Chart of the Day AUDUSD

Chart of the Day AUDUSD

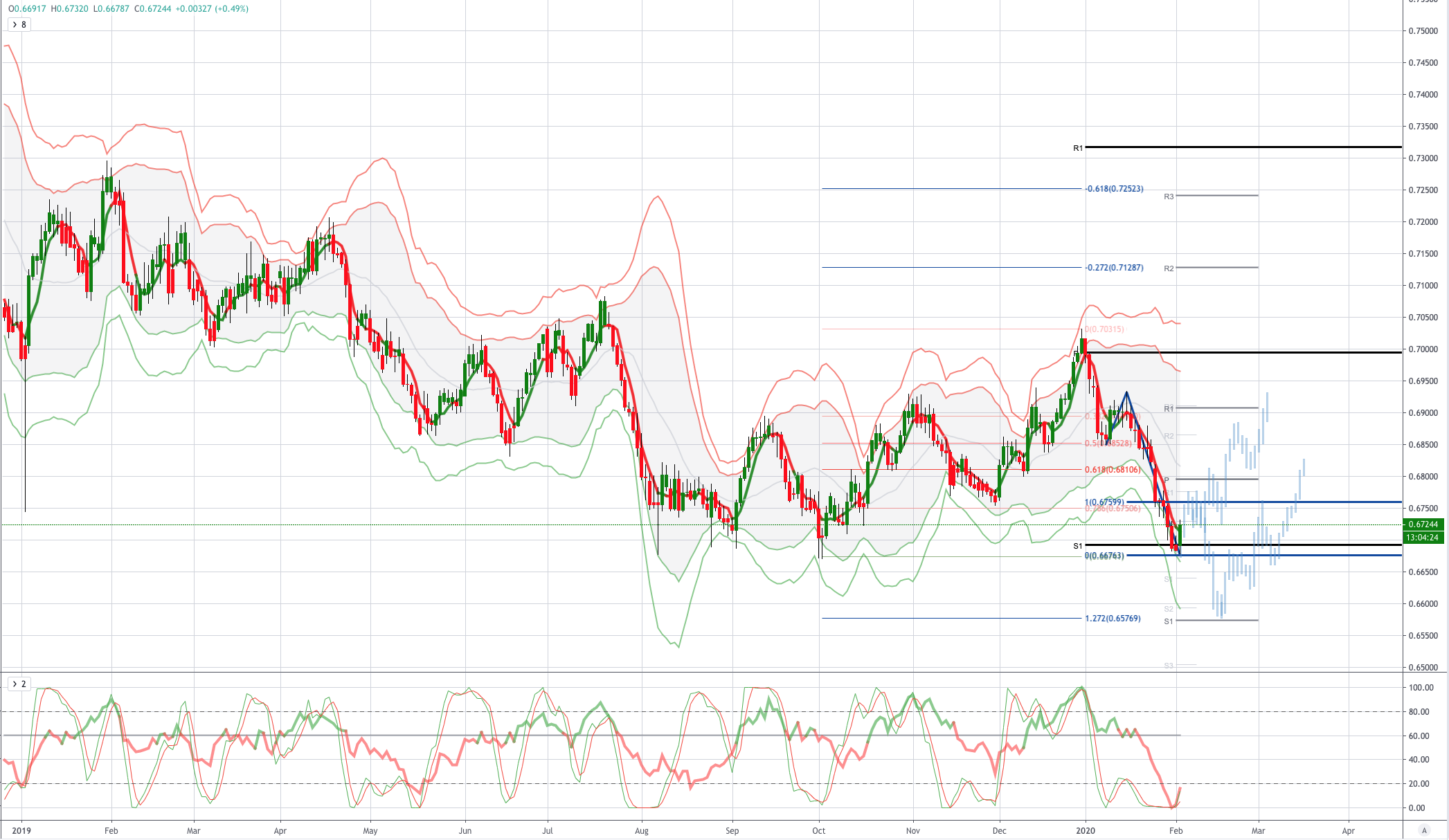

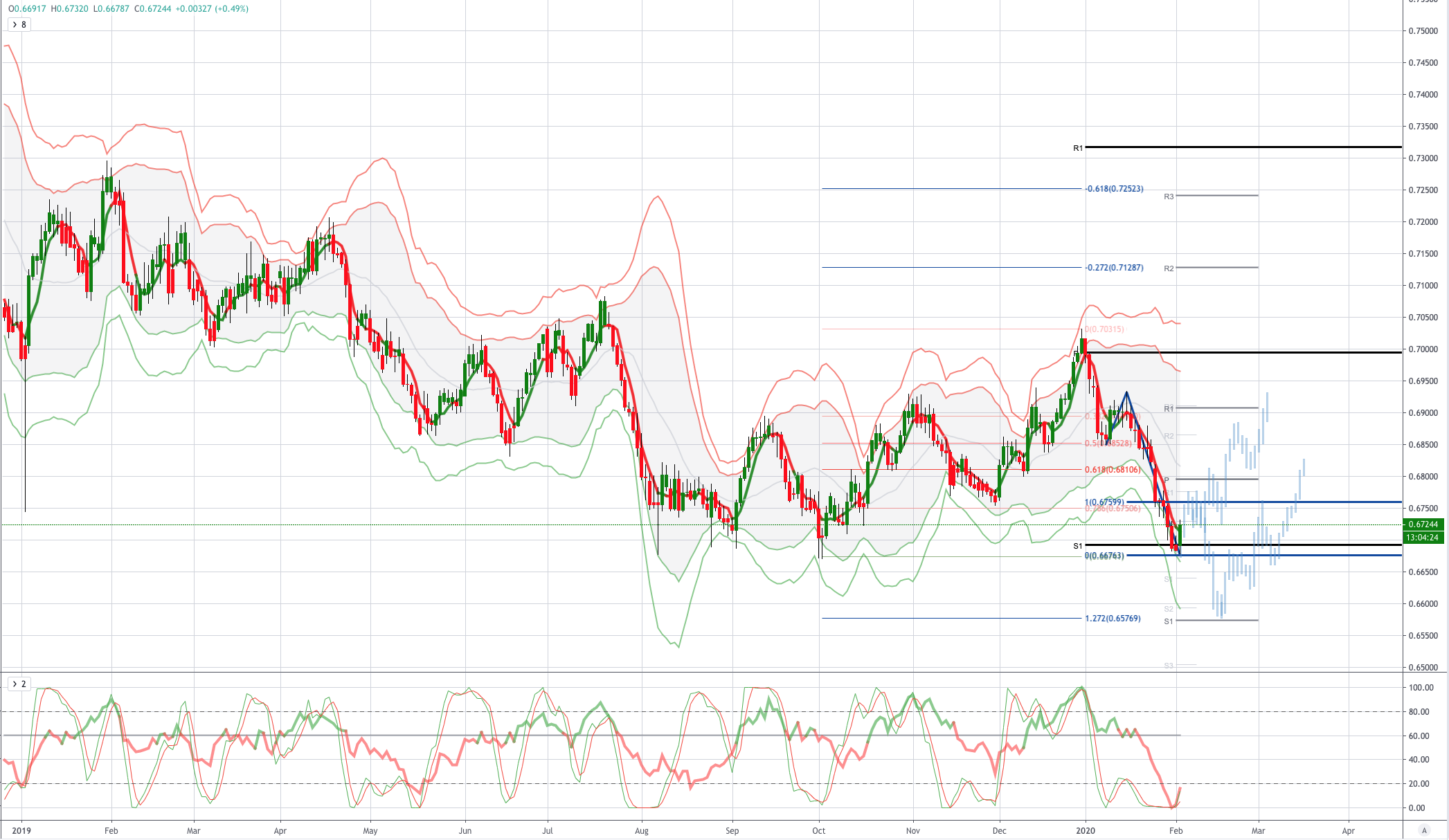

Potential reversal AUDUSD

AUDUSD - Asian equity markets have rebounded strongly overnight despite further reports of Coronavirus cases, including the first death in Hong Kong. The Australian central bank as expected, left interest rates unchanged. However, it noted downside risks to economic growth and said that it stood ready to lower rates if necessary.

The Caixin services PMI for January, which will be released early Wednesday, will be watched for early signs of the impact of the coronavirus on the economy. Given that the official manufacturing and non-manufacturing indices for January and the ‘Caixin’ manufacturing reading all showed little discernible effect, it is likely that the services reading will also have been taken too early to show much impact.

The Australian Dollar is feeling better into Tuesday, with the currency initially bolstered from recent lows as fears associated with the coronavirus are calmed. We've also seen demand after the RBA went ahead and left rates on hold, with no added dovishness in the communication, opting for more of a wait and see outlook. Looking ahead, US durable goods and US factory orders are the only notable standout on the calendar for the remainder of the day.

From a technical and trading perspective,AUDUSD is testing a potentially pivotal double bottom at .6670 area not only is this representative of a structural double bottom level but it also retains the yearly first support pivot point. A close today above .6730 would flip the daily chart bullish, however, some caution is warranted on long exposure, as we didn't get much in the way of divergence into the current low, in fact Psych registered a new low in sentiment. From a technical perspective we now have symmetry swing resistance sited at .6760 as this level contains corrective attempts, from a cycle perspective we should make a new low, with a minimum projected target of .6575, from this level we could see a more sustained correction back above .6800.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!