As banking system shocks subside the focus shifts to central banks’ battle with inflation

The dollar index struggles to bounce back up after dropping to 102.50 level, in line with the earlier idea that the Fed is avoiding clear policy recommendations, while the ECB is showing more readiness to raise rates. This shifts the interest rate differential in the direction that works against the US currency.

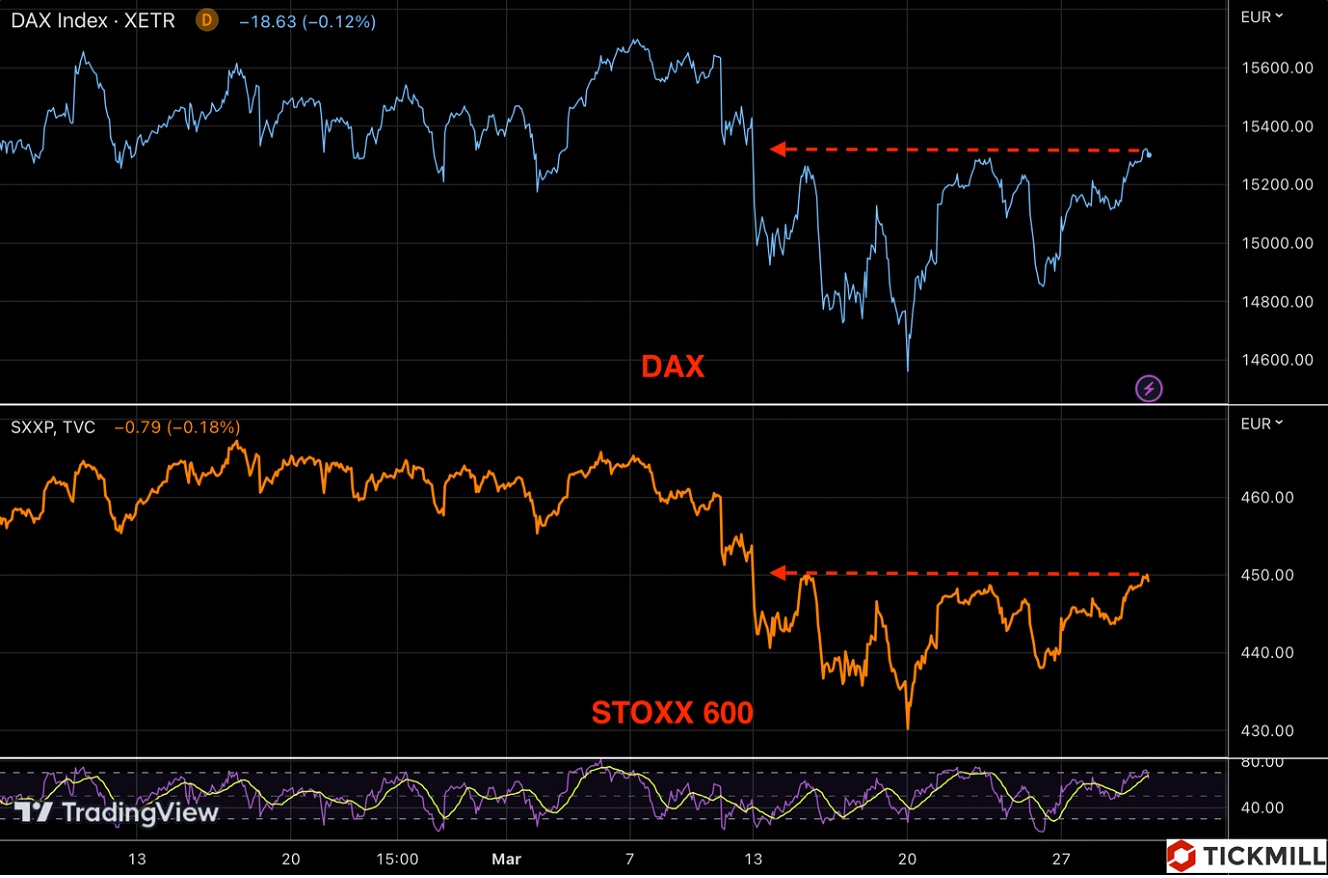

European indices bounced up more than 1% on Wednesday, almost recovering to pre-SVB Financial correction levels:

UBS and Deutsche Bank stocks, which are indicators of the Eurozone's perception of banking stress, continued to rise today, up 2.49% and 3.94% respectively. It's a pretty positive sign that market participants are becoming more confident that shocks in the banking system are successfully isolated and their impact is diminishing.

Significant declines in US crude oil and gasoline inventories according to EIA data supported oil prices, with WTI and Brent rising to two-week highs. Crude oil inventories fell by more than 7 million barrels (forecast +0.1 million), while gasoline inventories fell by 2.9 million (forecast -1.61 million). The inventory drop suggests increased demand from refineries and fuel distributors, such as gas stations, which in turn positively characterizes the dynamics of consumer demand, a key driver of economic expansion.

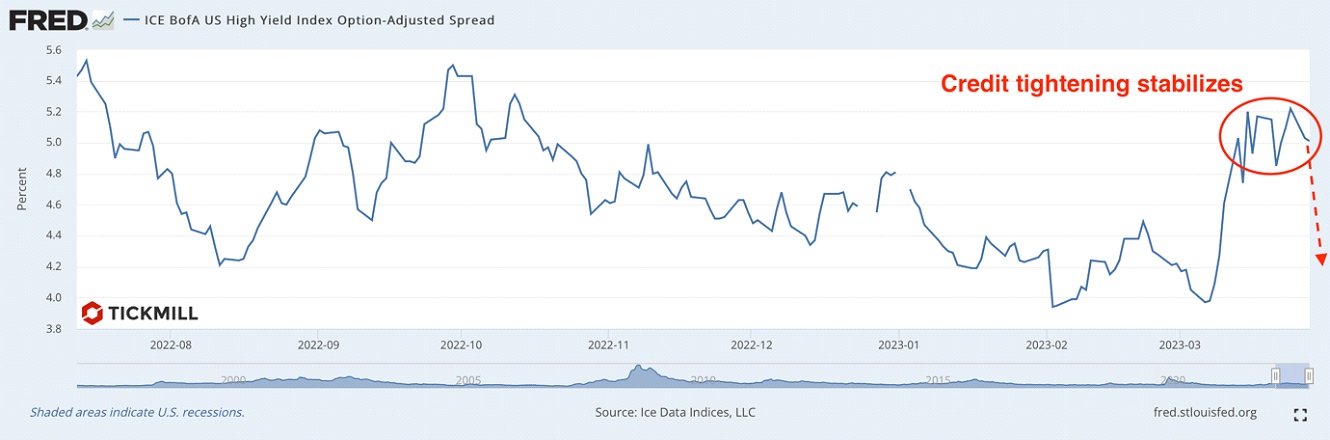

The reduction of concerns about banking stress in the US and EU will inevitably intensify search for yield (rotation from quality to risk), and therefore a narrowing of credit spreads (lower borrowing costs). As shown in the chart below, the spread between investment-grade bonds and high-yield bonds, after rising in mid-March, has stabilized and is likely to soon begin to decline:

As a result, there will also be an increase in inflation risks (thanks to credit expansion), which will inevitably reactivate hawkish rhetoric from the Fed as inflation is still quite high. That's why it may make sense to approach the current rally with great caution and consider the possibility of short positions on risk assets or profit-taking ahead of upcoming speeches by the Fed officials, especially Powell.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.