Chart of The Day AUDUSD

Chart of the Day AUDUSD

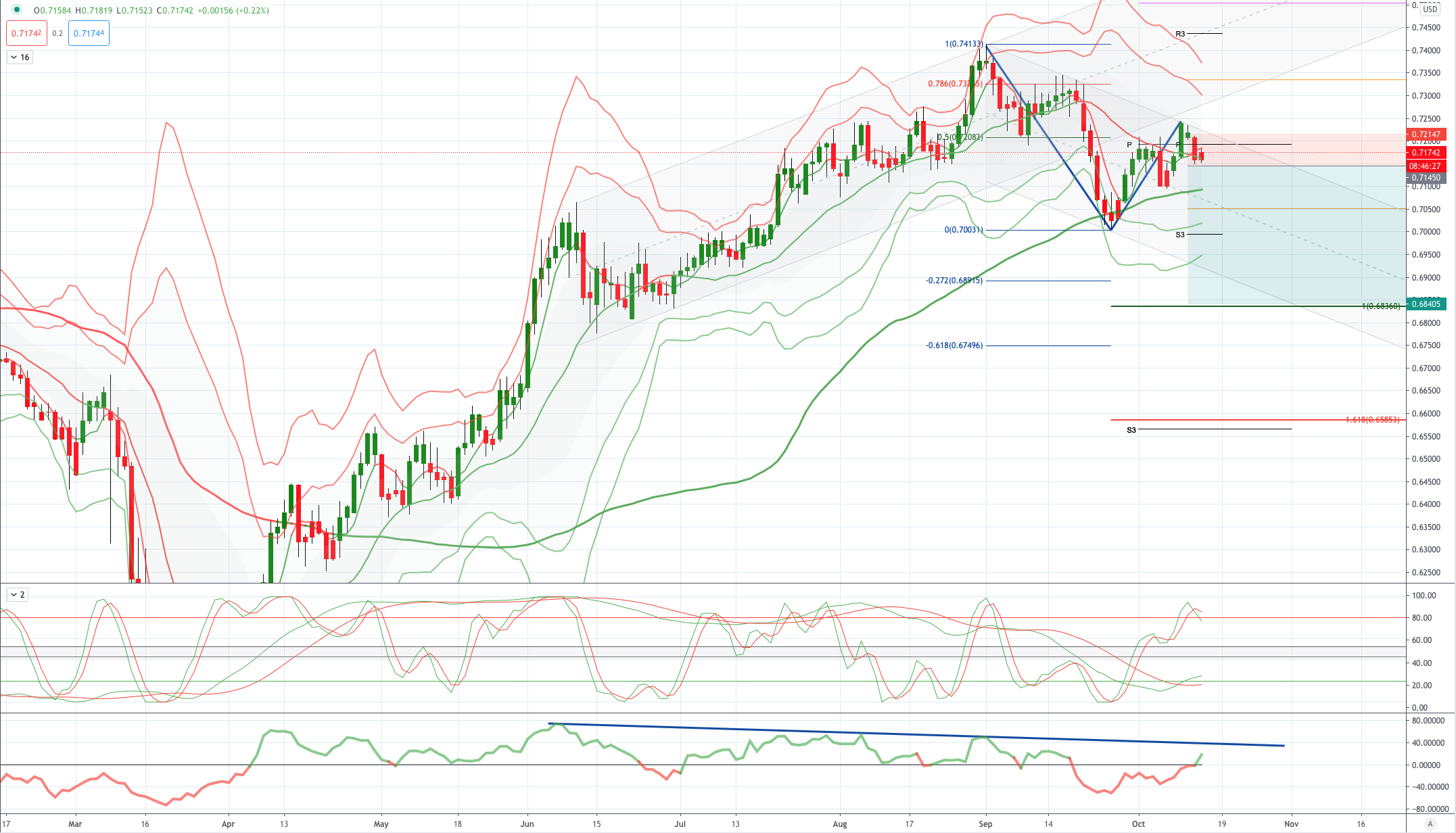

AUDUSD Potential Reversal Zone - Probable Price Path

AUD: Australian home loan surged in August: Home loans approval value beat expectation, recording a whopping 12.6% MOM growth in August, following a solid 8.8% rise in the July. This is better than the consensus forecast of a modest 1.9% increase and marks its third consecutive month of gains since June. Breakdown shows that owner-occupier loans surged by 13.6% MOM (Jul: +10.7%), completely smashed analysts’ expectation of a tiny 1.0% decline. Investor loan value also jumped by 9.3% MOM (Jul: +3.5%). Low interest rates in Australia as well as the pent-up demand post-lockdown appeared to have continued to support the Australian housing market.

USD: Two pharmaceutical companies have suspended research on coronavirus vaccines. In addition, the two parties in the United States have not yet reached an agreement on a new round of stimulus plan, and market risk appetite has not further increased. The US dollar index closed up 0.5% to 93.5. The U.S. 10-year Treasury bill yield rate closed down nearly 5 basis points to 0.73%. House Speaker Pelosi asked the White House to revise the stimulus package, while Senate Majority Leader McConnell pushed the Senate to vote on a smaller package, arguing that the Democrats ignored the agreement reached between the two parties and insisted that the stimulus be included in the stimulus case that has nothing to do with the epidemic Measures. President Trump called for a larger stimulus package. The US September consumer price index rose 1.4% year-on-year, the largest increase in the past six months, and the monthly increase slowed to 0.2%, the slowest in the past four months. Both data are in line with market expectations.

The International Monetary Fund (IMF) raised its global economic outlook to reflect the support of large-scale monetary and fiscal policies. It is expected that the economy will shrink by 4.4% this year, which is an ideal regression from the 5.2% forecast in June, and will grow by 5.2% next year, which is lower than the June estimate of a 5.4% increase. The IMF predicts that the U.S. economy will shrink by 4.3% this year, a significant improvement from the 8% drop estimated in June.

From a technical and trading perspective, the AUDUSD has retraced 50% of its September decline and found supply at the projected descending trendline resistance ahead of .7250. Yesterday's bearish reversal pattern has flipped the near and medium term volume weighted average prices bearish, as such a breach of .7145 should reward bearish exposure. Bears will initially target a test of predicted weekly range support sited at .7050, through here and then the the primary downside equality objective at .6838 will be targeted. On the day only a close through .7230 would delay the downside thesis.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!