Chart of the Day AUDUSD

Chart of the Day AUDUSD

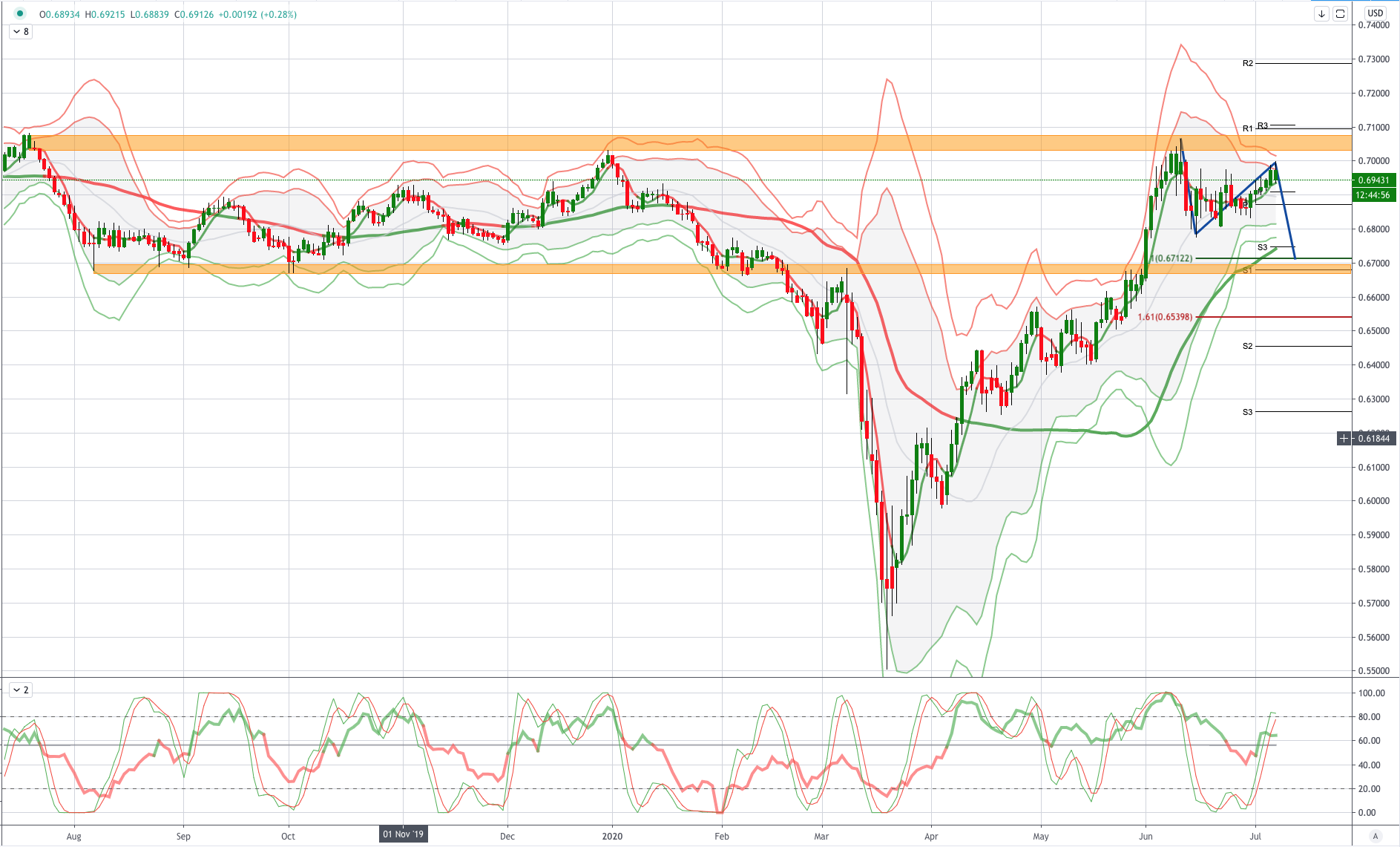

AUDUSD Potential Reversal Zone - Probable Price Path

AUD: As expected, the Reserve Bank of Australia kept rates and its policy stance on hold today. Highlights from the statement include: (a) despite the pace of asset purchases having decreased lately, the Bank is ready to scale them up again if needed, (b) no policy normalisation before progress is made towards the inflation and employment goals, and (c) the contraction has been somewhat smaller than previously expected.All in all expect to face downside risks in the short term, also on the back of the flare-up in cases in Australia and fresh lockdown measures, with Australia's second largest city Melbourne returning to stage three lockdown for six weeks from midnight tomorrow as the state continues to grapple with its second wave of the coronavirus pandemic. The return to lockdown was announced by Victorian Premier Daniel Andrews today, after the state recorded its highest ever number of COVID-19 infections overnight, 191 new cases The startling figure is the second day in a row Victoria has recorded triple-digit figures, with 127 cases revealed yesterday.

USD: In June, the US Supply Management Association's non-manufacturing index rose from 45.4 to a four-month high of 57.1, returning to the expansion level, which was better than the market expectation of 50.2. The service industry employment index rose from 31.8 to 43.1, reflecting that the current job market is still contracting. White House chief of staff Meadows said that President Trump is preparing to issue a series of administrative instructions to ensure the resolution of disputes with China, including the return of manufacturing to the United States, as well as immigration, drug prices and other issues, but did not disclose further details. The US Department of Agriculture reports that the amount of soybeans exported to China from the US is expected to increase, reflecting China's feed demand.

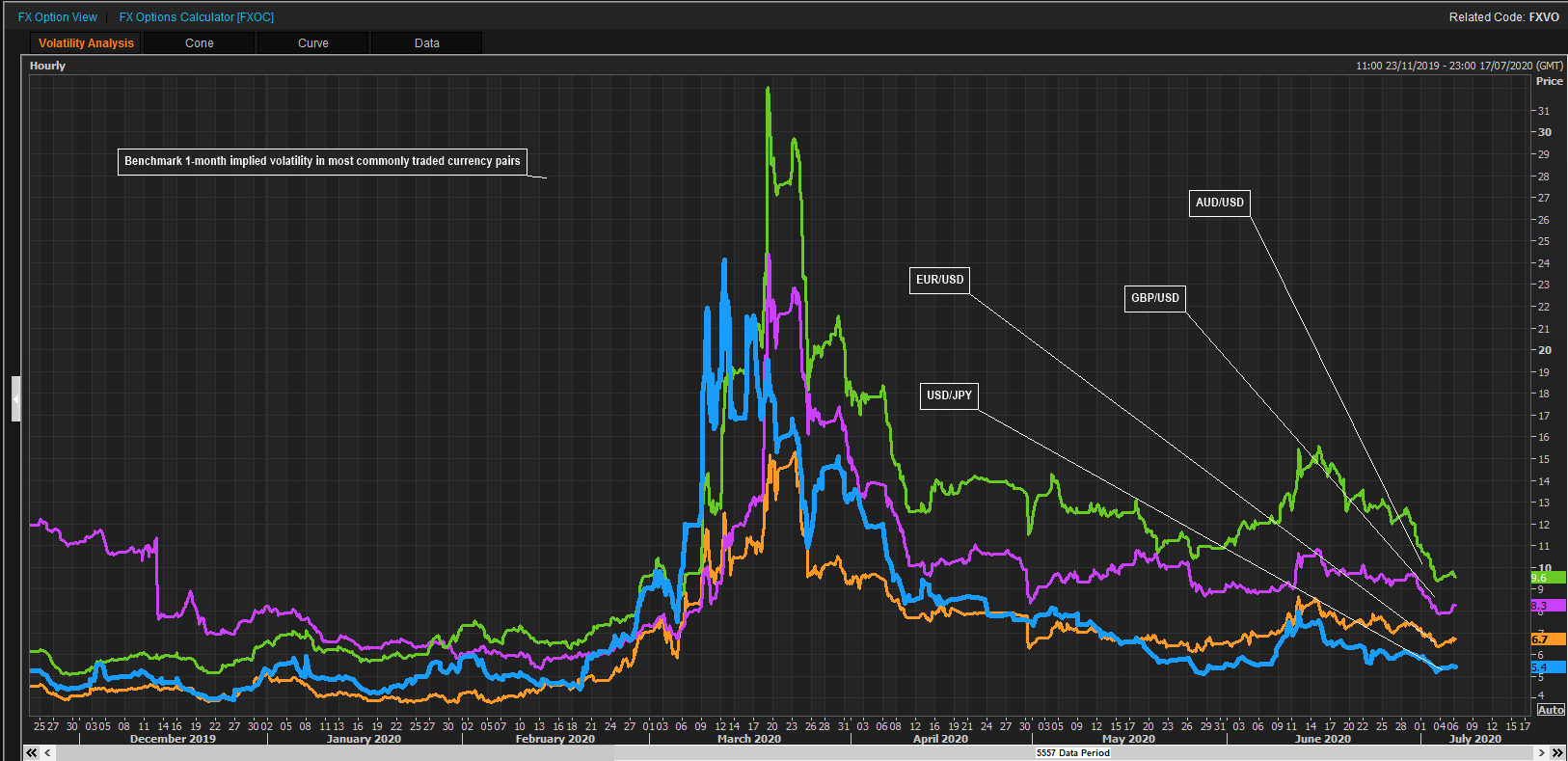

From a technical and trading perspective, the AUDUSD continues to find supply towards the .7000, as this level continues to contain the upside attempts, bears will look for a close below the near term volume weighted average price at .6935, bearish exposure should be rewarded below here for a move to test an equality objective sighted at .6712 this area has proved pivotal over the last 12months. Note AUDUSD volatility slide stalls for now – one-month implied volatility in lower-mid 9s, still the highest in G10 FX and supports the potential for a drift lower to test range support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!