CAD Retail Sales on Watch Following CPI Fall

BOC On Watch

With no US data on deck today, the focus will be on Canadian retail sales. With the BOC very much back in the show regarding rate hikes, traders are paying close attention to incoming CAD data. Earlier in the week we saw CAD CPI falling again last month, downplaying near-term hawkish BOC rate-hike expectations. The monthly headline CPI reading came in at 0.1%, down from 0.4% prior and below the 0.3% the market was looking for. With inflation cooling further, the BOC might well opt to pause at the next meeting on the back of two successive hikes over the last two months. However, with the other monthly readings seen beating expectations (despite falling against the prior month), expectations are still evenly split.

Retail Sales in Focus

Looking to today’s retail sales data, if the readings are seen coming in above forecasts this will no doubt feed into increased hawkish BOC expectations. In this scenario, CAD is likely to trade higher across the day. On the other hand, if we see weakness in today’s reading, that should keep CAD pressured near-term. Given the current strength in USD. Any resulting weakness in CAD today would be firmly bullish for USDCAD into the FOMC next week.

Technical Views

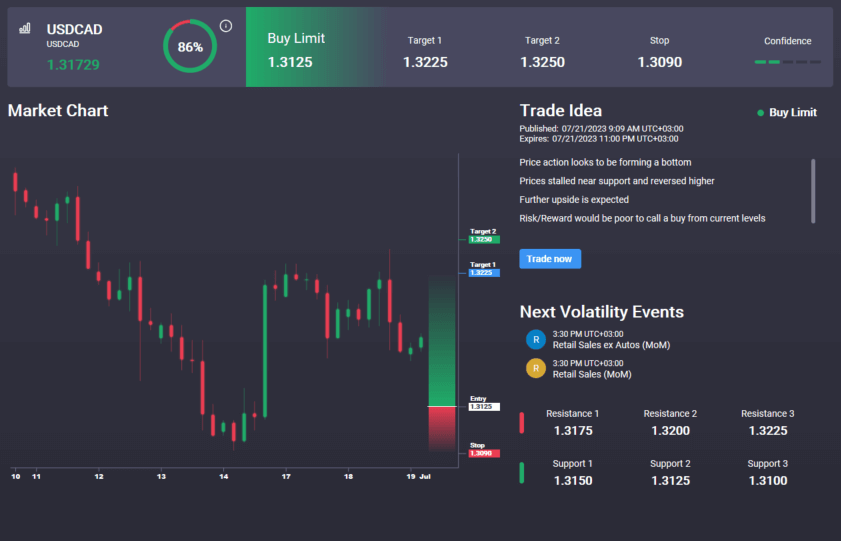

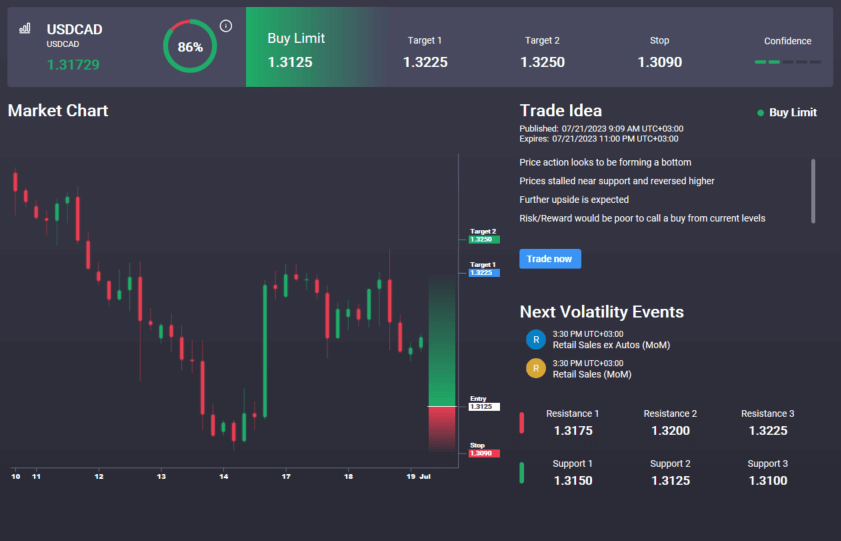

USDCAD

The sell-off in USDCAD has seen the market breaking down below the 1.3280 level recently. However, the sell off has failed to follow through with price since carving out an interim support base around the mid 1.31 area. Should these lows break, 1.2962 will be the next support to note. Notably, we have an active buy signal in the Signal Centre today from 1.3125 targeting a move back up to 1.3225 initially.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.