August NFP Suggests Inflation Pressure from the Labor Market Started to Decrease

The bond market selloff has been offering significant support to the greenback this week. The dollar index (DXY) rose to 110 on Thursday, however it failed to secure fresh highs and turned into a decline on a technical bounce. The main event of the day was the Non-Farm Payrolls report, which diverged from expectations, and in an unexpected way. Job growth was 315K against the 300K forecast, so no surprises here. Somewhat more interesting were the data on wage growth and unemployment. Monthly wage growth unexpectedly slowed down and amounted to 0.3% against the forecast of 0.4%:

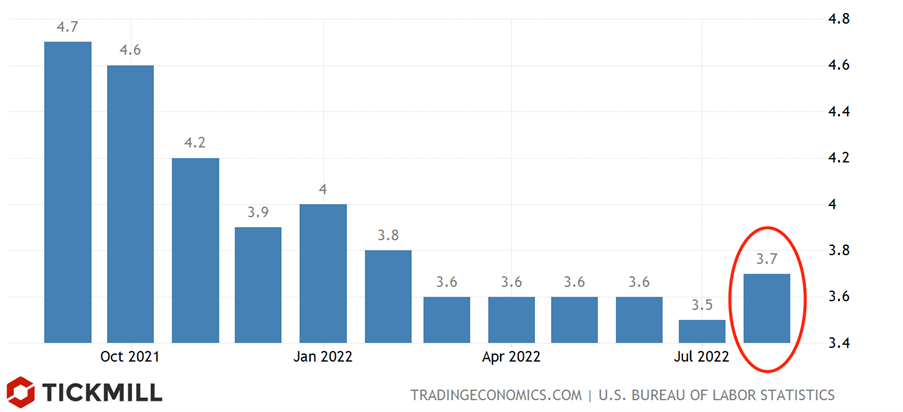

Unemployment unexpectedly rose by 0.2%, from 3.5% to 3.7%. It is worth noting that the increase in the unemployment rate occurred for the first time since the beginning of this year:

Earlier, ADP reported that the economy had moved from a high to a more moderate pace of job creation.

In general, the NFP report showed that the unusual imbalance in the US labor market (the excess of demand for labor over supply) is gradually starting to wane. This means that inflation pressure generated by this imbalance is also set to decline. First of all, this is indicated by the moderating pace of wage growth, which is the key sign that supply and demand for labor has finally begun to converge. Taking into account the increase in LFPR (from 62.1% to 62.4%), the chances of further moderation of employment growth in the economy increase. The growth of this indicator may also indicate that the households’ post-COVID savings are running out and the incentive to enter the labor market and look for work will only increase.

The main issue of concern to investors remains the impact of moderation signs in the labor market on the Fed tightening path. Earlier, the regulator hinted that it is willing to sacrifice the pace of economic growth in order to quickly return inflation to the target level. There is certainly no room for conclusion that today's report will somehow boost the chances that the Fed will soften the pace of tightening. However, chances of a 75 bp rate hike in September will likely decrease. In my opinion, the room for an upside in the US dollar will be limited, as investors are likely to switch to the September meeting of the ECB, which could be very positive for the Euro. The dollar index may find resistance at 109.50 next week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.