AUD Down as Aussie Inflation Misses Expectations

AUD Sold At European Open

The Australian Dollar has come under heavy selling pressure across the Asian session and into the early European session on Wednesday. The sales came in response to the latest set of Aussie economic data which showed inflation undershooting forecasts last quarter.

Headline & Trimmed Mean Inflation Both Miss

Headline CPI printed 0.6%, down from the prior quarter’s 0.9% and the 0.9% the market was looking for this time around. Trimmed mean CPI was also below forecast coming in at 0.3%, down from the prior month’s 0.4% and below the 0.5% the market was looking for this time around.

Fuel Prices Saw Biggest Positive Contribution

Looking at the breakdown of the data from the Australian Bureau of Statistics, the biggest positive contributions in the quarter came from automotive fuel, which rose 8.7%, followed by accessories, which rose 7.3%. On the downside, tertiary education saw a -1.7% contribution over the quarter while new dwellings contributed -0.1%.

Government Grant Impact on Prices

Commenting on the fall in new dwellings specifically, the Head of price Statistics at the ABS, Michelle Marquardt, said: “The fall in new dwelling prices was due to the impact of the Federal Government’s Home-Builder grant and similar grants by the Western Australian and Tasmanian state governments. Without the offset from these grants, the price of new dwellings would have risen, reflecting increases in materials and labour prices in response to strong demand.”

Inflation Rising, But Far from RBA Target

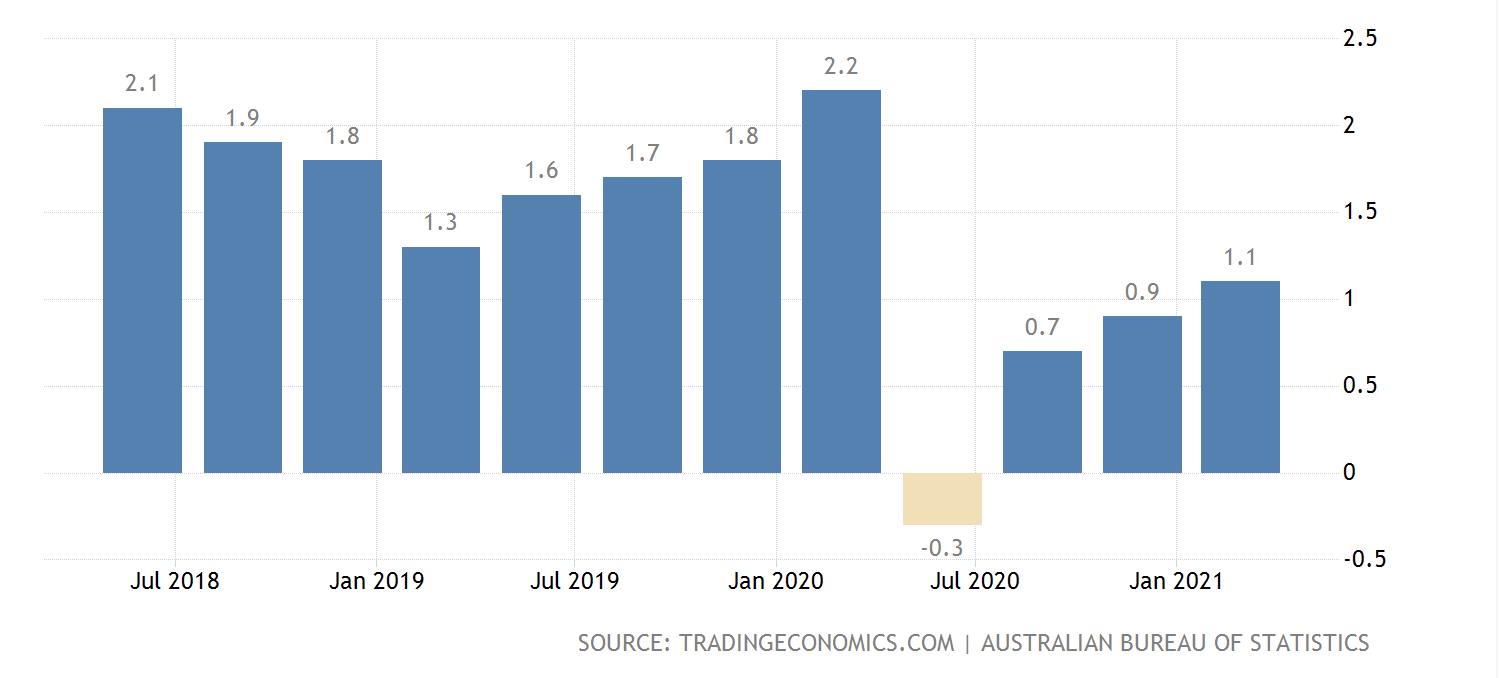

Despite the undershooting of expectations, annual inflation is now back up 1.1%, having risen steadily from the -0.3% printed in the June quarter 2020 during the height of the pandemic. However, at that level inflation is still around only half-way back to the RBA’s 2%-3% target which was last seen during the June quarter 2018.

RBA Easing to Remain

At its recent meeting, the RBA cautioned that inflation would remain sticky for some time and with the bank focusing on delivering its inflation target through increased wage growth, there is clearly no risk of the bank tightening monetary policy in the near term, raising downside risks for the Aussie. The RBA has cited optimism over the economic recovery in Australia, despite the uncertainty in the outlook, though remains steadfast in its view that rates are likely to remain on hold until 2024 at the earliest.

Technical Views

AUDUSD

Following the breakout above the bull flag formation (corrective channel from highs), AUDUSD has so far been capped at the .7824 level once again. Should price decline from here there is the potential for a head and shoulders pattern to develop with the neckline at .7564 being the key downside price pivot to note. To the topside, a break above .7824 will open the way for a move back up to .8003

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.