Chart of The Day NZDUSD

Chart of the Day NZDUSD

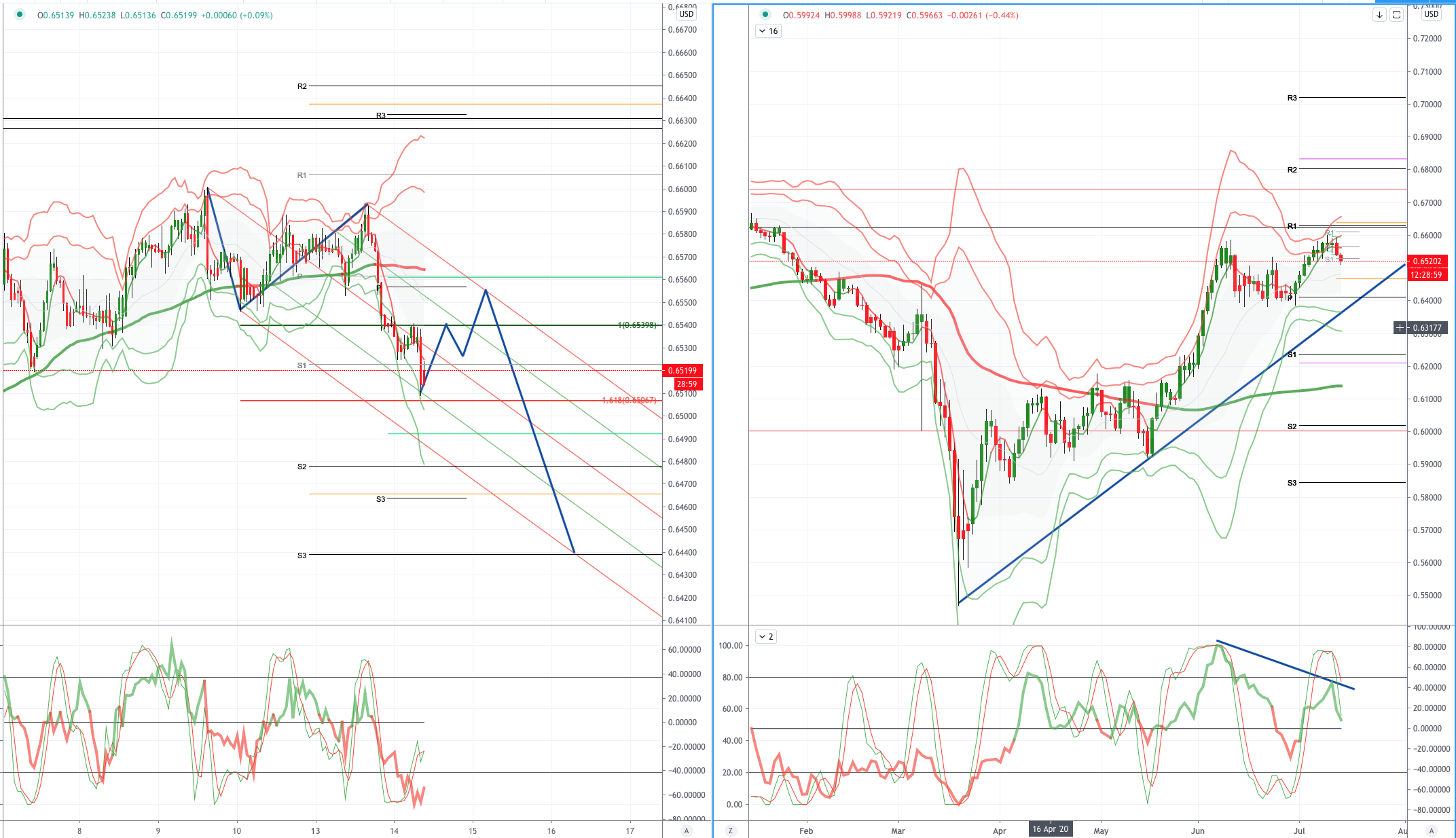

NZDUSD Potential Reversal Zone - Probable Price Path

US stocks broadly closed Monday’s session on a lower note after an early rally waned in response to California’s decision to roll back on reopening amid surging Covid-19 cases. Cases continued to rise in the US and worldwide; the WHO said that globally, cases rose by 1mil in a span of five days; the US continued to see record increase where states like Florida alone added 15,000 cases in a single-day. Hong Kong meanwhile is battling its third wave by swiftly introducing strict social distancing rules. The Dow Jones alongside its major peers had started the week with encouraging gains, ahead of the earnings season that kicks off today, rising more than 400pts before easing from the top of 2,6639 to finish the day little changed (+0.04%). The S&P 500 fell 0.94%, led by losses in the infotech and telecommunication sectors. The tech-heavy NASDAQ was down by 2.1% from its record high, snapping a three-day gaining streak. Stocks in Europe and Asia had closed higher earlier. Meanwhile, US treasury yields fell on Monday as investors bought the safer assets; 10Y UST yield fell 2.6bps to 0.618%. Gold price rose slightly (+0.2%) back above $1800/ounce. Crude oil fell more than 1% - Brent crude settled at $42.72/barrel and WTI at $40.1/barrel

NZD: New Zealand home sales rose 7.1% year-on-year in June, returning to positive growth for the first time in four months. Todd Muller, the leader of New Zealand’s largest opposition national party, announced his resignation, ending his term of less than two months. He said he could not be the leader of the opposition party when the country faced a critical moment.

USD: US Secretary of State Pompeo issued a statement alleging that China claimed that it was completely illegal to own most of the maritime resources in the South China Sea, as well as the bullying behavior to control these resources. The Chinese Ministry of Foreign Affairs announced that it will impose sanctions on US Senators Marco Rubio, Ted Cruz and other officials in response to US sanctions against China due to the Xinjiang issue. Bloomberg quoted sources as reporting that the US government ruled out the possibility of punishing China by weakening the Hong Kong dollar linked exchange rate.

From a technical and trading perspective, NZDUSD on the daily time frame has posted what seems to be a daily double top below the .6600 handle, the pattern is given further credence with the notable momentum divergence. Bears will be looking to increase bearish exposure on the intraday one hour timeframe, looking to increase short positions on the first three wave pull back versus the current impulsive decline. Overlaying a standard pitchfork can help identify high probability action areas, as of writing corrective pullback into the .6550 should be monitored for intraday reversal patterns to extend short exposure, ultimately looking for a test of the major trendline support coming in at the .6400 handle.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!