.225 from which we may see rebound and continuation of the primary bullish trend.

The Senate is likely to come under the control of Democrats and the prevalence of rhetoric, which will contain hints of new fiscal stimulus will allow the stock market to grow more confidently. However, if the Democrats' plans to stimulate the economy do not meet the expectations of the markets, then there will be an opportunity to short US stocks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.