Copper Hits 4-Month Highs

Market Tightness boosting Copper

Copper prices are back in the spotlight this week as the red metal continues to push higher. The futures market is now trading at 4-month highs as dovish Fed expectations and tighter supply conditions help bolster sentiment. Copper on the LME hit record highs on Friday as a result of fresh fears over tighter supply. News of lower output from Chile (largest global producer) alongside news of planned cuts by Chinese smelters has fuelled a jump in prices. Indeed, Chinese refiners have been diverting shipments to US to capitalise on higher COMEX prices, putting further strain on Chinese supply. Given that China is the largest consumer of copper globally, this market tightness is feeding into higher prices globally. This dynamic is playing out at a time when the copper market has been tightening naturally as a result of heavy supply disruption in recent months due to mine closures as a result of maintenance operations, extreme weather issues and other operational problems.

Dovish Fed Outlook & USD Weakness

Copper prices are also being helped by a weaker Dollar as a result of the dovish repricing in Fed rate expectations we’ve seen. Over the last fortnight, market pricing for a December rate cut has soared from less than 40% to almost 90% currently. Some weak data and dovish Fed commentary have fuelled the shift. While this narrative remains, USD looks poised for further weakness as we approach the FOMC, which should keep copper and the broader commodities space supported. Focus then will be on how dovish the FOMC is. Alongside a cut, traders will need clear dovish guidance to see USD sold firmly into the new year.

Technical Views

Copper

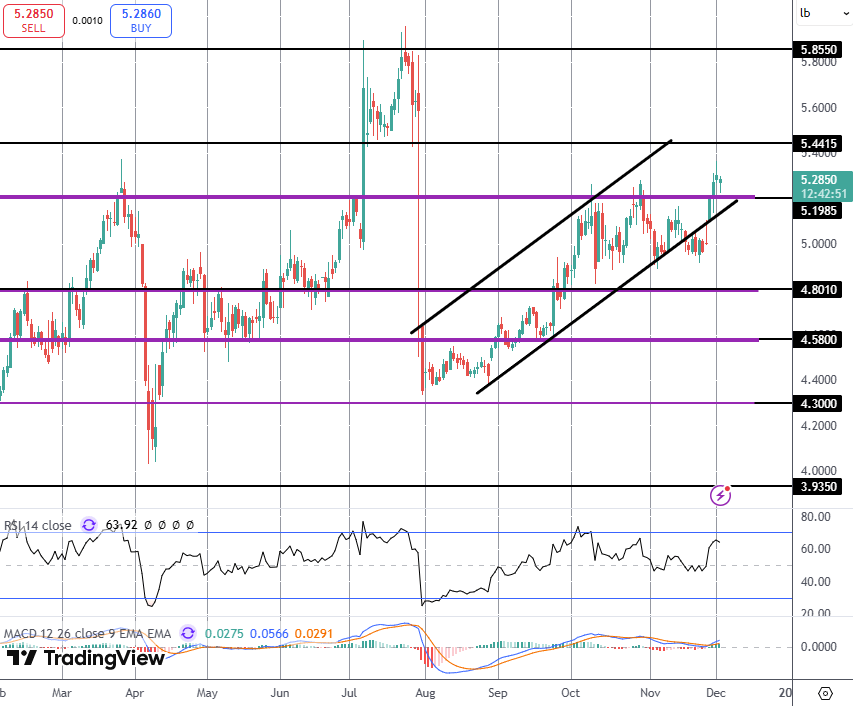

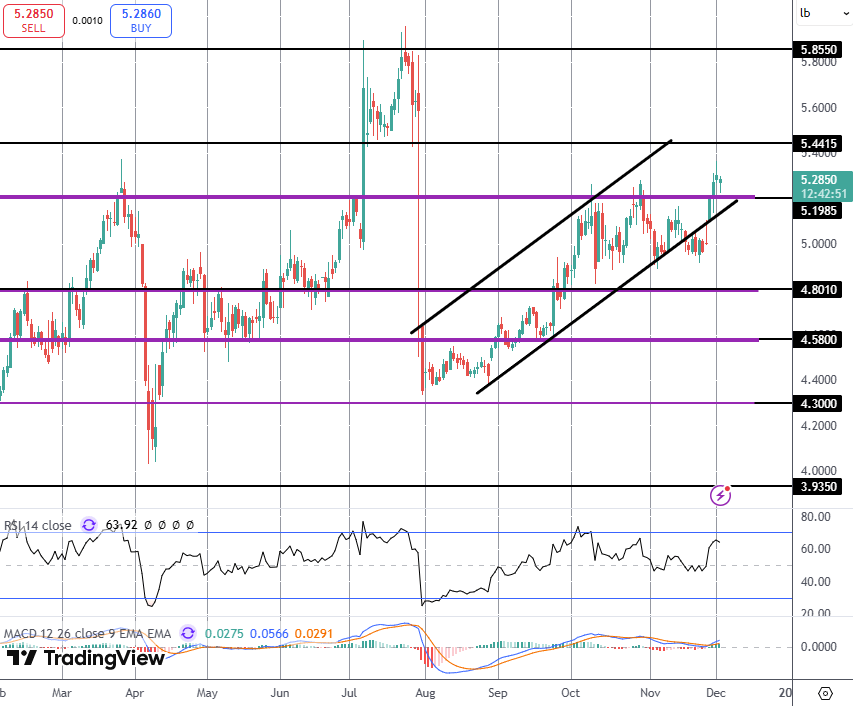

For now, copper prices remain above the 5.1985 level, supported still by the bull channel. While above this level and with momentum studies bullish, focus is on a fresh push higher towards the 5.4415 level next. Worth noting that we are seeing bearish divergence in momentum studies however so bulls should be wary of any reversal patterns forming.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.