Chart of the Day GBPUSD

Chart of the Day GBPUSD

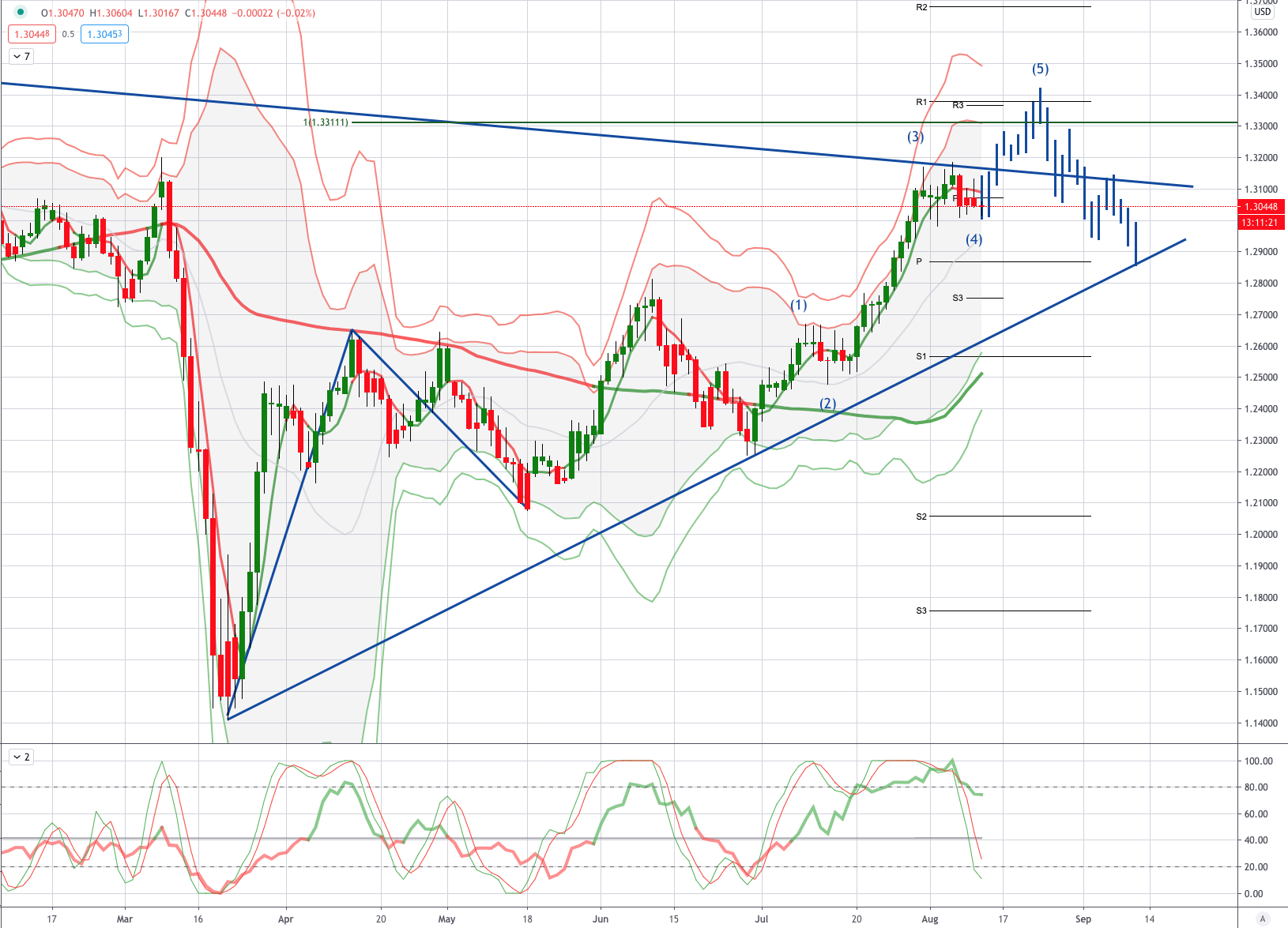

GBPUSD Potential Reversal Zone - Probable Price Path

GBP: In the UK, a media report highlights that Chancellor Sunak may postpone his Autumn Budget in the event of another wave of Covid-19 infections. UK GDP posted a stronger-than-expected gain of 8.7% in June. The acceleration from May’s more modest, but upwardly revised 2.4% increase reflected stronger growth in services (+7.7%) as more of the dominant sector emerged from lockdown. Construction (+23.5%) and manufacturing (+11%) also recorded more rapid growth in output. Despite the rebound in June, GDP still fell by 20.4% in Q2, the biggest quarterly decline on record.

USD: Investors seemingly expecting a new US fiscal package to be forthcoming despite the lack of progress in negotiations to date. Trump said he was “very seriously” looking into cutting the capital gains tax (likely by removing the inflation-indexation from the capital gains calculation), which would again circumvent Congress. The trend in COVID-19 new cases and hospitalisations in the US remains downwards, providing hope that social distancing restrictions can be removed in time across affected states and the broader reopening process for the economy can continue. Russia became the first country to grant regulatory approval for a COVID-19 vaccine, despite only two months of trials

From a technical and trading perspective, the GBPUSD continues to test the major descending trendline resistance at the 1.31 level, the current consolidation could potentially be the 4th wave in an incomplete 5 wave cycle. Bulls should look for a close back through 1.31 to deploy bullish exposure, a breach of 1.3185 will encourage bulls setting sights on confluent equality objectives 1.33/34 before another profit taking pullback likely plays out. A closing breach of 1.2975 would negate the near term bullish thesis opening a correction to test bids back towards 1.28

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!