Chart of The Day EURUSD

Chart of The Day EURUSD

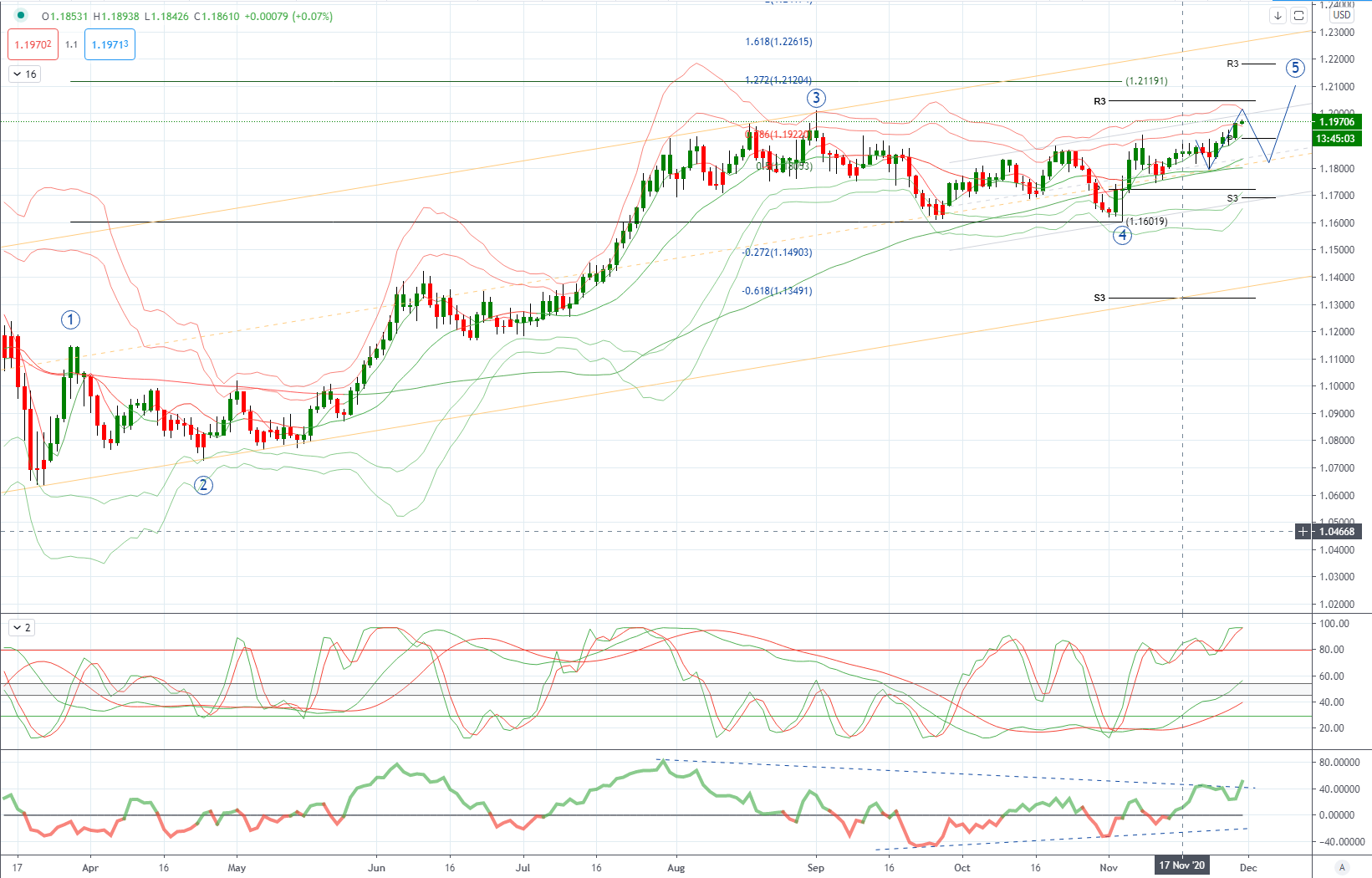

EURUSD Potential Reversal Zone & Probable Price Path

EUR: European sentiment turned gloomier in November: European Commission Economic Sentiment Index fell to 87.6 in November (Oct: 91.1), reflecting weaker sentiment across the services, industrial and consumer confidence levels. This was unsurprising considering the fact that the resurgence of Covid-19 on the continent led governments to re-impose fresh lockdowns, dampening an already weak sentiment ahead of the holiday’s season.

USD: Global risk sentiments appear supported into the month-end and post-Thanksgiving holiday, with the S&P 500 climbing 0.24% led by tech and energy stocks. US Senate Majority Leader Mitch McConnell has agreed to restart talks with Democrats over a new Covid-19 bill. US’ Black Friday sales were dominated by online sales, as Dr Fauci warned of “surge upon surge” of Covid cases partly due to Thanksgiving travel. Meanwhile, UST bonds rose on Friday with a bull-flattening bias as the 10-year yield fell 4bps to 0.84%. Meanwhile, South Korea’s October industrial production also unexpectedly shrank 2.2% yoy (-1.2% mom sa), echoing Singapore’s manufacturing print last week. Hong Kong has also shut in-person classes in schools from Wednesday for the rest of the year due to rising Covid cases. Separately, the risk of OPEC+ ministers not reaching an agreement on whether to delay January’s oil output hike over the weekend, on reported disagreements from UAE and Kazakhstan.

Citi Month-end FX Rebalancing Estimates - USD sell signal GROWS

The final estimate of month-end FX hedge rebalancing flows points to an above-average need to sell USD today. Signal strength has slightly increased since the preliminary update and now stands above two historical standard deviations in most crosses. The signal to sell USD exceeds 2 standard deviations in all crosses except JPY where assumed lower hedge ratios dampen local JPY buying needs.

From a technical and trading perspective, EURUSD looks poised to challenge the prior cycle highs just above 1.20, look for a potential extension here with month end flows supporting upside today, expect a late afternoon noon test of stops above 1.2030 around the London fix at 1600hrs. Watch for rejection here to set up a pullback into a wave 4 low around 1.19, if buyers step back in here then bulls will target the daily wave 5 objective at 1.2120, from this area we may see a more significant corrective phase. On the day only a loss of 1.19 would delay the bullish thesis opening a move back to test daily projected ascending trendline support to 1.1820 before another basing attempt

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!