Crude Rallies on Venezuela Blockade News

Crude Rebounding Midweek

Crude prices are rebounding sharply higher today after yesterday falling to their lowest level since 2021. Crude futures briefly pierced below prior YTD lows before buying erupted in response to news of Trump’s blockade on Venezuelan crude. As part of Trump’s ongoing pressure campaign against Venezuela, he ordered that sanctioned tankers be blocked from entering or leaving Venezuela. This comes shortly after the seizure of a sanctioned tanker and is expected to impact around 590k barrels per day, the majority of this supply intended for China.

US Unemployment Jumps

The extent to which the recovery can gain momentum looks uncertain however. Ahead of the news on Venezuela, crude prices saw heavy selling extending as traders reacted to the latest US jobs report. The unemployment rate was seen jumping up to 4.6% last month, hitting its highest level since Q3 2021. While Q1 rate cut expectations have weakened in line with a small upside beta on the headline NFP number, the jobs market remains weak, keeping US demand expectations anchored lower near-term.

EIA Data & Fed’s Waller

Looking ahead today, traders will be watching the latest EIA inventories data which is expected to confirm a drawdown of -2.4 million barrels. If seen, this should help push crude prices higher near-term, extending the drawdown from the prior week. However, we also have an important speech today from Fed’s Waller on the economic outlook. If Waller expresses concern this could hamper upside momentum in crude today.

Technical Views

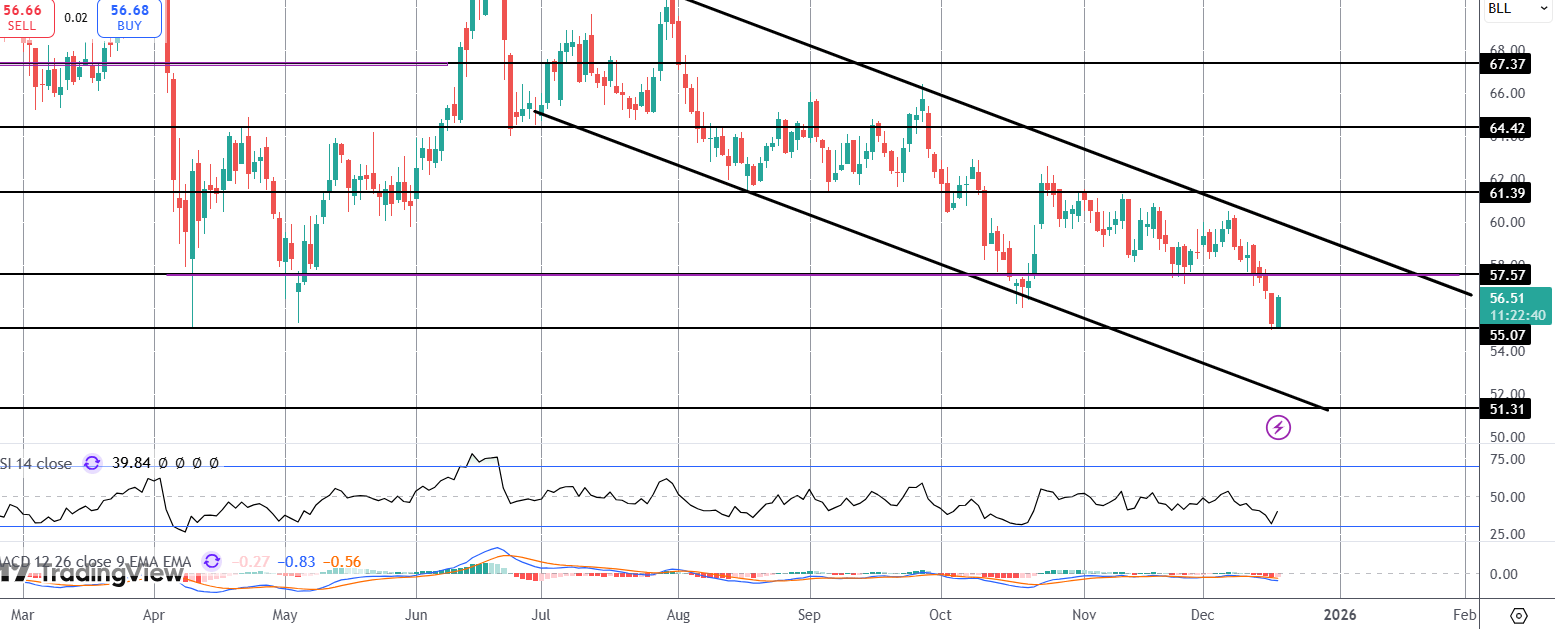

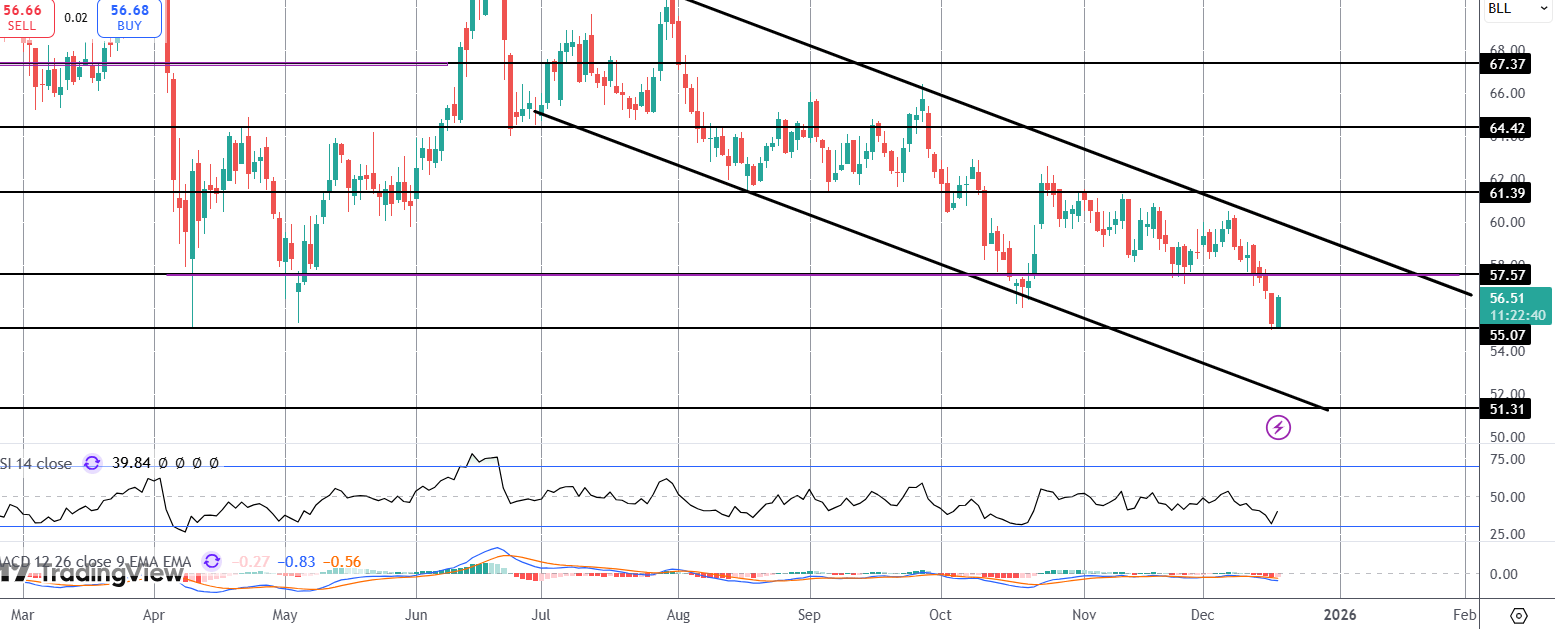

Crude

The sell off in crude has stalled for now into a fresh test of the 55.07 level. Risks remain skewed towards further near-term downside, while price remains below 57.57 with the 51.31 level and channel lows the next bear target. Topside, bulls need to see a break of the channel highs to alleviate bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.