Chart of The Day USDCHF

USDCHF Probable Price Path & Potential Reversal Zone

USD US President Biden signed an executive order to revoke the cornerstone oil pipeline project in cooperation with Canada. The Canadian dollar led the decline in commodity currencies last Friday. The US dollar index stabilized, closing the market up 0.1% to 90.2, ending the four-day decline and falling 0.6% weekly. Bloomberg reported that the United States will prohibit entry of non-US citizens who have recently traveled to South Africa to prevent the introduction of the variant coronavirus, and will resume entry bans for non-US citizens from Brazil, the United Kingdom, and Ireland. In addition, many Republican lawmakers believe that the US$900 billion stimulus package has been passed earlier, and the government does not need to rush to substantially increase fiscal measures. The Fed two day meeting starts Tuesday. The market expects the FOMC to maintain monetary policy unchanged. Traders will wait and see whether the Fed will release more signals on future adjustments to the pace of debt purchases. The data released by the United States last Friday generally exceeded expectations. In January, the Markit Manufacturing Purchasing Managers Index rose to a high of 59.1 in the past 14 years. In December, the annualized sales of existing homes increased to 6.76 million.

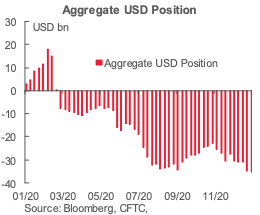

This week’s CFTC data reflect a further rise in aggregate USD short positions; the increase was relatively small overall, USD456mn, but the boost was enough to take the total bearish position amassed against the USD to a new record of USD35.4bn.

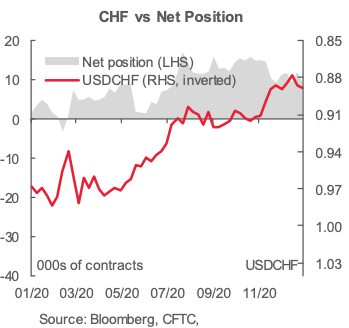

CHF The SNB remains uncomfortable with Franc appreciation and continues to remind the market it will need to be careful about any attempts at trying to force an appreciation in the currency. But the SNB will also need to be careful right now, as its strategy to weaken the Franc is facing headwinds from a less certain global outlook. Any signs of renewed risk liquidation will likely invite a very large wave of demand for the Franc that will put the SNB in the more challenging position of needing to back up its talk with action, that ultimately, may not prove to be as effective as it once was, given where we're at in the monetary policy cycle.

Net CHF longs were trimmed USD364mn, taking the bull bet here down to USD1.325bn.

From a technical and trading perspective, the USDCHF appears to be attempting to carve out an inverse head and shoulders pattern from the descending trendline support of what may be an ending diagonal pattern, more aggressive traders will likely deploy long exposure on a break of the neckline at the .8930 level targeting a test of the yearly pivot at .9182. A more conservative approach to a bullish strategy will be waiting for a breach of descending trendline resistance at .8950 and then using a successful pullback to retest the descending trendline from above before deploying long exposure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!