Chart of The Day USDCAD

Chart of The Day USDCAD

USDCAD Probable Price Path & Potential Reversal Zone

USD: During the US holiday yesterday, the financial market was closed for one day, and transactions in the foreign exchange market were relatively quiet. The market waits and sees whether the fiscal measures of the new US government can be passed. U.S. 10-year Treasury bills rose nearly 1 basis point to near 1.1% this morning. The former Fed Chairman Yellen, who was nominated to be the Treasury Secretary, attends her Senate hearing today. Yellen’s speech stated that if there is no large-scale fiscal stimulus, the US economy may face a longer recession, and interest rates are currently low, and the government should expand fiscal measures. DXY traded sideways on Monday, as it once again closed the day out flat near the 90.77 region, as markets digested Biden’s fiscal stimulus proposal and Fed Chair Powell’s pushback against bond tapering expectations. The USD weakened against JPY and was little changed against other majors like EUR, GBP and CHF. The focus this week is on President-elect Joe Biden’s inauguration on the 20th January.

Following the post-New Year lull, CFTC data reflected the largest week-to week turn against the dollar since early-Aug 2020 with the USD’s net short reaching its highest mark on record (in dollar terms) at USD35bn on the back of a USD3.7bn increase in favour of the currencies that we track.

CAD: Canada has a busy week ahead of it, there are major data reports on inflation and retail sales as well as the BoC policy decision. The data won’t tell us an awful lot, unfortunately; the focus is less on how the economy ended last year than how tighter lockdown measures will impact growth in early 2021. Markets anticipate a sharp slowdown in domestic growth in Q1. The BoC meeting is not expected to lead to any changes in policy; there has been some talk of a so-called “micro” cut in rates – that is to say a cut of perhaps 10bps. While this option might be in the BoC toolbox, using it would be of questionable value as it will not impact the near-term trajectory of the economy. The street is looking for no change in rates and that perspective is reflected in OIS contracts which reflect expectations for no change in policy from the BoC or the Fed in the next 12 months. The MPR and press conference may be of more interest – for the Bank’s perspective on the outlook and any additional comments on the CAD. Markets doubt the Bank will object too strongly to the CAD’s recent performance, the more so if the USD does push higher in the short run; trends reflect USD weakness, Governor Macklem has conceded previously, while USDCAD is not obviously misaligned, fundamental Fair Value estimate. There is little the Bank can really do about the CAD so it might better to say the least possible on the subject.

Speculative accounts are still not too enthused by the CAD’s performance as they trimmed the currency’s net long by USD197mn to USD950mn; as of mid Dec, investors still maintained a bearish outlook on the CAD (on the basis of CFTC data, at least).

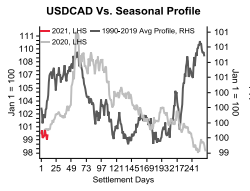

From a technical and trading perspective, the USDCAD is correcting its impulsive move from the 1.26 test early in the year and inline with the broader USD recovery (highlighted in the DXY chart below), the USDCAD looks poised to make a sustained break of the descending trendline resistance through 1.28 en-route to make a test of projected weekly range resistance at 1.29 en-route to test projected monthly range resistance at 1.2950. It is noteworthy that historical seasonal patterns are supportive of the near term bullish thesis (as highlighted in the chart above).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!