Chart of the Day US500 (S&P500)

Chart of the Day US500 (S&P500)

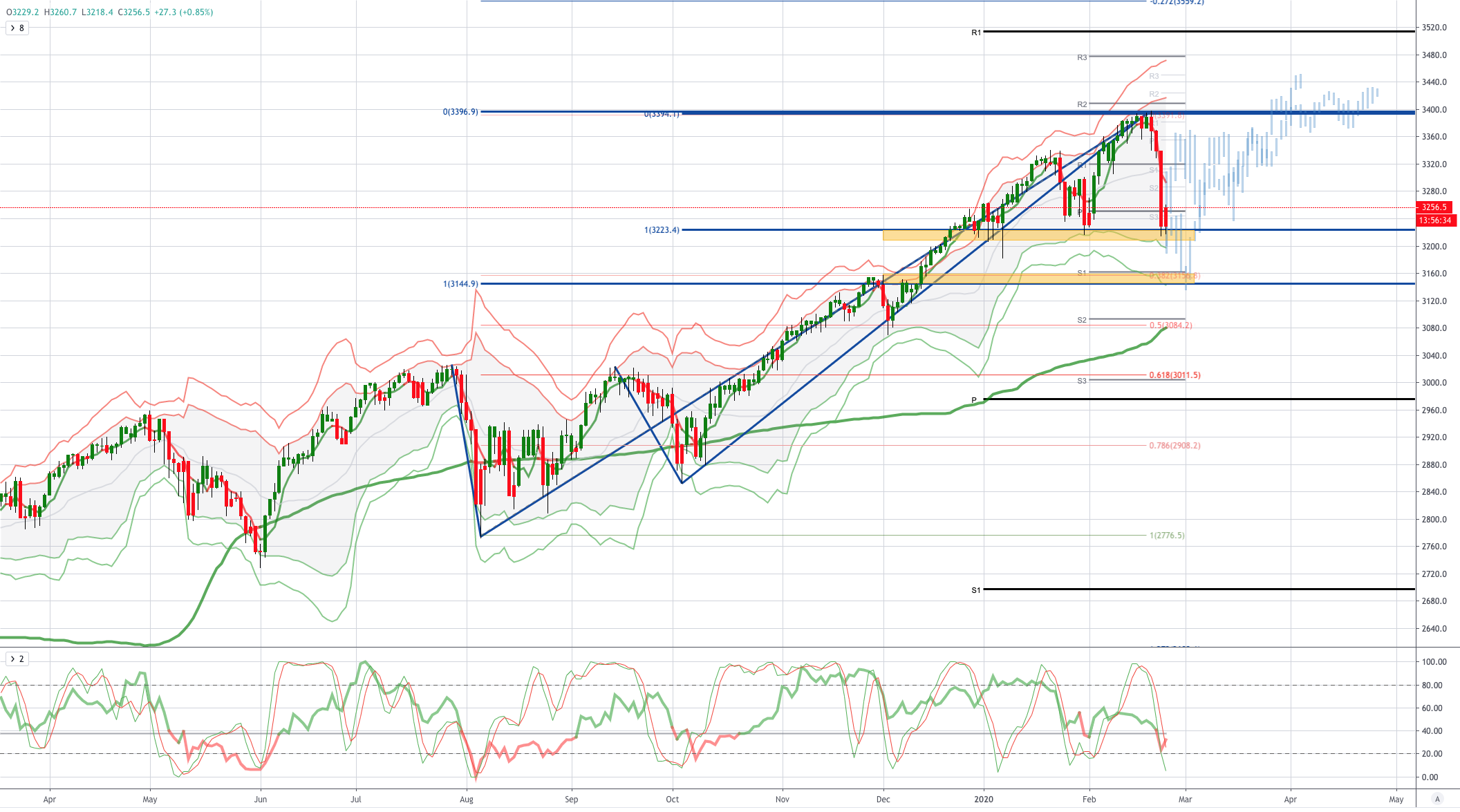

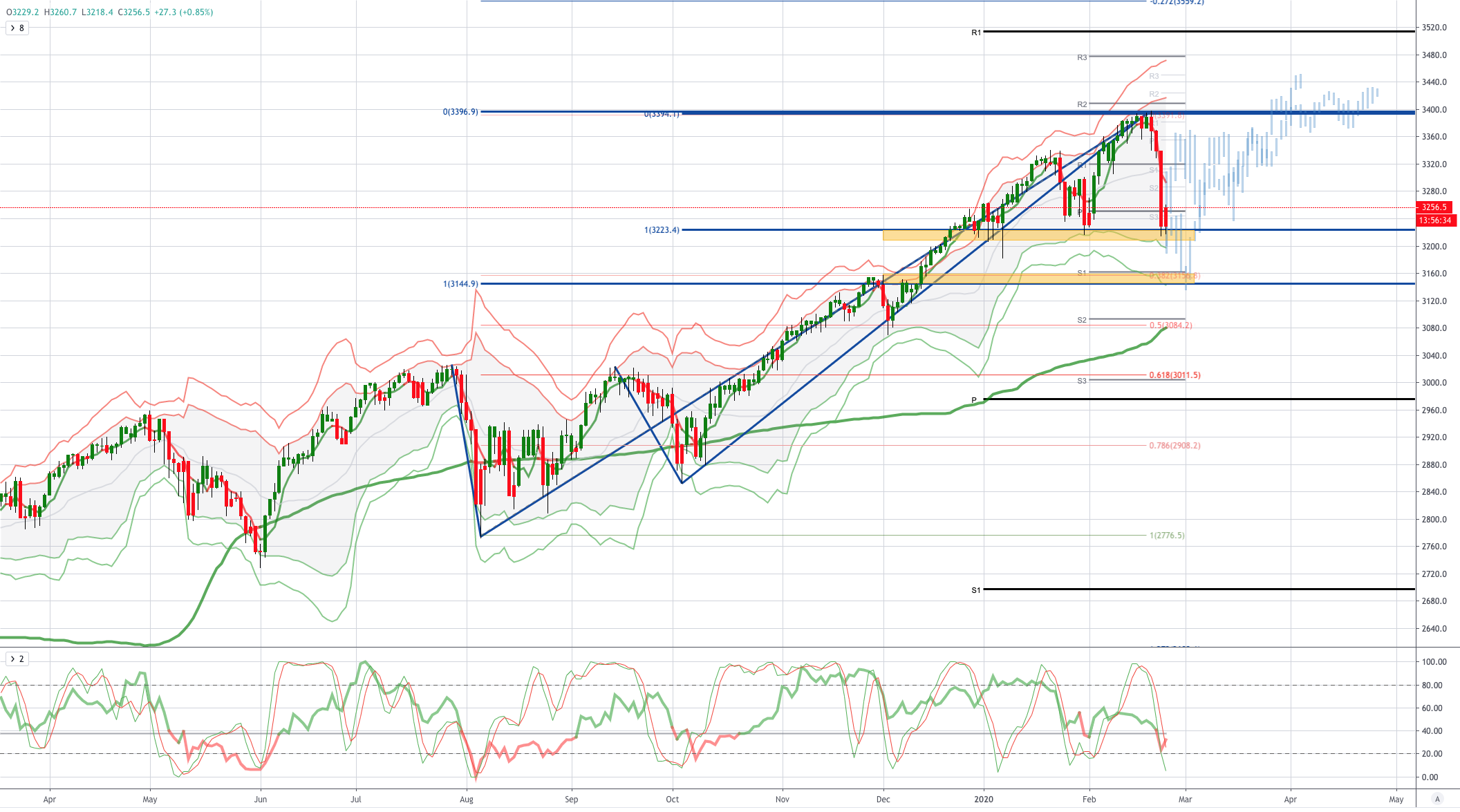

Pivotal Test US500

Another risk off session after the overnight Wall Street slump amid growing fears about the spread of covid19 in South Korea and Italy. The S&P500 saw it’s largest decline since February 2018, whilst UST bonds rallied further with the 10-year yield testing 1.35% intra-day before closing at 1.37%.even though US Treasury secretary Mnuchin opined that the covid-19 is unlikely to have a material impact on the Phase 1 trade deal. Italy in particular risks slipping back into recession with the latest Covid-19 outbreak.

COVID-19 concerns continue to dominate headlines around the world, after cases are seen spiking in South Korea, Italy and the Middle East, which sparked fears of further spread beyond China. Speaking at a news conference in Geneva, World Health Organization (WHO) Director-General Tedros Adhanom Ghebreyesus said a sudden increase in coronavirus cases in Italy, Iran and South Korea were "deeply concerning" but for now authorities were not seeing an uncontained global spread of the virus or witnessing widespread serious cases or deaths. "The key message that should give all countries hope, courage and confidence is that this virus can be contained, indeed there are many countries that have done exactly that," he said at the news conference.

From a technical & trading perspective the US500 is testing pivotal symmetry swing support sighted at 3223 as this area contains the downside there is the potential to set a base, which will only really be confirmed ona close back above 3340. However a failure to set a corrective platform from this area will likely see another leg lower to challenge the next pivotal symmetry swing support level sighted at 3144, where once again bulls will look to form a platform to build a base to take prices higher to ultimately challenge and exceed the prior cycle. A failure to find support from the secondary symmetry swing support would likely suggest a more meaningful cycle high is in place and likely see the downside move extend to test the yearly pivot point from above, testing bids back below the 3000 level

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!