Chart of The Day USDCHF

Chart of The Day USDCHF

USDCHF Potential Reversal Zone & Probable Price Path

USD: The Fed returned the unused funds of the emergency loan program as required by the US Department of the Treasury. US stocks fell last Friday. After the US dollar index fell for six consecutive trading days, the market closed by 0.1% to 92.4, still falling 0.4% on a weekly basis. The 10-year Treasury bill yield rate in the United States fell slightly to below 0.825%, and fell by 7 basis points on a weekly basis. The Fed will return the unspent funds of five emergency loan programs that expire at the end of this year to the Ministry of Finance. Treasury Secretary Mnuchin discussed the economic stimulus plan with Senate Republican leader McConnell. McConnell supported the transfer of the unused US$580 billion allocated to the Federal Reserve’s emergency loan program to support a new round of fiscal expenditures. The pharmaceutical manufacturer Pfizer submitted an emergency use authorization application for the coronavirus vaccine to the U.S. Food and Drug Administration, and the first batch of vaccination may begin as soon as three weeks later. There were more than 170,000 new infections in the United States last Saturday, and the cumulative number of confirmed cases has exceeded 12 million. The World Trade Organization said that as the global coronavirus epidemic worsens, the trend of strong rebound in global trade may slow down in the fourth quarter of this year

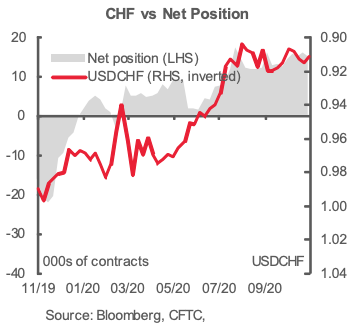

CHF: The SNB remains uncomfortable with Franc appreciation and continues to remind the market it will need to be careful about any attempts at trying to force an appreciation in the currency. But the SNB will also need to be careful right now, as its strategy to weaken the Franc is facing headwinds from a less certain global outlook. Any signs of renewed risk liquidation in 2020, will likely invite a very large wave of demand for the Franc that will put the SNB in the more challenging position of needing to back up its talk with action, that ultimately, may not prove to be as effective as it once was, given where we're at in the monetary policy cycle.

From a technical and trading perspective, the USDCHF appears to be carving out an intraday inverted head and shoulders reversal pattern. Initial confirmation of this pattern will come on a h4 close at or above current levels. Earlier this afternoon the DXY made new lows for the year but reversed sharply in what may prove to be a near term bear trap. With CFTC data showing that positioning remains stretched this could fuel some additional near term short covering in the CHF. A such bullish exposure in the near term should be rewarded through .9140 with a measured move objective sighted at .9300

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!