Bitcoin Recovery Gaining Ground

BTC Pushing Higher

Bitcoin prices are continuing to grind higher on Thursday as the recovery off the $80,195 level lows starts to gain traction. The futures market is now up more than 13% off the month’s lows, helped in part the dovish repricing we’ve seen in the Fed rates outlook recently. Market pricing for a December rate cut is now around 85% up from below 40% at the start of last week. This shift comes in response to mixed September labour market data, some dovish Fed commentary and weaker-than-forecast PPI and retail sales data on Tuesday. With traders now widely expecting the Fed to ease again we’ve seen a broad rebound in risk appetite which is feeding into better demand for crypto again.

State Treasury Purchase & ETF Flows

BTC is also being boosted this week by news that the Texan state treasury purchases $5 million shares in the BlackRock BTC ETF, making it the first US state to do so. This marks an important milestone for the crypto community and opens the way for other states to follow suit. Any further news of subsequent state purchases should help bolster BTC sentiment keeping prices supported near-term. Additionally, the latest industry data shows that BTC ETF flows have turned net positive again this week following heavy outflows in recent weeks. Together, these factors suggest that BTC should continue to recover near-term, particularly while Fed easing expectations remain high.

Technical Views

BTC

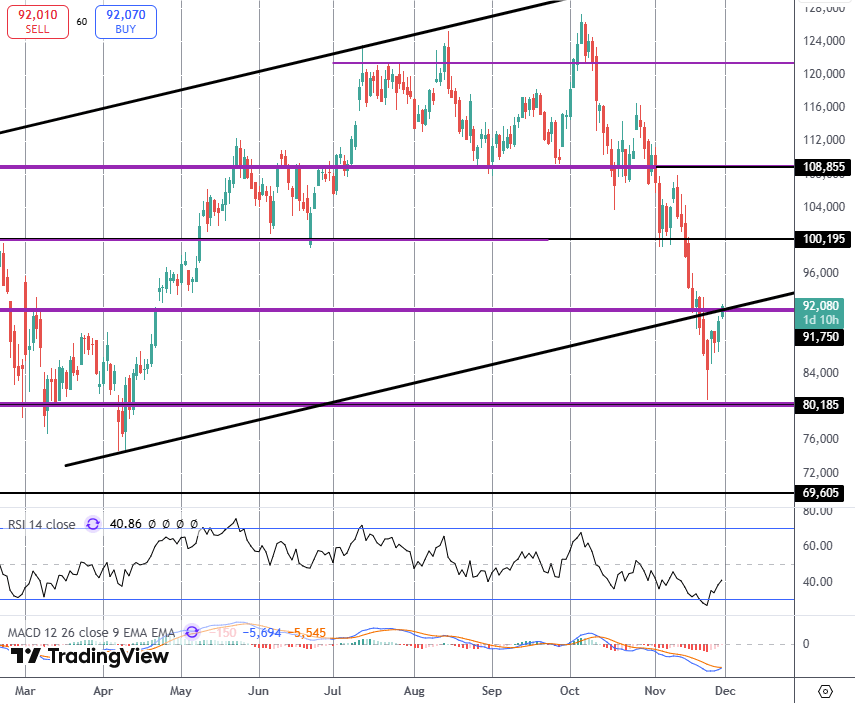

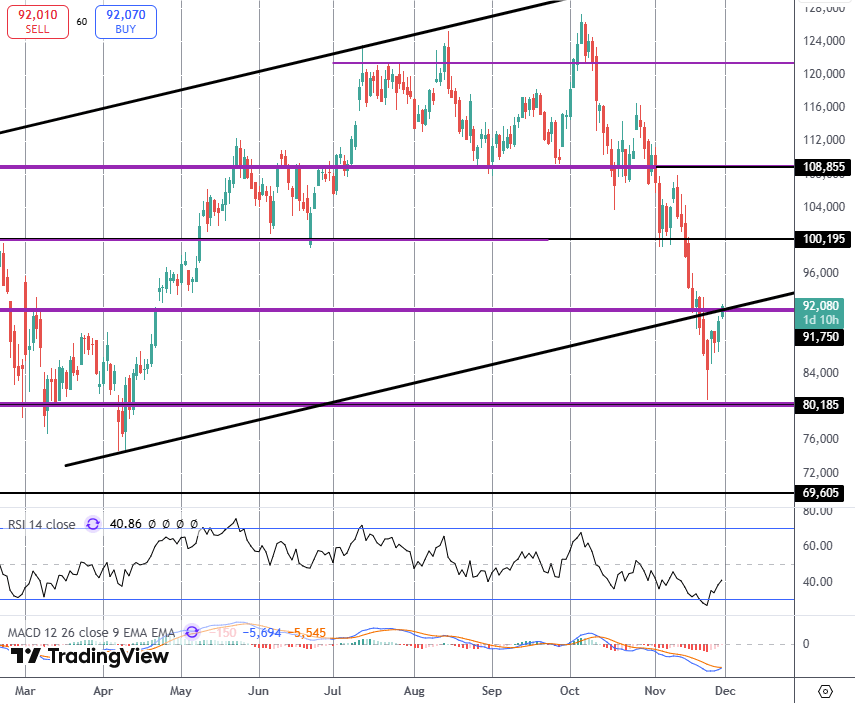

The sell of fin BTC has stalled for now into a test of the $80,185 support. Price is now attempting to get back above the broken bull channel lows and $91,750 area. If bulls can break back above this area, focus will be on a recovery back towards the $100k mark next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.