Chart of The Day NZDUSD

Chart of The Day NZDUSD

NZDUSD Probable Price Path & Potential Reversal Zone

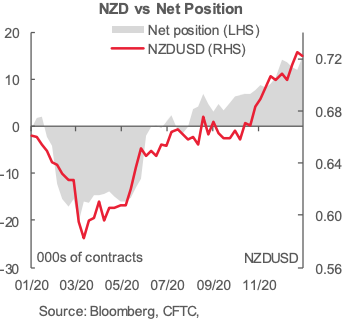

NZD: Dairy prices increased by 4.8% at last night’s Global DairyTrade auction, better than we had expected and taking the index to its highest level since 2014. Meanwhile, whole milk powder prices rose by 2.2%, reaching their highest level since the start of 2017. Firm demand, higher international grain prices, signs of slower growth in EU milk supply, and some concern about subdued NZ milk supply were all supportive factors going into the auction. The result will put further upward pressure on domestic milk price forecasts, which are mainly congregated around the $7 mark, in the middle of Fonterra’s $6.70-$7.30 range. There was little market reaction in either NZ rates or the currency to yesterday’s QSBO business survey. Net confidence increased further, to -16 from -38 (seasonally adjusted), while firms’ employment and investment intentions also increased sharply. Notably, there were renewed signs of labour market shortages and capacity constraints, especially in the construction sector, although pricing expectations remained subdued.

USD: US equity markets closed higher overnight in anticipation of the Biden administration and Janet Yellen at the helm of the Treasury. During her confirmation hearing for Treasury Secretary, Janet Yellen said she would not pursue a weak USD, but argued that aid for the unemployed and small businesses gives the “biggest bang for the buck”. In addition, she also hinted at the possible issuance of 50-year bonds while sounding tough on China’s “abusive” trade practices on IP theft, product dumping and illegal subsidies. The S&P 500 gained 0.8%, with Netflix adding 8.5m subscribers to cross 200 million whereas Goldman and BofA earnings were mixed. Meanwhile, VIX retreated to 23.24 overnight and UST bonds traded in a range with the 10-year bond yield hugging 1.09% despite an initial knee-jerk reaction to Yellen’s hints of adding a 50-year bond. Elsewhere, the IEA cut its 2021 global oil demand forecast by 600k barrels a day, indicating that “it will take more time for oil demand to recover fully as renewed lockdowns in a number of countries weigh on fuel sales”.

From a technical and trading perspective, the NZDUSD is in the latter stage of potentially completing a three wave corrective pattern versus the B wave swing high at .7240 which has a downside equality objective at .7072, this area coincides with daily and monthly projected range support. Watch for bullish reversal patterns to confirm the pattern, if this pattern plays out hen we can reasonably expect a new advance to retest prior cycle highs above .7300 en-route to an ideal upside objective of .73800/.7400

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!