Chart of The Day NZDCAD

Chart of The Day NZDCAD

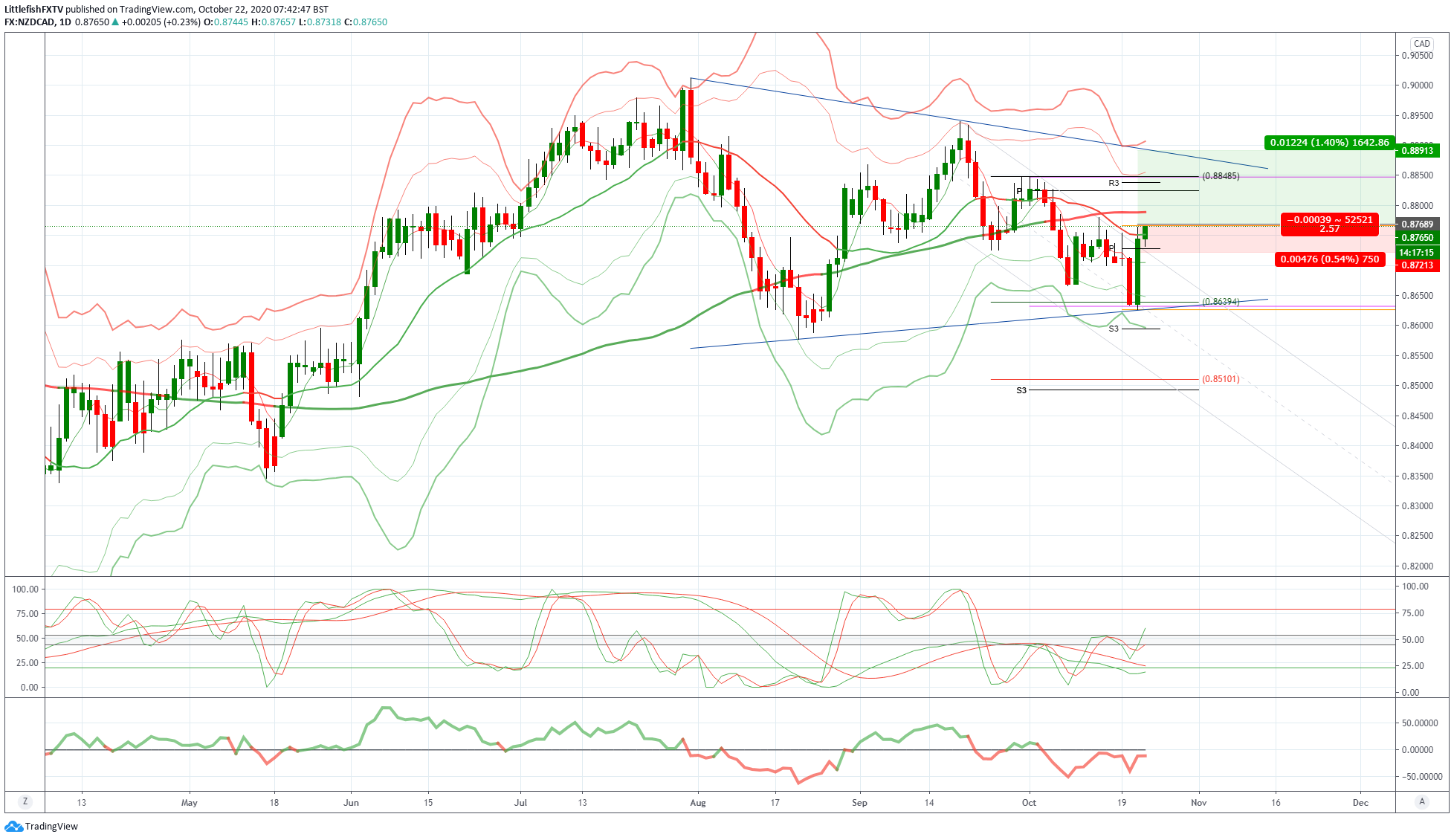

NZDCAD Potential Reversal Zone & Probable Price Path

NZD: The domestic bond market saw a higher and steeper curve, driven by the upward move in US Treasury yields during the session. The 10-year NZGB rose by 5bps to 0.58%. Earlier in the day, NZDM announced that the syndication of a new 2028 bond would likely take place next week. The short-end of the swaps market was well supported as OIS rates drifted down another 2bps, as the market becomes more convinced that the RBNZ will cut the OCR next year. The 2-year rate swap fell a touch to 0.01% and can fall a lot further if the RBNZ takes the OCR down to minus 0.5%. Curve steepening was also evident in the swaps curve, with the 10-year rate up 4bps to 0.50%. New Zealand Credit Card recorded modest growth in Sep: New Zealand credit card spending recorded 1.0% MOM growth in September (Aug: -5.6%), reflecting moderate rebound in consumer spending. This translates to a smaller YOY decline of 9.9% (Aug: -11.8%). Despite the reopening of the economy and relatively well contained outbreak, monthly spending has not recovered back to levels observed seen prior to the pandemic given the absence of tourists and cautious consumer sentiment

CAD: The CAD’s underperformance may reflect focus on Ottawa where PM Trudeau’s decision to make a Conservative motion on a COVID-19 spending committee (to look at the misuse of public funds) a confidence matter threatens to trigger a general election. Markets doubt the opposition parties really want to go down this rabbit hole in the midst of the pandemic and with polling suggesting that the minority Liberal government could win a majority if a vote were held now, however. Economic data surprises have softened over the past month or so, supporting the impression that the Canadian economic recovery is coming off the boil somewhat. Markets don’t think the data will add too much to the CAD story at the moment as most large economies have made back the “easy” economic gains from the virus slowdown and second wave concerns are becoming more pronounced.

From a technical and trading perspective, NZDCAD staged a significant bullish reversal pattern yesterday after successfully completing a test of the downside equality objective at .8639 which also coincided with the monthly and weekly projected range support. Bullish exposure should now be rewarded on a breach of the overnight highs, placing a protective stop below the weekly pivot, bulls will initially target a retest of the monthly pivot at .8823 enroute to a test of the projected descending trendline resistance sited towards .8900.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!