Chart of The Day WTI Crude Oil

Chart of The Day WTI Crude Oil

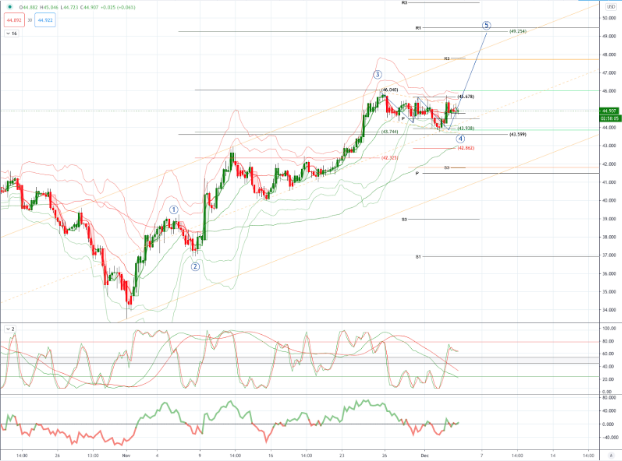

WTI Crude Oil Potential Reversal Zone & Probable Price Path

An extension of US stimulus optimism as Democrats backed a bipartisan proposal framework of $908b led to modest overnight gains in Wall Street. The S&P 500 rose 0.18% while VIX also edged up to 21.17. UST bonds declined with a steepening bias as the 10-year yield touched 0.96% before closing at 0.94%. Front-end T-bills also fell on the need for a government funding bill by the end of next week. The 3-month LIBOR edged up to 0.2305%. Meanwhile, the Fed’s Beige Book reiterated a modest to moderate expansion, but with signs of slowdown in areas with surging Covid cases.

WTI crude futures were choppy overnight around the 45.00/bbl level as focus centres on today's OPEC+ meeting with recent reports suggesting headway was made towards an agreement and that OPEC+ delegates are said to be positive that consensus will be reached. This renewed optimism helped price action and briefly lifted WTI near the USD 46.00/bbl before pulling back, while the recent mixed inventory data, tentative risk tone and COVID-19 concerns contained overnight price action.OPEC and its allies are closing in on an agreement to modestly boost their collective oil output by as much as 500,000 barrels a day starting next month, people familiar with the matter said cited by WSJ. WTI and Brent futures are seeing downside as market expectations were skewed towards an extension of current cuts (7.7mln BPD) through Q1 2021. One OPEC+ option being mulled: Jan: 7.7- 0.5=7.2 cut Feb: 6.7 cut March: 6.2 cut April: 5.7 cut Average cut for 3 months will be 6.7 instead of 7.7, according to energyintel.

From a technical and trading perspective, WTI appears to be ina wave 4 consolidation phase, while prices remain supported at the $44 area bulls will look to deploy long exposure on a closing breach of $46 ass this will suggest that the market can extend ina 5 wave sequence to complete the current cycle from the November lows targeting an equality objective versus wave 1 at the $49 level. A closing breach of $43 would delay the upside thesis opening a move to test primary trendline support back to $41 before another base attempt is likely to be made.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!