BOJ Comments Fuel USDJPY Volatility

Comments & Confusion

USDJPY is back under offer today as volatility in the pair continues. The pair plunged almost 4% on Thursday before buyers kicked in to send the rate back up over the last two sessions. The main driver behind the whipsaw action is comments from the BOJ on monetary policy ahead of the coming meeting next week.

BOJ U-Turn

Comments last week from BOJ’s Ueda seemed to point to the prospect of a forthcoming shift in BOJ policy, which drove JPY sharply higher. However, the BOJ has since seemingly U-turned on these comments, noting that it sees no likely need for an imminent shift in BOJ monetary policy. These latest comments have seen the market walking back its expectations of any shift in policy next week.

Hawkish BOJ Risks Remain

However, on the back of recent BOJ operational tweaks and comments, traders are very sensitive to the fact that there are hawkish risks going into next week’s meeting. While the BOJ might not adjust policy, we could certainly get more of a signal that a change is coming next year which, if seen, should reignite JPY longs. Alternatively, if the bank pushes back against these expectations USDJPY might see a fresh leg higher near-term, particularly if we get any unexpected strength in tomorrow’s US CPI report.

Technical Views

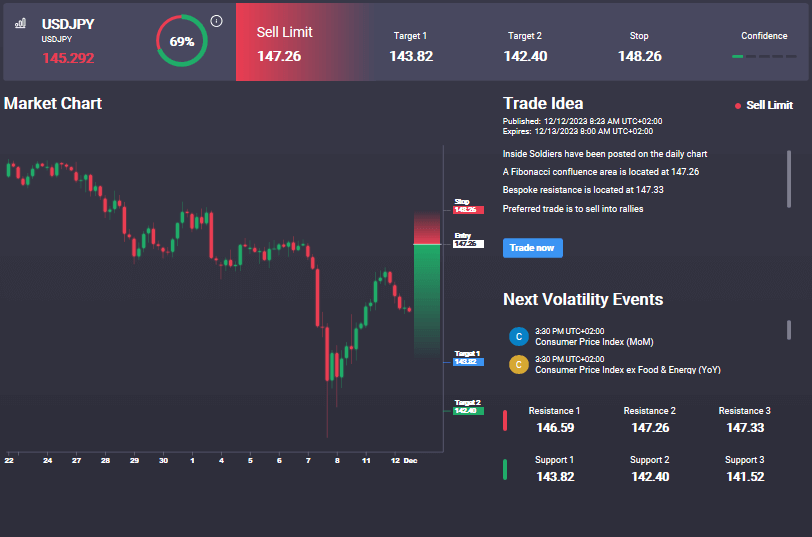

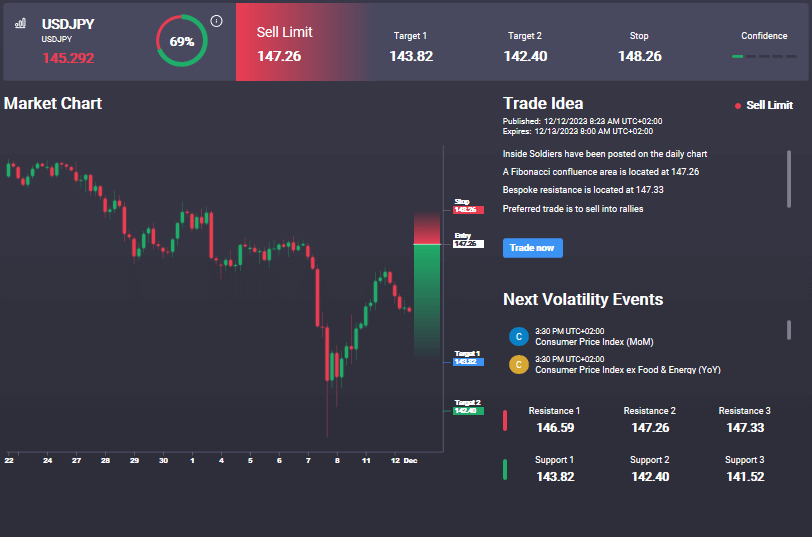

USDJPY

Following the breakdown below the rising trend line and below the 145 level, USDJPY has since bounced sharply off the 142.03 level and is now trading back above 145. While above here, the focus is on a further push higher towards the 148.98 level next. However, if price slips back below current support, focus will shift back to 142.03 and potentially lower, in line with bearish momentum studies readings. Notably, we have an active sell signal in the Signal Centre today set at 147.26, suggesting a preference to fade any rallies.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.