Chart of The Day AUDUSD

Chart of The Day AUDUSD

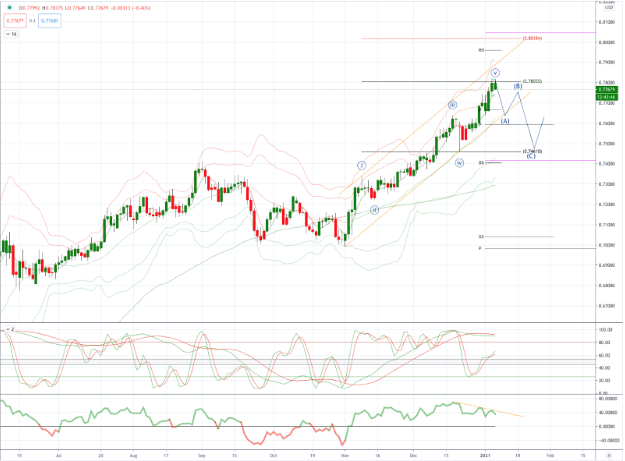

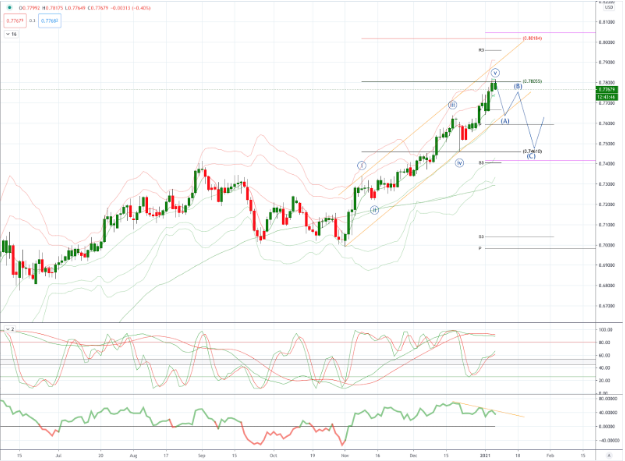

AUDUSD Probable Price Path & Potential Reversal Zone

AUD: Australia's November trade surplus was 5.02 billion Australian dollars, lower than market expectations of 6.4 billion Australian dollars (the previous value was revised down to 6.58 billion Australian dollars). Building permits in November rose by 2.6% month-on-month, which was greater than market expectations by 2% (previous value was revised down to 3.3%). We're seeing some offsetting flow out of Australia today, with Aussie supported on solid trade data, but finding offers on the pullback in iron ore prices. Overall, the Australian Dollar has been bid to multi-month highs on the back of broad based US Dollar outflow as the market prices in more easy Fed policy and more stimulus from the US government

USD: Fed minutes showed discussions on QE enhancement: The latest FOMC meeting minute showed that Fed officials expected economic expansion to slow in the coming months amid worsening pandemic across the country. In the medium term, positive vaccine news however had improved the economic outlook. All official supported enhancing the Fed’s guidance on asset purchases, adopting qualitative and outcome based guidance. This would offer more clarity about the role of asset purchase program in providing monetary policy accommodation. Some officials are open to weighting purchases of treasury securities of longer maturities and increasing the pace of purchases. There was also discussion of gradual tapering. Overall officials saw current pace as being appropriate and nearly all favoured maintaining the current composition of purchases.

From a technical and trading perspective, as discussed in the Daily Market Outlook the AUDUSD is stalling at an interim 5th wave equality objective at the .7800 handle as this area contains the current advance, there is scope for a three wave correction to develop. Counter trend bearish exposure should now be rewarded on a breach of .7730, bears will then target a retest of wave 4 support back to .7460 and prior cycle highs at .7410. This area will be pivotal for the broader bullish trend, if bulls daily to provide sufficient demand here then the correction can extend to test the psychological .7000 level. On the day only a closing breach of yesterday's highs would negate the near term corrective thesis. FX option traders note a very large AUD put strike trading this week: 1-month expiry 0.7500 AUD puts paid 400-million Wed, 350-million Thurs - Implied volatility at 11.6 both days, premium 14.5 pips - Option would allow holder to sell AUD/USD at 0.7500 at expiry - Option can increase in value if AUD/USD takes a sudden turn lower - Expiry gets Feb 2 RBA - They might express concern with AUD strength

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!