Chart of the Day EURUSD

Chart of the Day EURUSD

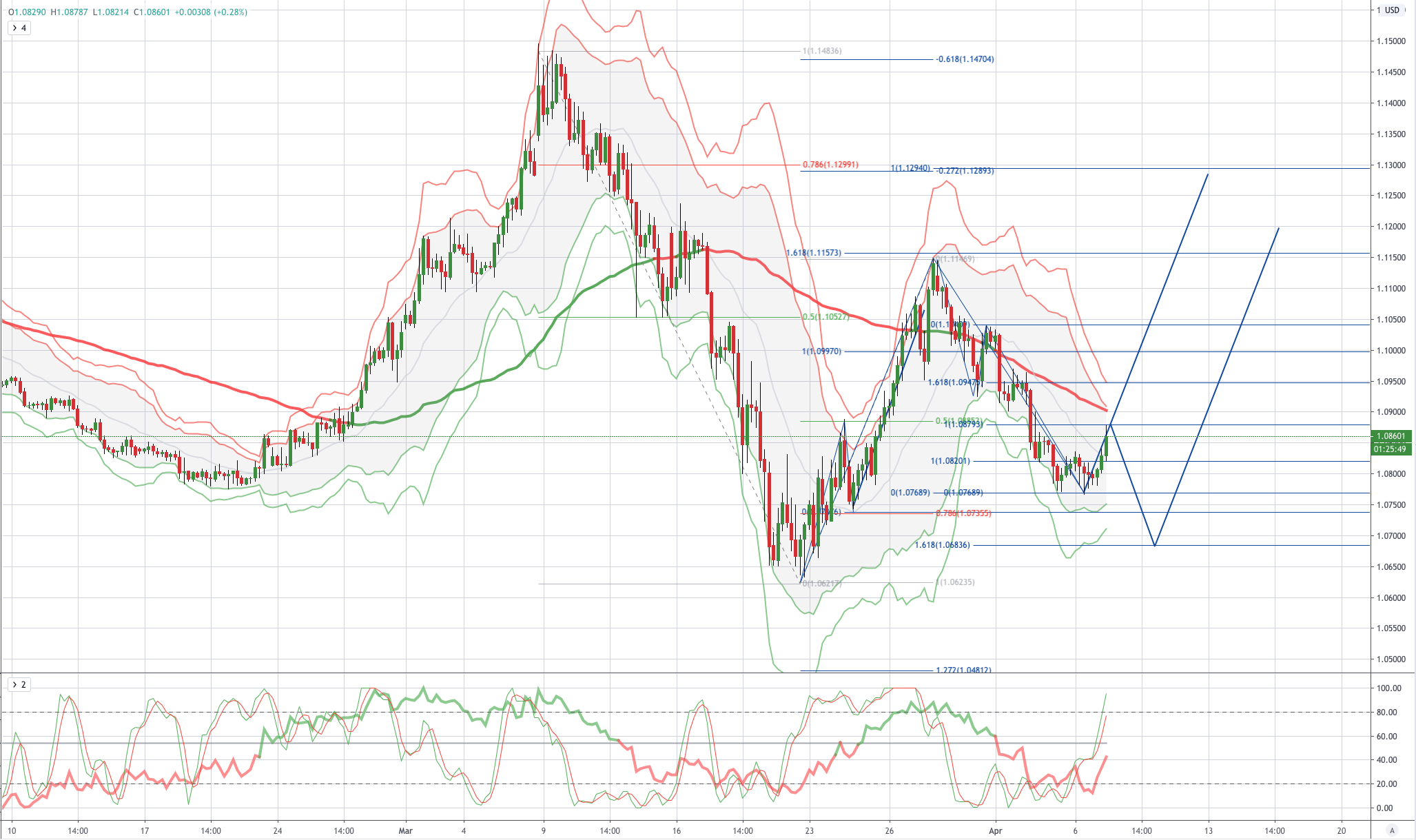

EURUSD - Probable Price Path

EURUSD - Today then focus will be on the Eurogroup meeting of finance ministers to decide on a European response to the coronavirus economic impact to complement national fiscal measures and the ECB’s monetary policy stimulus package. There has been well-publicised disagreements on so-called ‘corona bonds’ favoured by countries including France, Spain and Italy, but opposed by others such as Germany and the Netherlands who are adverse to joint EU debt liabilities. Northern European countries instead favour the use of credit lines from the European Stability Mechanism (the EU’s bailout fund), with countries reportedly receiving potential funds of up to 2% of GDP. Reports suggest that other supporting measures will be considered, including a European Commission proposal for a short-time working scheme worth €80-100bn.

Attention will remain on the trajectory of the coronavirus outbreak, especially in some of the hotspots, amid signs that the number of cases may be easing. As noted above, the number of new cases in Italy fell to 3,599, the lowest in nearly three weeks, while in Spain new infections declined to a two-week low of 5,029. UK new infections also fell to 3,839, but that is still higher than a week ago.

The Federal Reserve has announced another new facility. In conjunction with the US Treasury, the Fed will provide term loans to banks backed by small business loans made under the Paycheck Protection Programme (a scheme which provides loans to small businesses which keep employees on their books and helps keep cash flow running).

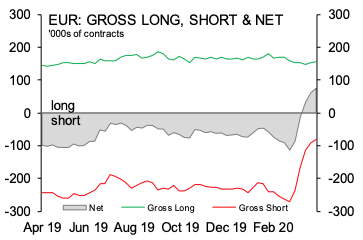

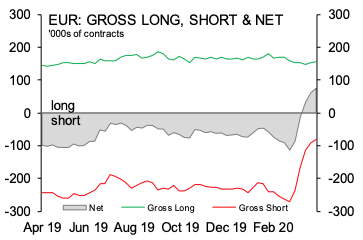

According to IMM data the growing EUR spec long, might not be what it seems. Net EUR longs rose for a third week, recording a sizable USD1.9bn increase to USD10.2bn or 74.3k contracts, which is the most constructive speculative investors have been on the EUR since mid 2018, on the face of it. But a deeper dive into the data reflects the fact that all of the recent “improvement” in EUR sentiment has been driven by a reduction in gross short exposure, which has more than halved over the past month (from 166.5k contracts to 80.8k). Gross EUR longs are more or less flat over the same period (153.8k a month ago versus 155k in this week’s report). Investors are less bearish on the EUR, it would appear, rather than more negative on the USD.

According to IMM data the growing EUR spec long, might not be what it seems. Net EUR longs rose for a third week, recording a sizable USD1.9bn increase to USD10.2bn or 74.3k contracts, which is the most constructive speculative investors have been on the EUR since mid 2018, on the face of it. But a deeper dive into the data reflects the fact that all of the recent “improvement” in EUR sentiment has been driven by a reduction in gross short exposure, which has more than halved over the past month (from 166.5k contracts to 80.8k). Gross EUR longs are more or less flat over the same period (153.8k a month ago versus 155k in this week’s report). Investors are less bearish on the EUR, it would appear, rather than more negative on the USD.

From a technical and trading perspective, the EURUSD has tested and held the equality objective at 1.08 and decent bids have emerged. Intraday the key hurdle is the symmetry swing resistance at 1.0880, if this is breached then a daily close through 1.09 would encourage the recovery and set bullish sights on an upside equality objective towards 1.1280 which has a cluster of Fibonacci significance representing the 78.6% retracement of the March decline, the 1.272% extension of the first leg of the corrective recovery and the 100% equality objective. On the day a close through 1.08 would negate the bullish thesis.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!