Chart of the Day USDCAD

Chart of the Day USDCAD

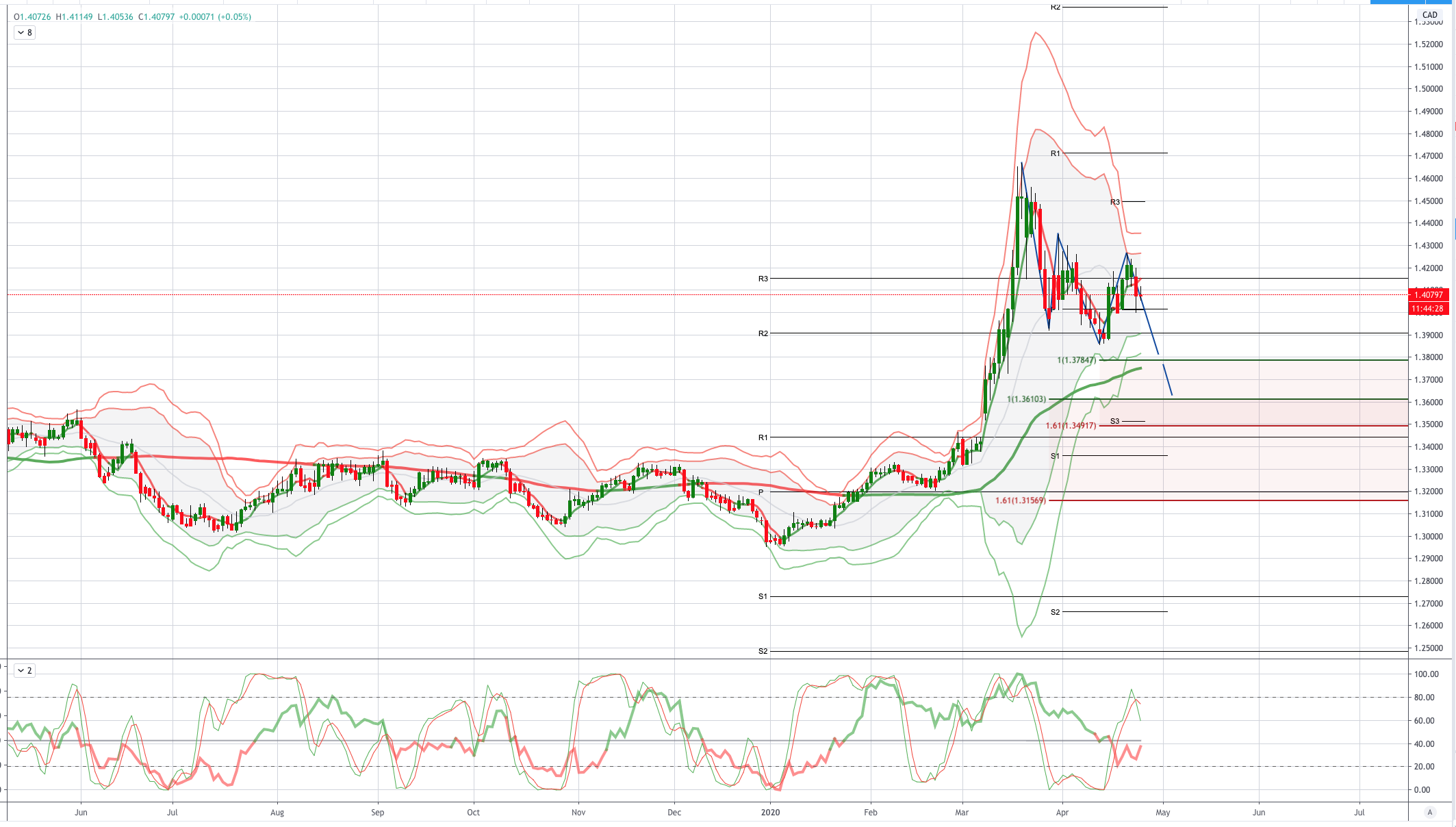

USDCAD - Probable Price Path

US equity markets were little changed (S&P500 -0.1%) overnight amid disappointing hints about Gilead’s Remdesivir drug performance in Covid-19 trials. The UST bond yield curve flattened as longer dates bonds were stayed bid with the 10-year at 0.60%. Elsewhere, the EU agreed on a new deal for a EUR540b short term rebuilding plan but remain divided on a longer term plan. ECB chief Lagarde warned of too little action and the risk of a -15% recession. Meanwhile, BOJ is said to be considering lifting the annual bond purchase cap to unlimited and double targets for CP and corporate bonds at next Monday’s meeting.

US Initial jobless claims eased to 4.43m but brought the total to 26.5m, while new home sales slumped 15.4% in March in its biggest decline since 2013. The April PMI also crashed from 40.9 to 27.4 (lowest since at least 2009). The House passes $484b in additional aid for small businesses and hospitals, and now awaits President Trump’s signing.

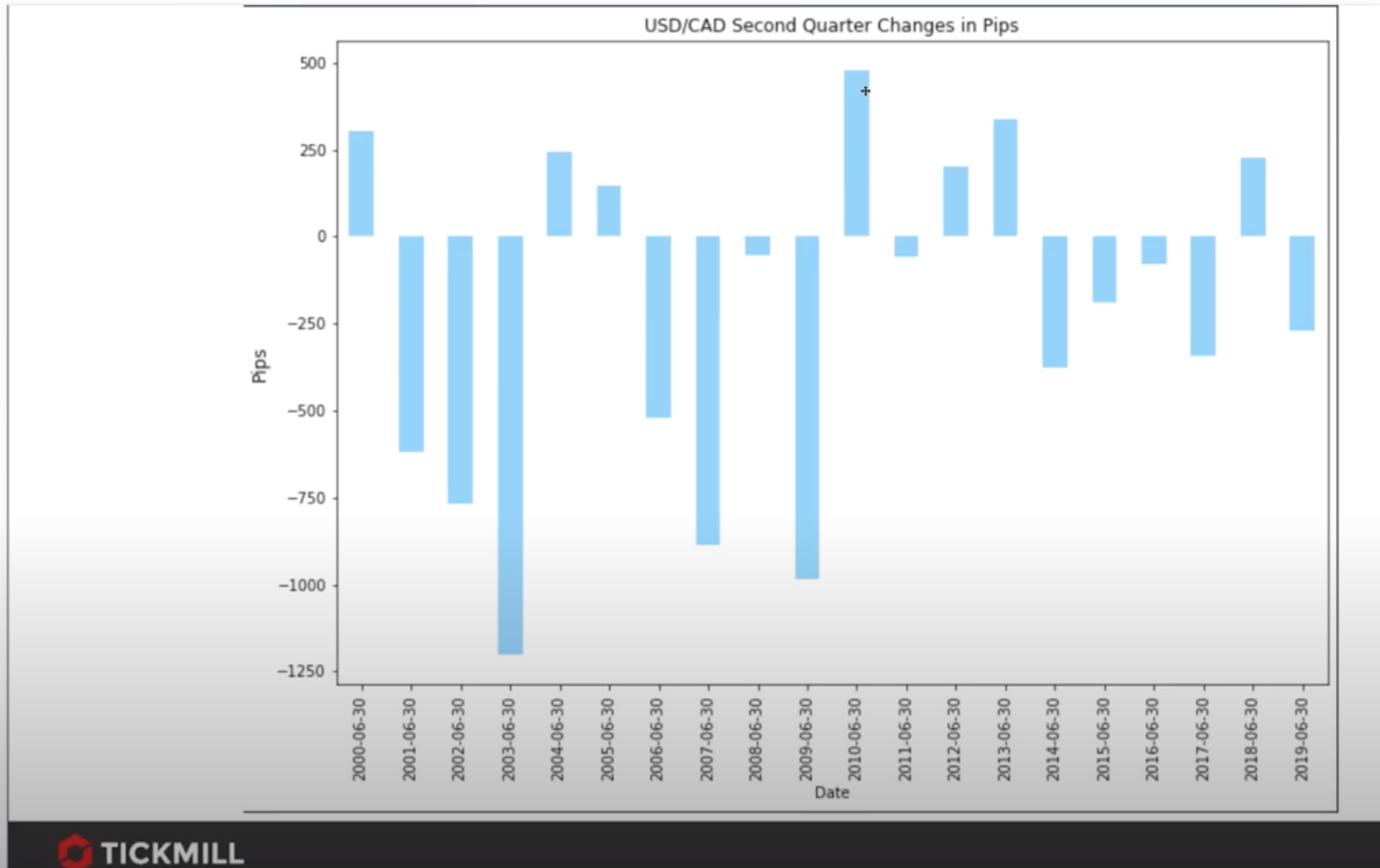

Oil Prices continue to stage a recovery post-Tuesday, when front-month WTI futures recorded negative prices. Brent closed 4.7% higher to $21.33/bbl while WTI rose 19.7% to $16.50/bbl. The Brent-WTI spread of $4.83/bbl is now the lowest in three weeks. The CAD is showing modest gains, lifted by a 13.5% gain in crude prices. As highlighted in yesterdays live analysis session, from a seasonality perspective the CAD has witnessed gains in Q2 13 times out of the last 20years

From a technical and trading perspective, in line with the view that 12.50 would set a base in Crude Oil we now look for the USDCAD to turn lower yesterday's close flipped the daily chart bearish as yesterday's highs contina upside attempts today bearish exposure should be rewarded as we trade below yesterday's closing level the initial downside objective will be the prior cycle lows at 1.39 through here and bears will look for tests of two equality objectives firstly at 1.3784 through here opens the primary equality objective measured from the late Marcg cycle high at 1.3610

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!