Chart of The Day S&P500

Chart of The Day S&P500

S&P500 Probable Price Path & Potential Reversal Zone

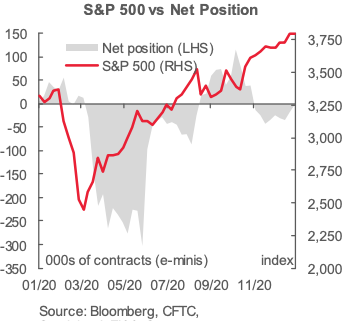

Global risk sentiments stalled ahead of the FOMC meeting even as the IMF raised its 2021 global growth forecast from 5.2% to 5.5%. The upgrade was mainly due to the US (5.1% versus 3.1% previously) whereas the Euro-area was cut by 1 percentage point to 4.2% and the UK by 1.4 percentage points to 4.5%. Meanwhile, Covid cases crossed 100 million globally, with the UK surpassing 100k deaths, and Japan is likely to extend its state of emergency. The S&P 500 retreated 0.15% yesterday but VIX slipped to 23.02. On the US earnings front, Microsoft beat sales forecast with $43.1bn and AMD and Texas Instruments were also upbeat on sales, whereas Starbucks’s same-store sales fell by a worse-than-expected 5%. Other gainers included 3M, J&J and GameStop. Market attention now turns to Apple, Facebook and Tesla. UST bonds pared losses amid a record $61bn 5-year auction, with the 10-year UST bond yield hovering around 1.03%. There is still another $62bn of 7-year bonds to be auctioned. The 3-month LIBOR was at 0.2185%. Elsewhere, China’s PBOC unexpectedly drained liquidity from the interbank market which contributed to interbank market funding cost and stock market volatility.

The main event to watch is the FOMC decision, but we do not expect any tweaks in its policy settings, although the FOMC statement is likely to acknowledge the recent softening in US economic data prints, especially on the labour market front. Fed Chair Powell is also likely to continue to sing a dovish tune, reiterating the need for continued policy accommodation amid the rising Covid scourge at least until vaccination efforts make more headway, and there are no intentions to taper its bond purchases pace anytime soon.

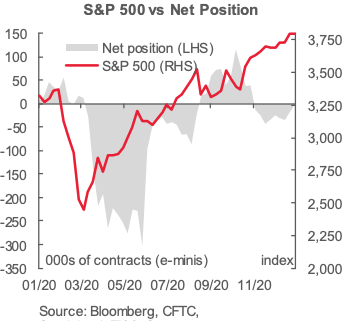

From a technical perspective counter trend traders will watch for bearish reversal patterns on a quick rejection from the 3890/3910 area, (note the intraday divergence that is developing on the Psych indicator which acts as an additionally confirmation for the corrective thesis) such price action would warrant cautions bearish exposure initially targeting a move to test 3820/30 the monthly pivot which held on the quick test we witnessed on Monday, a failure for fresh demand to re-engage in this area would open the potential for an extension to the downside to test support back to 3760

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!