Bearish Signals Mount for the European Currency

The S&P 500 hit a fresh high on Monday, despite the growing chances of policytightening by the Fed as investors focus on surprises in US corporate reportsand sliding Treasury yields. Tesla's capitalization has exceeded $ 1trillion onthe back of the news that car-sharing company Hertz ordered 100K Teslas.Despite incriminating investigations, Facebook has delighted investors with soliduser growth and an intention to buy back $50 billion in shares. The momentummay push the US market to a new high, as earnings surprises from Twitter,Alphabet and Microsoft, which are reporting today, are likely to be positive aswell.

As of October 20, of the 500 companies included in the S&P 500, 67companies reported. Earnings of 86.6% of them beat expectations, 11.9%disappointed, indicating potential presence of bullish bias in the US stock market.

In the FX, the dollar is trying to develop an upward movement after breakoutof a two-week bearish channel. In the last few sessions, the dollar index consolidatedclose to the upper border of the channel, in addition, three tests of thesupport zone 93.50 lacked meaningful continuation:

A potential surge of optimism amid positive reporting by large US companiesthis week may nevertheless exert short-term pressure on the dollar.

The weakening of the euro amid a price shock in the commodity market willlikely force the ECB to revise its short-term inflation forecast, which maybecome known at tomorrow's meeting. If the ECB does not clarify the timing ofthe curtailment of the main asset purchase program, in combination with theeconomic forecast, this could be a blow to the real yields of European bondsand lead to an additional Euro downside.

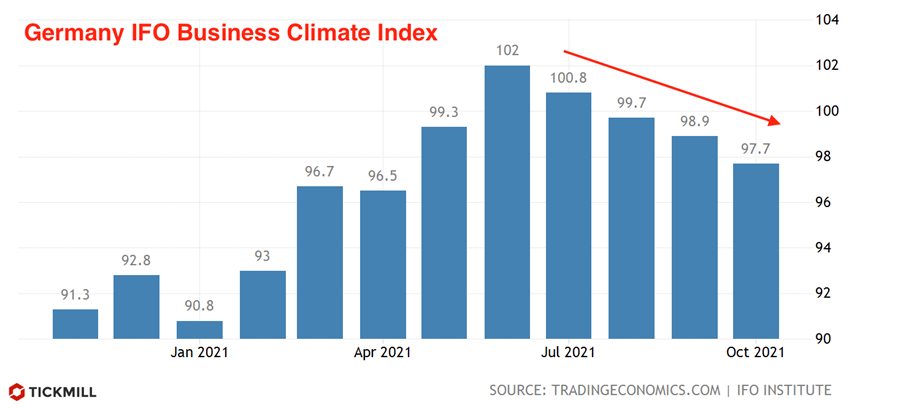

Yesterday's data showed that Germany's leading indicator of economicactivity, the IFO index, declined for the fourth straight month in October:

Both current situation and expectations deteriorated, which increases therisk of stagnation of the German economy in the fourth quarter. Given theslowdown in the bloc's leading economy, the ECB's bias to cut stimulus measuresor report upcoming cuts may be small right now, which is definitely a bearishEuro signal:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.