Chart of the Day NZDCAD

Chart of the Day NZDCAD

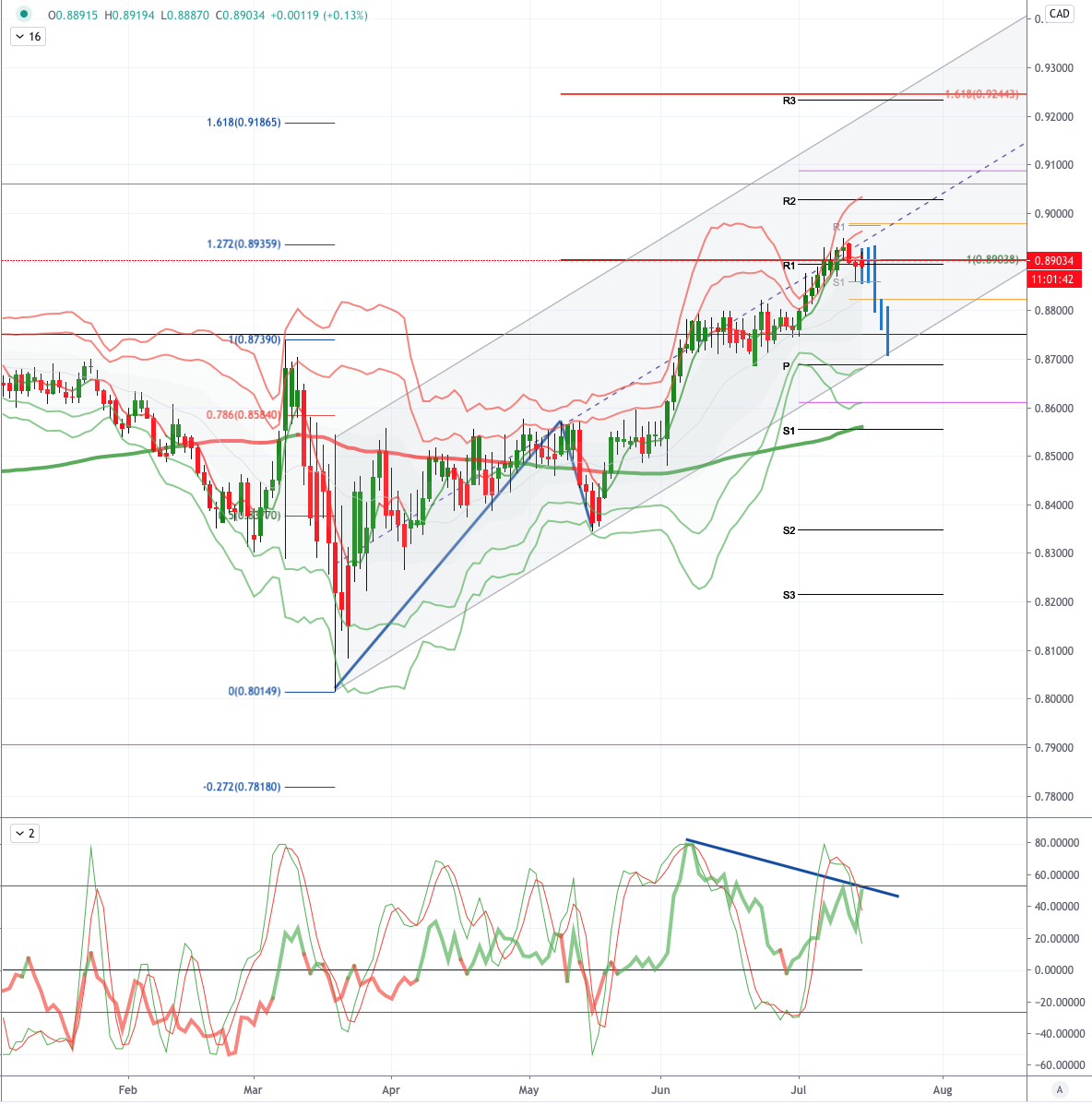

NZDCAD Potential Reversal Zone - Probable Price Path

The market is looking forward to further progress in coronavirus vaccine research. The tug-of-war continues with global risk appetite surging amid the start of US earnings season despite rising Covid-19 cases, especially in Florida. US banks reported a mixed bag of earnings with near record loan loss provisions of almost $28b for JPMorgan, Citigroup and Wells Fargo alone. Wells Fargo reported its first quarterly loss since 2008 and cut its dividend, and Citigroup also fell, whereas JPMorgan rose on a record trading revenue. Meanwhile, the Trump administration has rescinded new rules on foreign students studying online after lawsuits filed by Harvard and MIT, but President Trump has signed into law a bill sanctioning Chinese officials who contributed to the erosion of Hong Kong autonomy. The S&P500 index gained 1.35% while the VIX eased to 29.52. UST bonds ended flat with the 10-year bond yield at 0.62%. The 3-month LIBOR edged marginally lower to 0.2709%

NZD: The New Zealand Dollar has regained a bid tone into Wednesday, with the currency trading off the risk on flow. Meanwhile, PM Ardern has warned the country must prepare for a second wave of the coronavirus, in light of developments in other countries around the world. Earlier, the RBNZ purchased NZD390 million in government bonds at its daily operations

CAD: The Canadian Dollar has run into a period of sideways trade, with the currency mostly likely not wanting to make any fresh directional decisions until it sees what comes of today's anticipated central bank decision. Looking ahead, we get the Bank of Canada policy decision, Canada manufacturing sales, and a batch of US releases including exports, empire state manufacturing, industrial production and the Fed Beige Book.

From a technical and trading perspective, NZDCAD has advanced from the March lows to test upside objective confluence at .8903/35, this area represents the equality objective and the 127.2 extension measured move from Match high to low swing. Profit taking has started and it is reasonable to anticipate a further pull back as such bearish exposure should be rewarded ona breach of yesterday’s closing level at .8890 initially targeting a move to test the ascending trendline support and monthly pivot sighted at .8700, a closing breach would open a test of projected monthly range support sighted at .8600. A close through .8950 would negate the corrective thesis opening a .9180/9245 test next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!