Covid Pandemic Roars but it is not the Time to Panic yet

.png)

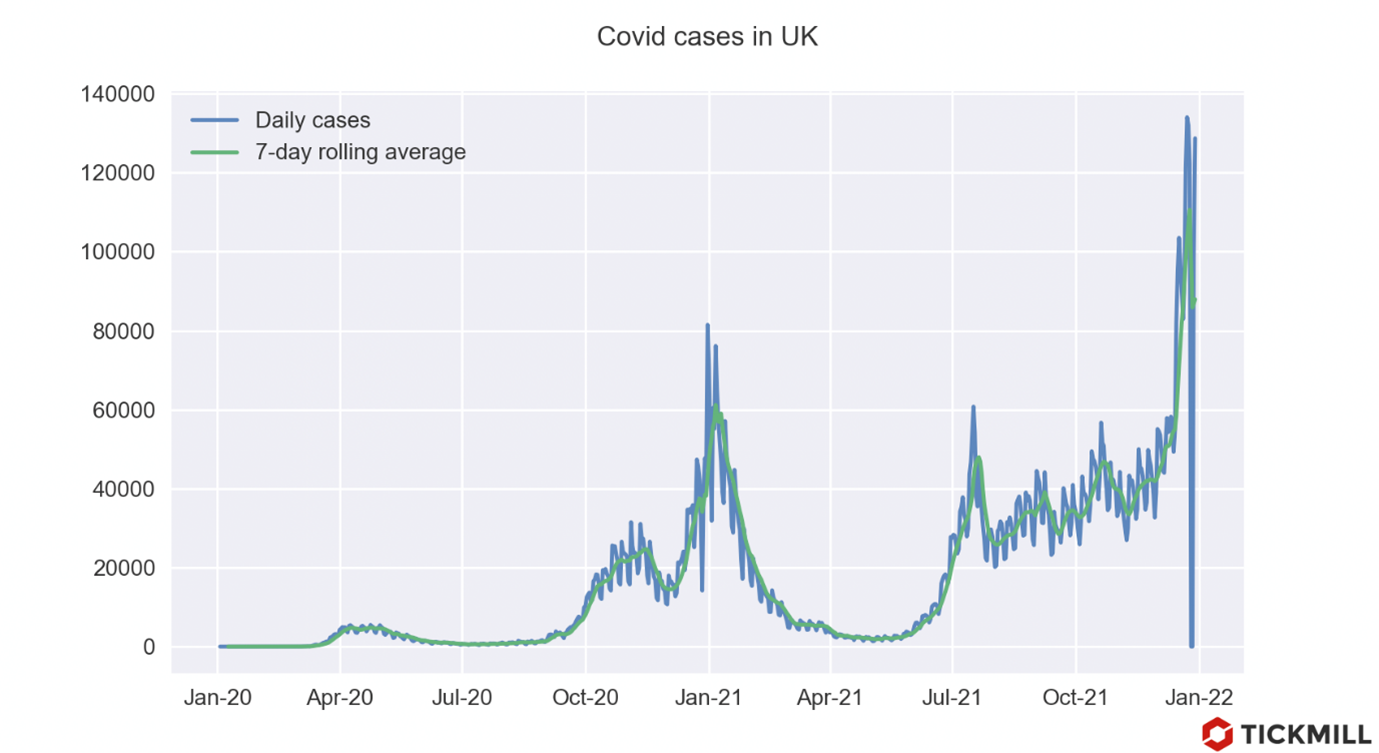

The pandemic commands back into spotlight in the new 2022 asa weekly rise in cases last week nearly doubled the last record, spiking to 10million cases. However, this news caused little tremors in the financialmarkets. The threat of new social curbs due to the spread of the Omicron appearsto be lower - according to a Danish expert from the Stratens Serum Institute,the chance of hospitalization in the current wave is 50% lower than during theDelta wave. The British Ministry of Health estimates the odds range to be50-70%. In this situation, it is possible that the authorities of differentcountries may opt for a strategy to build up herd immunity, choosing lighterrestrictions that may ensure higher than previous rate of incidence. It isquite possible that the wave of Omicron will become the final stage in the developmentof the pandemic. The risk factor for this scenario is, of course, the highcontagiousness of the strain. For example, Britain, with a fairly high level ofvaccination, faced a record increase in the number of people infected in thesecond half of December:

It should be borne in mind that a painful repercussion of the surge in daily cases worldwide may be a new wave of short-term shortages in the labor market due to temporary disability, as well as shortened periods of self-isolation announced in developed countries. This increases chances of a new round of inflation, primarily through the wage channel. In this case, central banks may have to accelerate tapering of asset purchases and bring forward rate hikes, and in this regard the Fed may lead the race with central banks of low yielding currencies.

Also, a completer and more objective picture of the pace of Omicron's march across the planet will appear closer to mid-January, since due to the Christmas holidays there was a lag in collecting and processing information on those who caught the virus.

European markets railed on Monday; major indices gained 1% on average. The dollar remains in a moderate corrective downtrend as markets have adjusted down the chances of the first Fed rate hike in March 2022 and await more data. The dollar's gains against the euro may resume this week ahead of Friday's NFP report, which could easily be above forecast due to the seasonal spike in employment during the Christmas period, particularly in retail. In addition, in the middle of the week the minutes of the last "quite hawkish" Fed meeting are slated to release, and on Thursday - inflation figures for December in large economies of the Eurozone, such as Germany and France. According to the consensus forecast, the price pressure in the Eurozone eased in December, as, firstly, the VAT reduction in Germany at the beginning of last year falls out of YoY accounting, and secondly, the pressure on inflation from transport fuels, which also made a significant contribution to the overall rise in prices at the beginning of last year is deemed to be not as strong at the beginning of this year.

Technically, the most probable area for selling on EURUSD, taking into account the upcoming fundamental data, may be near the 1.14 mark, where the upper bound of current downtrend channel resides:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.