Daily FX Analysis: 20 Sep, Friday

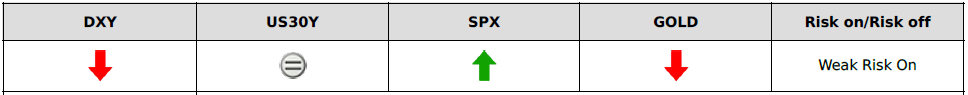

Asia stocks seemed set for a muted session after U.S. equity ended on Thursday without much changes.The dollar and Treasury yields dipped.

Risk sentiment remains neutral or slightly tilted towards some optimism over the trade talks. The S&P 500 Index closed little changed, within 1% of a record, as gains in software companies offset losses for car makers. White House economic adviser Larry Kudlow crossed the wires on Thursday afternoon U.S. time, saying that there has been a softening in the mood in talks between US and China officials ahead of next month's high-level talks in Washington, per Reuters.

Trade negotiators from the U.S. and China resumed face-to-face talks in Washington, as the Trump administration said a Chinese delegation will visit American farmlands next week. Talks between a Chinese delegation led by Liao Min, a vice minister for finance, and Deputy U.S. Trade Representative Jeffrey Gerrish began Thursday and are scheduled to continue Friday. The negotiations are expected to lay the ground-work for top-level negotiations between U.S. Trade Representative Robert Lighthizer, Treasury Secretary Steven Mnuchin and Vice Premier Liu He in October in Washington, according to Bloomberg. But investors are wary of being too optimistic this time, given that no further detail is given.

USD

Technical Analysis:

Fundamental Analysis:

USD | Bullish ↑ | ★★☆

20 Sep: USD edged slightly up on Thursday after a hawkish Fed. Fed has upwardly revised its GDP forecast but is still concerned about growth while ignoring the recent pick-up in inflation completely. Central bankers are very reluctant to show any hint of further rate cut while the market is still betting on another rate cut this year which provides room for USD to edge up if market bets wrongly. On the data front, US released the initial jobless claims for the week ended September 13, which came in at 208K better than the 213K expected, showing a stable job market. The Current Account in Q2 posted $128.2B vs 127 B expected while the Philadelphia Fed Manufacturing Survey beat the market’s expectation by printing 12 vs 10.9 expected. still below previous 16.8. Finally, Existing Home Sales in the US rose by 1.3% in August. These data still show that U.S. economy is still benefiting from robust household spending but manufacturing remains weak. Job market is stable enough to support Fed's hawkish stance this time. USD is likely to steady and may go higher today.

EUR

Technical Analysis:

Fundamental Analysis:

EUR | Bearish ↓ | ★☆☆

20 Sep: EUR rose against the greenback after the Fed cut interest rates by 25 basis points yesterday, an insurance cut against risks including weak global growth and resurgent trade tensions, while signalling a higher bar to further reductions in borrowing costs. For today, we could be seeing the EUR edge lower as investors anticipate Germany’s PPI data which is expected to record a 0.2% decline (MoM) and a 0.6% growth (YoY), both numbers being lower than its previous data which could cause the EUR slide lower.

GBP

Technical Analysis:

Fundamental Analysis:

GBP | Bullish ↑ | ★★☆

20 Sep: Yesterday, the Sterling edged lower driven by the weak retail sales data before holding steady as BOE kept interest rates unchanged. Following that, Pound surged to the highest level against the greenback amid a report that European Commission President Jean Claude Junker thinks a Brexit deal can be reached by 31 Oct. Juncker said in an interview that he was doing “everything” to prevent a no-deal Brexit, which would be catastrophic. That said, we caution the upside for the currency as money market traders have quietly accumulated more than 1 million derivative contracts that will pay off if the UK central bank cuts rates by 50 basis points, by September next year. Record volumes for the call options changed hands this week and the size of the holding is more than 7 times this year’s average daily turnover of such contracts. For today, we could be seeing the currency edge higher on renewed optimism with regards to Brexit though we caution the volatility given that Brexit remains the main driver of the currency.

AUD

Technical Analysis:

Fundamental Analysis:

AUD | Neutral | ★☆☆

20 Sep: The AUD slipped to lows on increase of the unemployment rate, which was the focus for investors yesterday. Rising unemployment being an indicator that wage growth may be stalled for the oncoming future has subsequently increased the likelihood of a RBA rate cut this October which added further pressure to the AUD.

US-China delegates have also begun meetings to kick off trade discussions. News flowing from these meetings will likely make some moves to the AUD; however majority of investors focus should still be on the outcome of higher level talks; where we would expect a larger reaction from the AUD. As the week wraps and with no domestic data due today, it is likely that today will see a consolidation of the AUD therefore we’re inclined to take a neutral bias on the AUD for today.

JPY

Technical Analysis:

Fundamental Analysis:

JPY | Bearish ↓ | ★★☆

20 Sep: On Thursday, JPY jumped after BOJ kept its monetary policy on hold. But the central bank also announced that it would review its monetary policy next month amid the downside risks to the economy. This could mean possible action in October. On the data side, Japan released the July All Industry Activity Index, which was up by 0.2% when compared to June. During the upcoming Asian session, Japan willrelease August National Inflation, with the annual CPI ex-Fresh Food seen up by 0.4% against the previous 0.6%.

U.S. equities ended Thursday near where they started as investors failed to find a catalyst to lift the index further up. Treasuries yield steadies. Risk sentiment is neutral or slightly risk-on waiting for news from the trade talk. JPY is likely to move sideways or edge slightly lower today.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.