Chart of The Day S&P500

Chart of The Day S&P500

S&P500 Probable Price Path & Potential Reversal Zone

With all eyes on US President Biden and his inauguration plea to end the “uncivil war” and called for “unity”, risk appetite was supported overnight in anticipation of more fiscal stimulus and a slew of executive orders unwinding some of Trump’s policies The latter included mandating masks on federal property, revoking a permit for the Keystone XL oil pipeline and reversing a travel ban on several Muslim and African countries. The S&P 500 gained 1.39% to a fresh record high, led by tech shares, while VIX sank to 21.58. UST bonds erased initial declines despite a soft $24b 20-year bond auction, with the 10-year bond yield at 1.08%. The 3-month LIBOR eased to 0.22241% while the USD also traded softer. Elsewhere, BOC kept their policy rates steady at 0.25% respectively while generally sounding cautious of downside growth risks. China’s 1- and 5-year LPR fixings were also unchanged.

Key market focus will be whether stasis also applies to the ECB policy decision due later today – ECB’s Lagarde will also have to strike a fine balance between holding its firepower while dealing with a resurgent Covid outbreak, 1Q21 lockdown, Italian political uncertainties and EUR strength. Today’s economic data calendar comprises HK’s Dec CPI, US’ Dec housing starts, building permits, initial jobless claims and the Philadelphia Fed business index. In the US yesterday The NAHB homebuilders’ confidence unexpectedly fell from 86 to 83 in January. With a unified Democratic control of the government for the first time in a decade, market hopes are for Biden’s $1.9tn fiscal stimulus to come quickly to the aid of the US economy

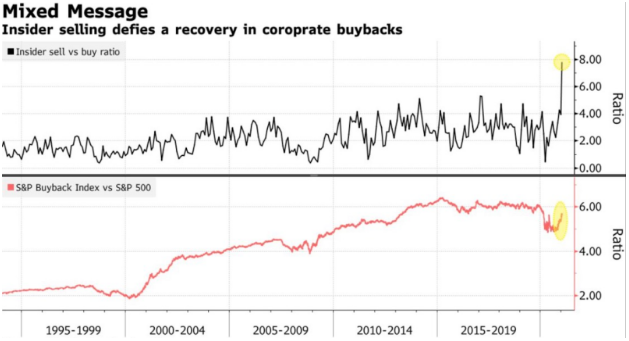

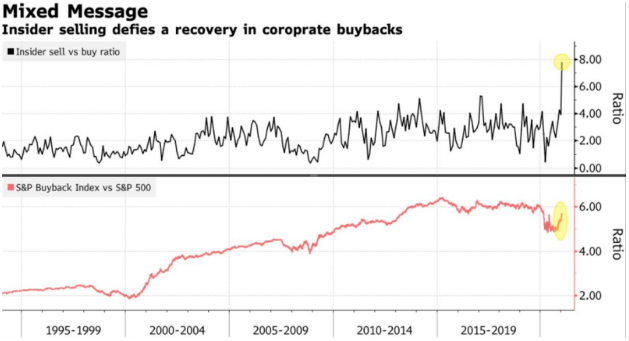

From a technical and trading perspective, the S&P500 is carving out an interim ending diagonal pattern which could be the catalyst for a corrective profit taking pullback, with a buy the rumour sell the fact setup post President Biden’s inauguration. While somewhat anecdotal but noteworthy nonetheless Bloomberg highlight an interesting dichotomy in position in the Global benchmark index with insider selling now at record levels as stock valuations soar insiders are selling the highest valuations in history while retail traders are chasing and buying the highest valuations in history.

From a technical perspective counter trend traders will watch for bearish reversal patterns on a quick rejection from the 3880/95 area (note the Psych indicator is testing levels that prompted the pullback in mid October 2020), such price action would warrant cautions bearish exposure ntially targeting a move to test 3830 from above, which 3860/80 caps look for a test of 3740/20 pivotal projected trendline support, from this area bulls will look to wrestle back control for the next leg higher to target 4000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!