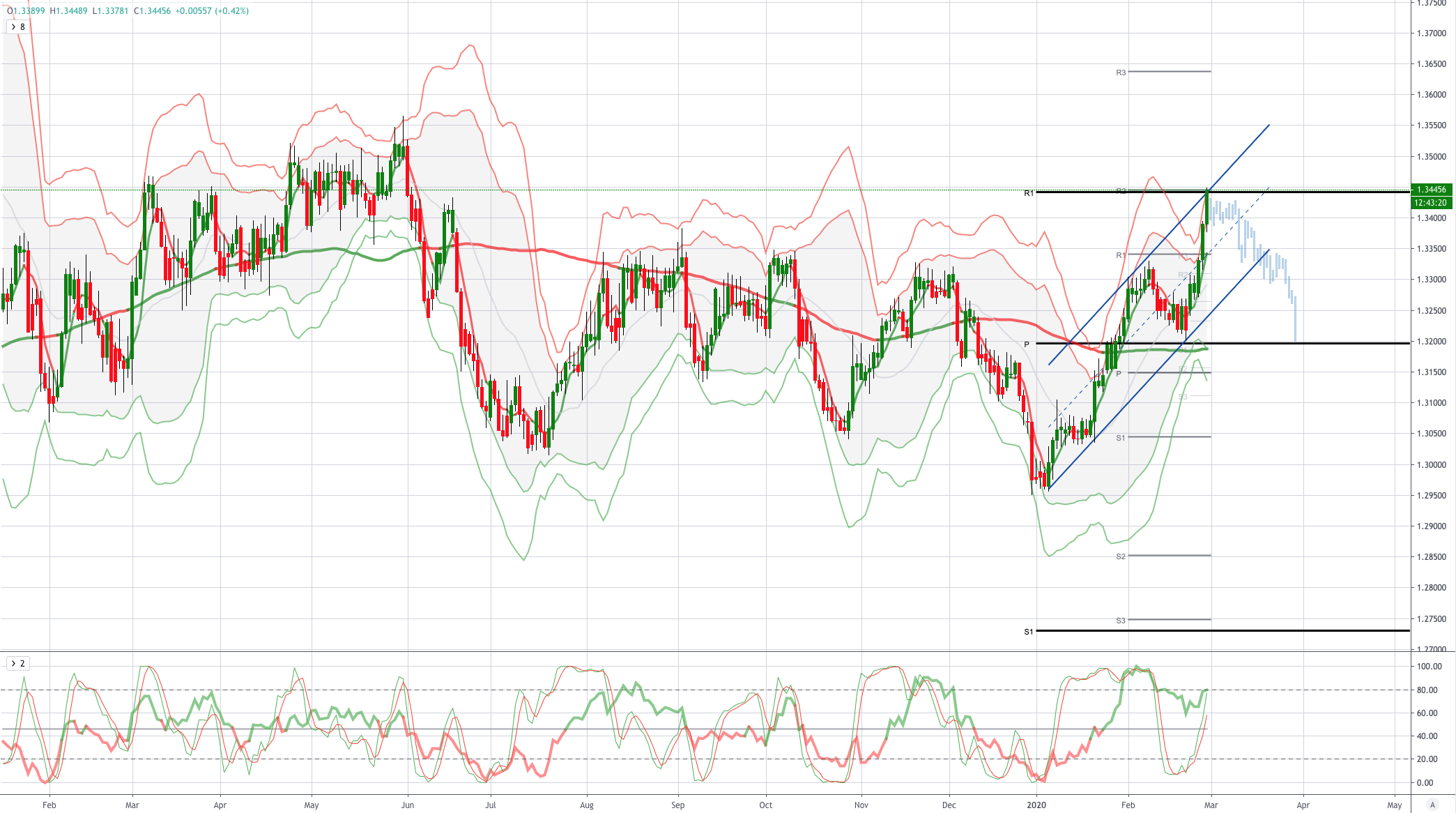

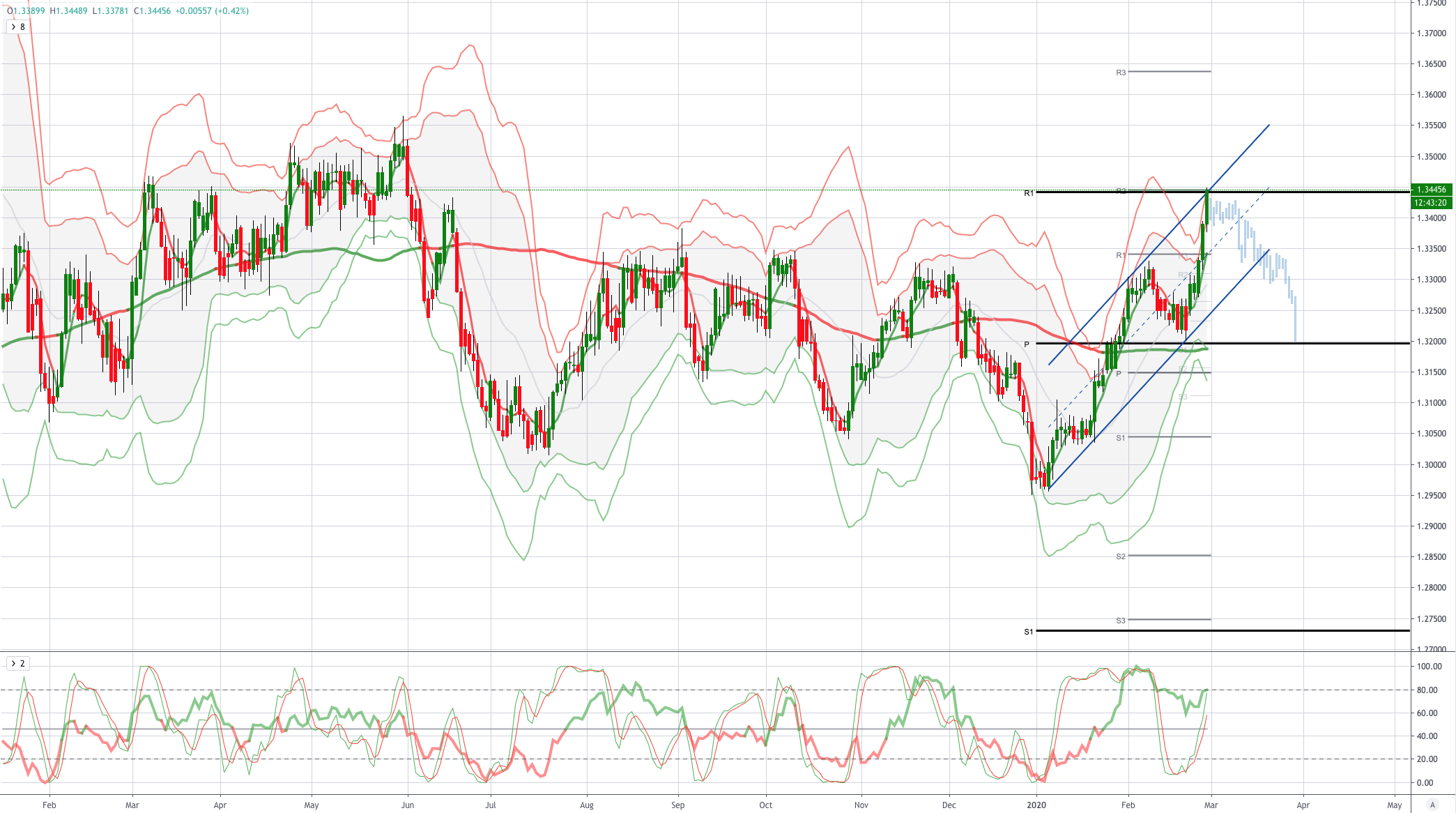

Chart of the Day USDCAD

Chart of the Day USDCAD

USDCAD Pivot Cluster Test

Risk appetite is sinking faster than a rock these days, with the S&P500 sliding 4.4% lower overnight amidst the ongoing UST bond rally (10-year at a record 1.27%, 60bps lower than where it started the year) due to growing concerns that the Covid-19 outbreak would dampen economic activity and corporate earnings. The WHO warned that the Covid-19 is at a “decisive” stage and has the potential to become a pandemic. Japan is also closing all schools from Monday for at least a month. Meanwhile, the US CDC is expanding testing, albeit Fed’s Evans opined that it was “premature” to think about cutting rates due to Covid-19. Elsewhere, ECB’s Lagarde said the central bank was “certainly not at point yet” to cut rates due to Covid-19. Watch for IMF’s likely global growth forecast downgrade due to the Covid-19 outbreak.

In the US the revised 4Q19 GDP growth was still at a 2.1% annualised rate, but personal consumption came in softer than expected at 1.7%. Meanwhile, the non-defense capital goods orders surged 1.1% in its largest gain since January 2019 and initial jobless claims climbed 8k to 219k. However, the futures market is speculating that the Fed will need to cut rates and soon. The 1-month to 1-year T-bill curve has inverted further to 39bps.

The CAD remains under pressure. While US-Canadian interest rate differentials continue to move against the USD, weaker crude oil prices are a clear headwind for the CAD which is also losing ground to the strengthening EUR; EURCAD has risen just under 2.5% from the low seen a week ago while CADJPY is down around 2.8% from last week’s high. Lower global rates, pulling down the CAD curve, and a weaker exchange rate are doing some of the grunt work for the Bank of Canada (BoC) in terms of providing support for the economy and markets remain somewhat reluctant to endorse the view that the BoC will cut rates at next week’s policy meeting. OIS pricing indicates a 26% chance of a BoC rate cut on Wednesday versus a 45% risk of a Fed rate cut at the March 18th meeting.

From a technical & trading perspectiveUSDCAD as anticipated the USDCAD had advanced to test pivotal resistance sighted at 1.3450 this level represents the yearly first resistance and monthly second resistance pivot points as well as projected ascending trendline resistance, watch for consolidation in this area and a close below the near term volume weighted average price to suggest a corrective phase, initially targeting a retest of ascending trendline support back to 1.33. A failure below 1.33 would open a move to retest the yearly pivot point from above back to 1.32

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!