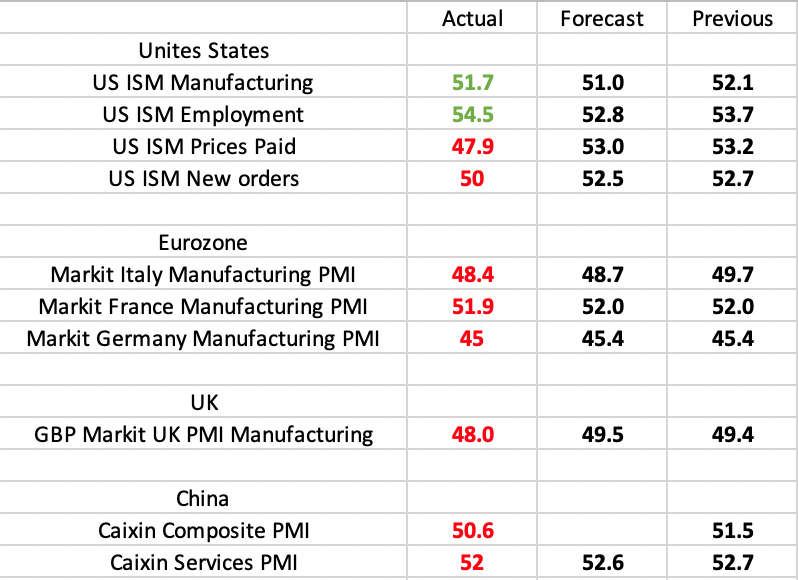

China’s “final touch” in the gloomy picture of global manufacturing PMIs

Stock markets in Asia extended losses on Wednesday, as it seems that the buoyancy related to G-20 trade truce is giving way to concerns about new tariffs against the EU and the global deterioration in manufacturing PMIs.

South Korea, one of the Asian leaders in export of goods with high added value, said it expects a slowdown in economic growth and export volumes. Two thirds of the country's exports account for trade with regional partners, thus deteriorating forecasts is a signal of growing economic issues among its neighbors.

The dividend-oriented sectors, such as utilities and real estate, supported the modest growth of US stock indices on Tuesday, which may indicate a gradual increase in investor rotation from “growth” to “value” stocks, that is, a reduction in risk appetite.

The trade truce between China and the United States goes into the category of "latent" sources of optimism, since the easing of sanctions on Huawei only laid a solid foundation for the positive development of trade talks. Unfortunately, concrete actions are bereft of certain deadlines, since previous “active phases” of the trade war have shown the full breadth of the US claims to China.

The gauges of business activity in the manufacturing sectors of US, Eurozone and China, released earlier this week, have seized the initiative in leading market sentiments. As for the positive aspects from this row of reports, we can highlight only better-than-expected prints of broad ISM indices on manufacturing and employment in US:

The slowdown in services sector in China is of considerable concern, since even during the active phases of the trade standoff, activity in the sector remained stable, suggesting that the trade war has a limited effect that only extends to export manufacturers. Now it is clear that the fire spread to the "surviving" components of the Chinese economy.

USTR has published an additional list of European goods worth $4 billion which are subject to new tariffs. Earlier in April, the department introduced tariffs for $21 billion dollars of European goods. The latest victims of tariffs were European producers of olives, Italian cheese and Scotch whiskey.

Rising demand for US government bonds is accompanied with the respective review of “50 bp cut” outcome of July meeting. The chances for the sharp rate cut rose to 29.7%. The yield on 10-year UK bonds fell to 0.722, for the first time in 10 years, being below the key rate set by the Central Bank. Demand for fixed-income safe assets is growing despite Mark Carney’s determination to raise rates in case of “soft” Brexit outcome.

Trump announced that he intends to nominate new candidate for Federal Reserve board of governors, a supporter of the gold standard Judy Shelton. In a recent article in WSJ, she spoke in favour of changing the money regime, but from the point of view of practical value (especially for Trump), her willingness to lower the interest rate to 0% is particularly interesting. Gold prices cheered the news, as the interest of current and potential Fed officials in the use of gold in monetary policy can have far-reaching consequences for its role in the economy.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.