Chart of the Day US500 (S&P500)

Chart of the Day US500 (S&P500)

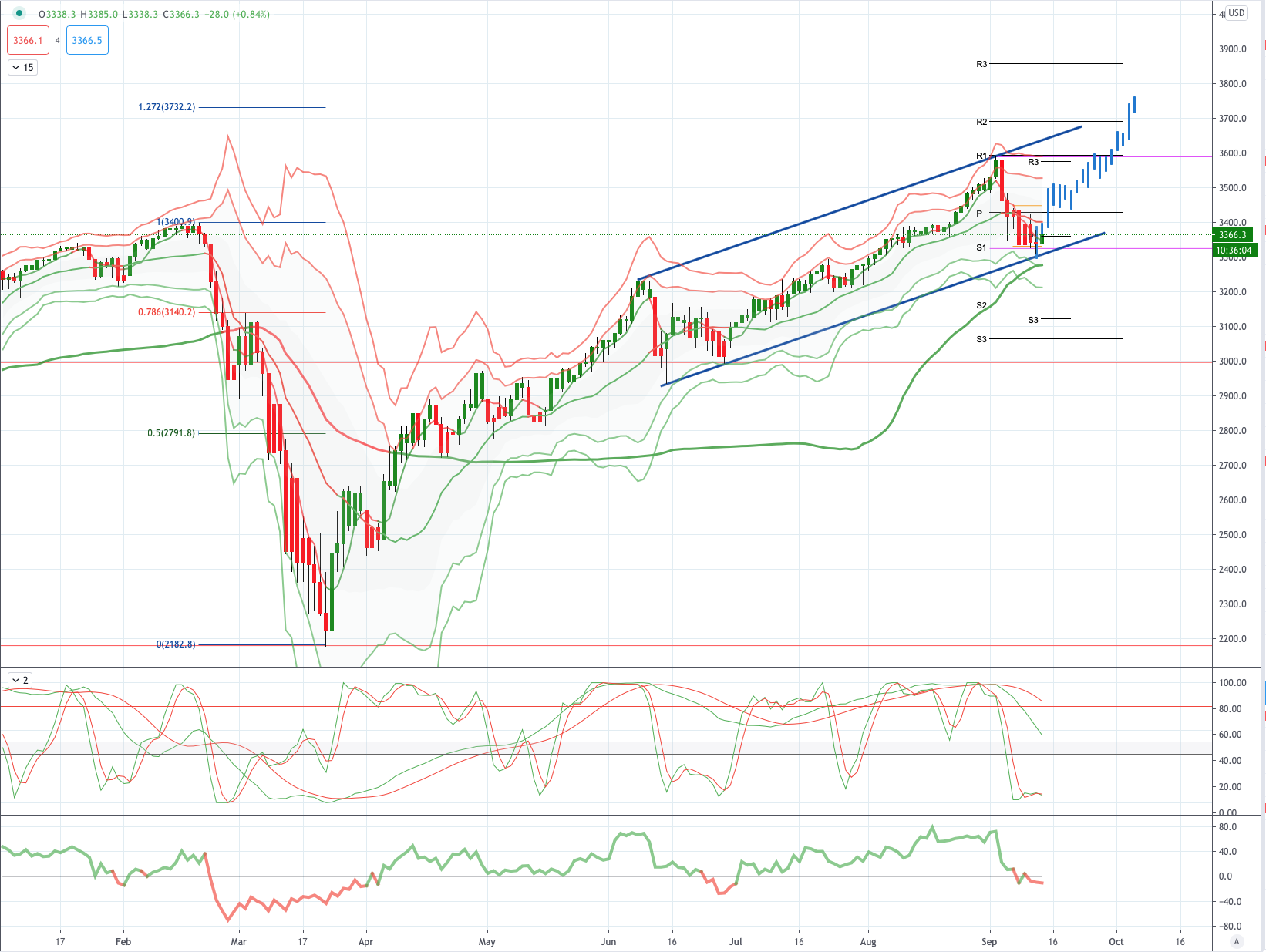

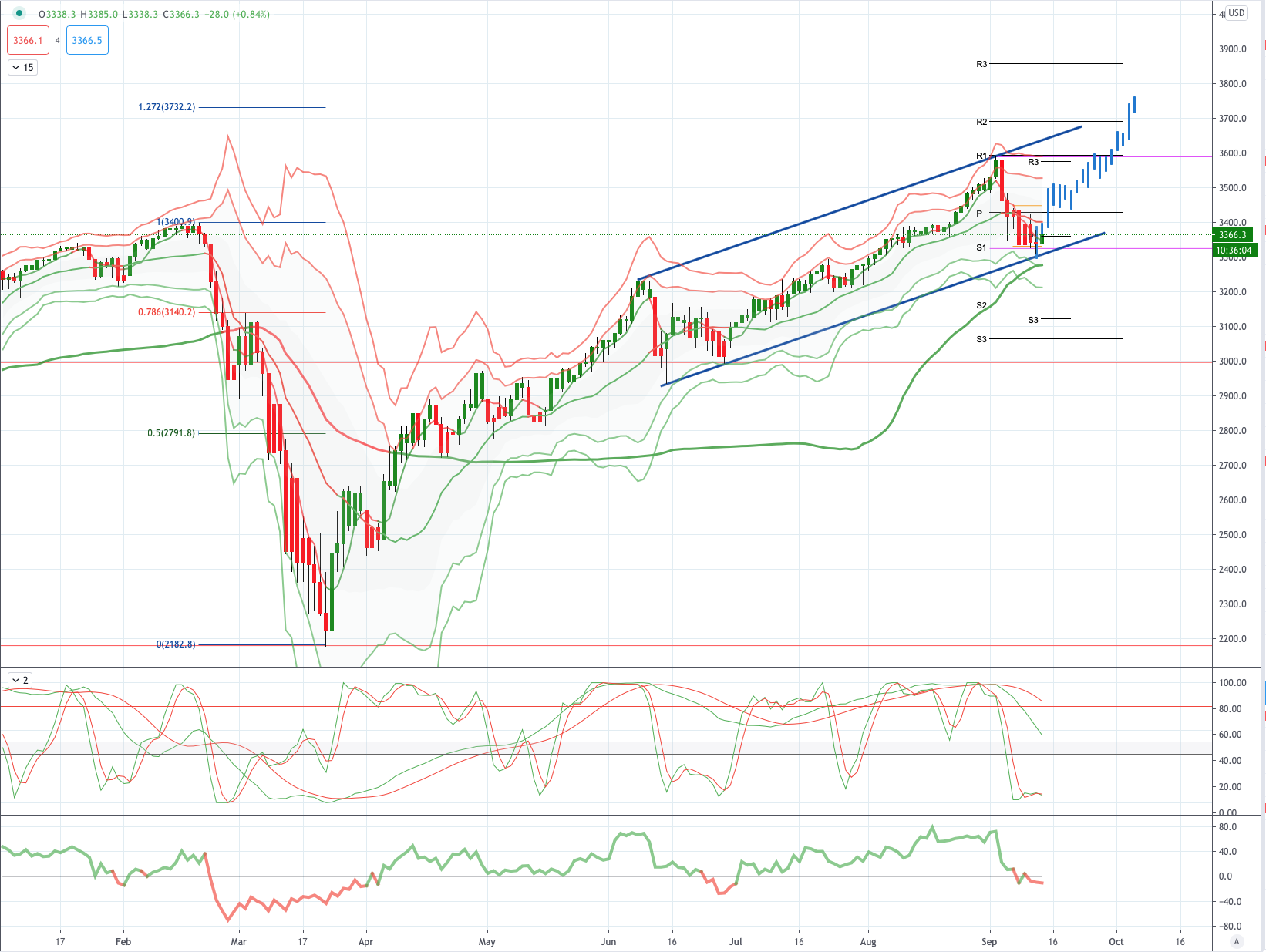

US500 (S&P500) Potential Reversal Zone - Probable Price Path

A big week lies ahead with a slew of central bank meetings including the FOMC, BOE, BOJ, BI and CBC. The S&P 500 index closed the week slightly higher at +0.05%, but the Nasdaq 100 Composite Index chalked up 0.6% losses on Friday and marked its worst week since March, with VIX easing to 26.87. Meanwhile UST bonds advanced after recovering from earlier session lows despite the stronger-than-expected US’ August CPI inflation data, with the belly of the curve outperforming and the 10- year yield a tad lower at 0.67% as buyers emerged. The 3-month LIBOR rose to 0.2504%. Meanwhile, China has tightened rules and capital demands on non-financial companies that do business across at least two financial sectors and have financial assets exceeding CNY500b (for those with banking licenses) or CNY100b (for those without banking operations) from 1 November. Elsewhere, Israel has voted to impose a second nationwide lockdown starting Friday for at least three weeks, Turkey’s sovereign credit rating was cut by Moody’s to B2, and AstraZeneca and University of Oxford have restarted their vaccine trial.

Starting with the FOMC, this is the last meeting ahead of the 3 November elections and especially given the current fiscal stimulus impasse, we expect a clarification of the specifics of its new average targeting framework (eg. how long will the Fed allow the temporary overshoot of inflation for instance) as well as the updated SEP forecasts (which will likely reflect the Fed Funds rate being static in the new 2023 forecasts), followed by the BOE (where the prospects of a no-deal Brexit is back on the table with the highly controversial Internal Bill Agreement being debated, and may weigh on the BOE to be more cautious, albeit divided), and BOJ (where governor Kuroda is likely to continue to lean on the dovish side). Friday is also the quadruple witching for US markets with the quarterly expiration of futures and options on indexes and stocks.

From a technical and trading perspective, the S&P500 continues to consolidate just above symmetry swing and trendline support sighted at 3300 as this level continues to attract buyers there is a window for another leg of upside expansion which should see this initial cycle off the March pandemic crisi lows complete at an ideal 3732 equality and Fibonacci objective. From this level a more meaningful correction may develop as we head into what appear to be a very uncertain US political season with players likely looking to take some chips off the table until the outcome of the US elections. There are strong and dominant cyclical patterns that support this view as discussed in last week's live analysis session. A breach of 3300 would negate the upside expansion thesis suggesting that the pre election high is in and we likely see more downsie rotation into the the November 3rd election day.

Disclaimer: The material provided is for information purposes only and should not be

considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!