Chart of The Day EURUSD

Chart of The Day EURUSD

EURUSD Probable Price Path & Potential Reversal Zone

EUR Italian Prime Minister Conte will resign today in order to obtain the President's re-authorization to form a government. The euro exchange rate was soft, falling by more than 0.4% against the dollar at most, and closing down nearly 0.3% to 1.214. Bloomberg quoted government officials as reporting that Conte hoped that after he resigned, he would again be authorized by the president to form a government. The party led by former prime minister Renzi withdrew from the ruling coalition earlier, causing the ruling coalition to lose more than half of its seats in the upper house. European Central Bank President Lagarde said that the European Central Bank will participate in the market for a long time to ensure favorable financing conditions to deal with the epidemic and its consequences

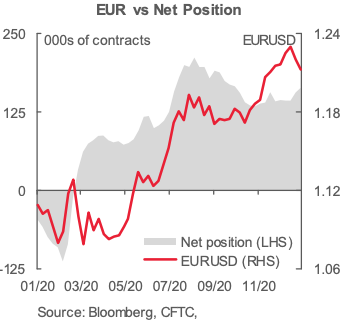

Net EUR longs rose by USD997mn, a little more than half the USD1.8bn increase seen last week. Gross EUR shorts are relatively stable and most of the positioning shift is being driven by an increase in gross EUR longs. The net long position of USD24.7bn (the equivalent of 163k contracts) remains below peak bullish sentiment seen at the end of August last year

USD: The US government's $1.9 trillion economic stimulus plan may not be implemented in the short term, and the market's risk aversion sentiment rebounded slightly. The U.S. dollar index closed up 0.2% to 90.4, a good performance for two consecutive trading days. The U.S. 10-year Treasury bill yields closed down nearly 6 basis points to 1.03%, the lowest in the past three week. US President Biden expressed his willingness to negotiate with the Republican Party on the stimulus plan, hoping that the two parties can reach an agreement on the plan, but he does not rule out passing the plan with only the support of the Democratic Party. Democratic Senate leader Schumer said that he will fight no later than mid-March when the unemployment benefits in the previous round of bills will be exhausted. In addition, the nomination of former Federal Reserve Chairman Yellen as Treasury Secretary was confirmed by the Senate. White House Press Secretary Psaki pointed out that the U.S. government will patiently handle Sino-U.S. relations and plans to evaluate Trump’s tough policy toward China when he was president. The Fed starts its two day meetinging today, and the market expects the FOMC to maintain policy unchanged

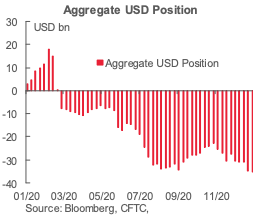

This week’s CFTC data reflect a further rise in aggregate USD short positions; the increase was relatively small overall, USD456mn, but the boost was enough to take the total bearish position amassed against the USD to a new record of USD35.4bn.

From a technical and trading perspective, the EURUSD is testing pivotal trend support at the 1.21 handle, on the H4 timeframe bulls will be looking for a close back through the pivot clustered daily, weekly and monthly to encourage the view that the current corrective phase has completed and the dominant uptrend may resume. As such a H4 close through 1.2150 warrant long exposure using 1.21 as an aggressive invalidation point, initially targeting 1.2250 enroute to a retest of prior cycle highs at 1.2350

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!