Commodity Price Pressures Ease in the US but Labor Market Remains a Source of Inflation

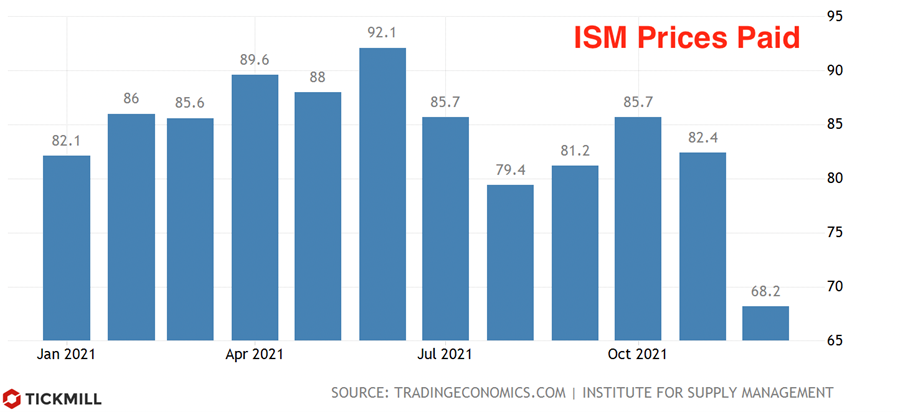

The gap between supply and consumer demand created by fiscalstimulus in 2020 and early 2021 appears to be narrowing, as indicated in thelatest ISM report on activity in the US manufacturing sector. The headlineindex fell slightly - from 61.4 to 58.8 points (forecast 60), however, the behaviorof individual components is much more interesting. Take for example Prices Paidindex which reflects producers’ costs spent on materials and intermediate goodsand is often considered as a proxy of future consumer inflation. It roserapidly in the second half of 2020 and remained at elevated levels in 2021, howeverthere was a sign of U-turn in price pressures as the index plunged from 82.4 inNovember to 68.2 in December:

The sharp decline reflects a mix of a rise in supply and easing demand for raw materials which means that the link between commodity price gains and consumer inflation should weaken soon. The idea of easing demand is also reinforced by lowering delivery times as the corresponding index fell from 72.2 to 64.9 points.

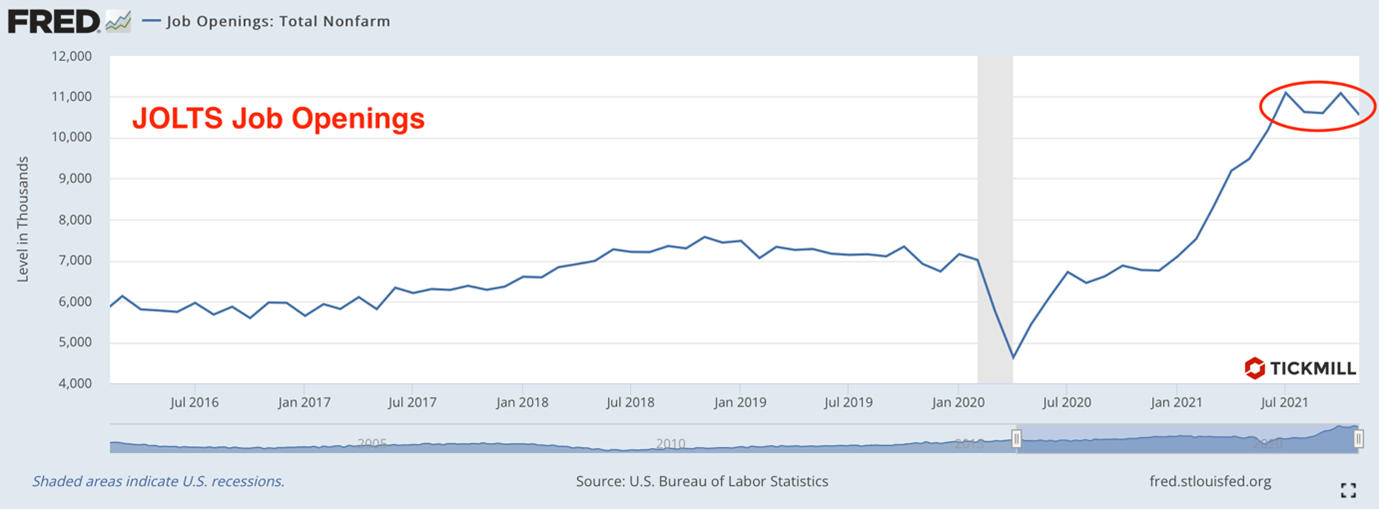

Nevertheless, the US labor market remains a source of strong inflationary pressure, and will remain for some time to come. The number of open vacancies, according to the latest data from JOLTS, remains above 10 million, but MoM change shows there are signs of topping out. Compared to November, the number of vacancies decreased by 529K:

The labor market tensions are also exacerbated by the spread of the Omicron strain which doesn’t meet any barriers, including vaccines, and in general, the governments are quite pragmatic about its containment, allowing as many people as possible to get sick. This promises a wave of sick days, short-term disability, the duration of which will depend on the duration of the new wave of covid. Because of this, tensions in the labor market are likely to remain, and employers will continue to fight for workers by raising wages.

As for the economic calendar for today, the focus is on the ADP employment report. Job growth is expected by 400K and the figure above the forecast should drive expectations of a bullish surprise on Friday, when the NFP report for December is due to release.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.