Can Copper Breakout Continue?

Copper Hits 3-Month Highs

Copper prices surged higher yesterday on a combination of increased optimism over a US/China trade deal and a fresh rate cut from the Fed. The futures market broke out to fresh 3-month highs, eclipsing the previous monthly high set on October 9th. News that the US and China have agreed a deal which will include an extension of the current tariff pause for a further 12 months has seen risk assets broadly higher into the back end of the week.

Fed Cuts Rates – But Offers Mixed Guidance

The lift in sentiment around news of the US/China trade deal was amplified by a fresh rate cut from the Fed yesterday. The bank announced a further .25% cut in rates, in line with market expectations. However, market reaction to the news was muted as Powell went onto highlight division among Fed members in the post-meeting presser. Powell note that a furtehr cut in December is not a done deal, saying that policymakers had very split opinions on furtehr easing given the ack of labour market data available currently. With USD remaining bid on the back of the meeting and growing uncertainty over whether the Fed will cut again, the near-term outlook is a little cloudy. However, the fallout from the US/China trade deal should continue to support commodities prices for now.

Goldman Issues Warning

Despite the current rally, there is still some pessimism over whether copper can retest YTD highs this year. In a note this week Goldman Sachs warned that the rally in copper is unlikely to last unless we see a meaningful drop in inventories. Recent supply disruptions have helped lift prices on tighter market expectations. However, Goldman sees this as temporary and unlikely to sustain the rally unless copper stores move down from record levels, driving demand higher.

Technical Views

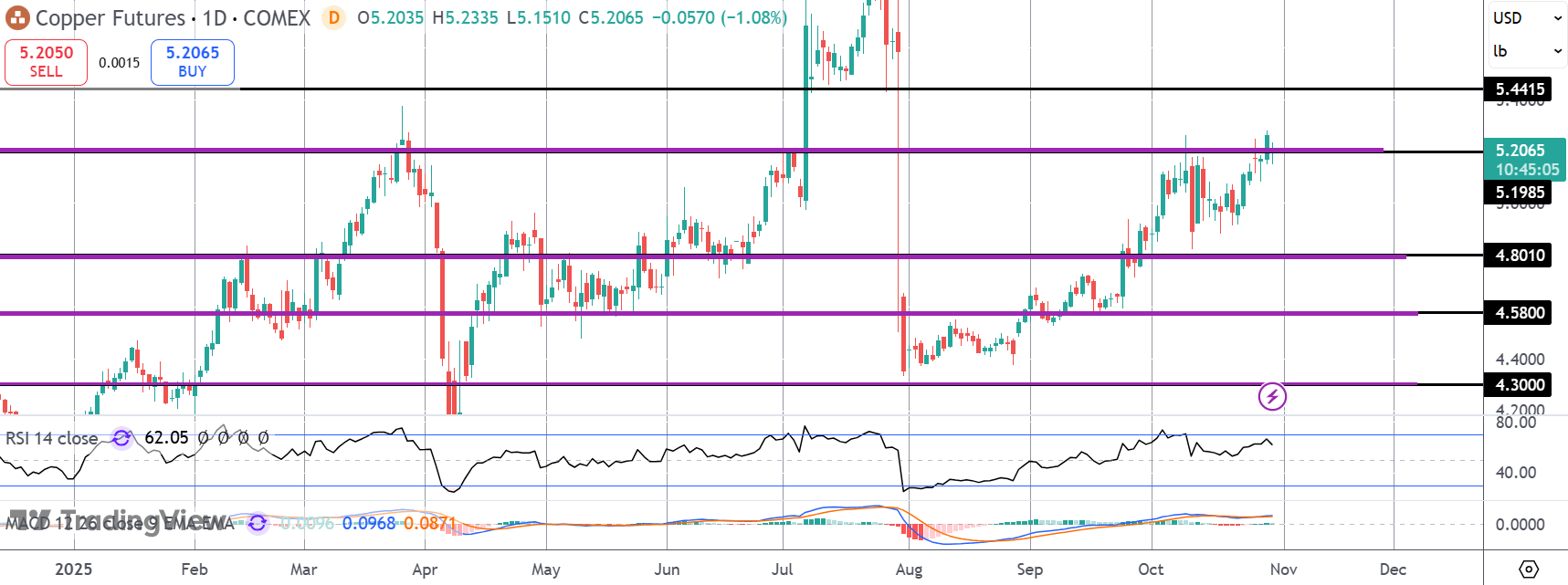

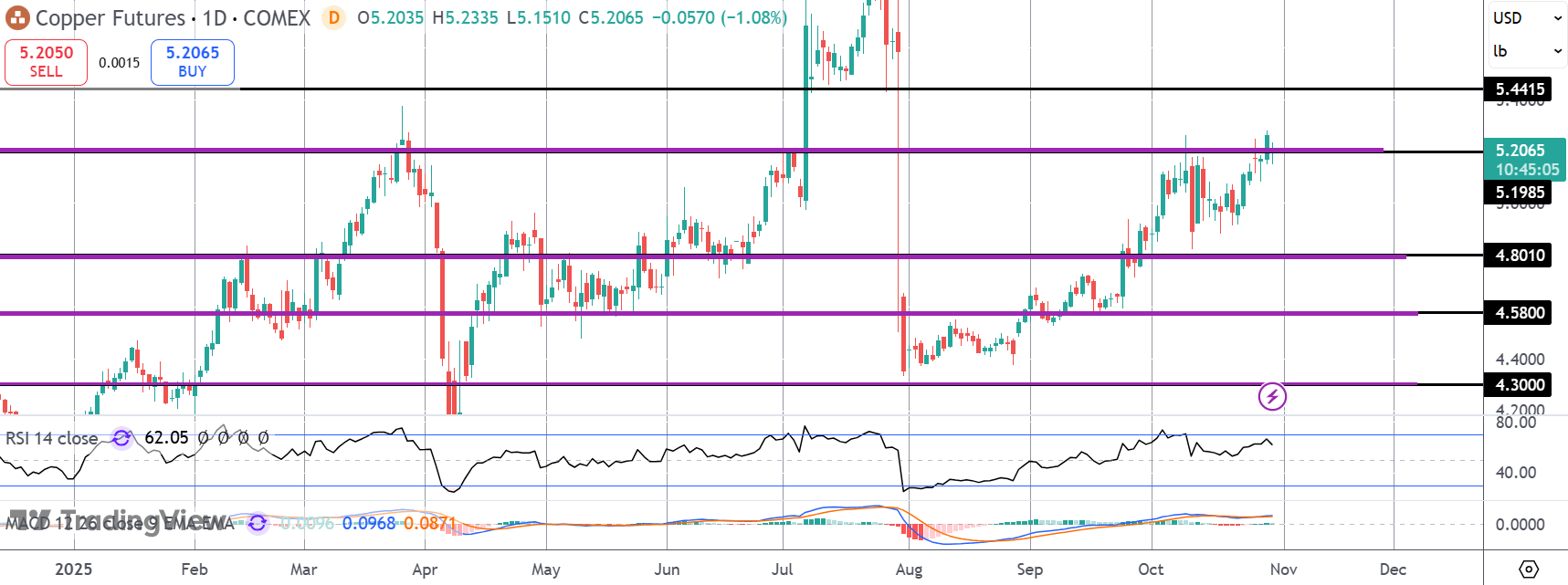

Copper

Copper prices are now testing above the 5.1985 level again which, if broken, opens the way for a test of higher resistance at the 5.4415 level next. Bearish divergence in momentum studies is worth noting here, however, and traders should be wary of any reversal signals particularly if we move back below 5.1985 near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.