Daily Market Outlook, April 06, 2021

Daily Market Outlook, April 06, 2021

US equity markets rose yesterday, continuing their strong start to Q2. However, Asian markets are mixed after China’s central bank told banks to restrict loan growth for the rest of the year. UK PM Johnson yesterday confirmed that a further loosening in lockdown restrictions in England will go ahead on 12th April. However, he may face opposition from MPs over plans to consider domestic “Covid passports”. The Australian central bank left monetary policy unchanged at its latest update.

In the US, last Friday’s labour market report for March posted a 916k monthly rise in employment, the largest increase for seven months, while the unemployment rate dropped to a new 12-month low of 6.0%. Yesterday’s ISM services survey had a reading of 63.7 for the headline index (up from 55.3 in February). Both prints suggest that the US economy has considerable momentum behind its rebound even before the impact of the latest fiscal package past in March is seen.

The economic calendar for the holiday-shortened week is, not surprisingly, light. There is likely to continue to be a lot of interest in the thoughts of central bankers particularly about the recent rise in bond yields and any sign of them faltering in their intentions to keep monetary policy very loose in the face of improving growth trends. The US Federal Reserve and the European Central Bank will release minutes from their last policy meetings this week. Policymakers from those institutions and other central banks will also appear at virtual sessions at the IMF-World Bank semi-annual conference. The IMF will also release new economic forecasts and the focus will be on how much growth expectations, particularly for the US, have been revised up.

Today’s data calendar is particularly sparse with nothing of note in the UK. The Eurozone unemployment rate for March is expected to be unchanged from February at 8.1%. That compares with a recent pandemic peak in August of last year at 8.7%. As in the UK, unemployment has stayed relatively low despite a big economic impact from the pandemic due to government support measures. The Sentix investor confidence index for April will provide an indication of how market sentiment is holding up in light of recent news of an acceleration in Covid-19 cases in the EU. Last month, it rose to its highest level since February of last year.

In the US, the JOLTS survey may provide some interesting detail on employment trends. As it is an update for February, it lags last week’s labour market report by a month but it should still provide some information on which sectors have seen a particularly sharp rebound in the labour market.

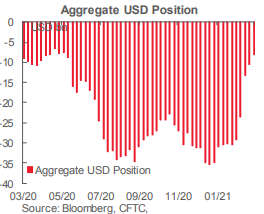

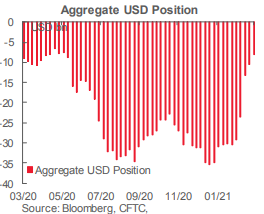

CFTC Data

IMM data covering the week through March 30th reflect a further reduction in overall USD shorts, with the aggregate position, reflected in the main currencies in this report, falling a little less than USD2.5bn in the latest week, to total USD8.1bn. This was the sixth successive week that aggregate USD shorts have been cut back, leaving speculative accounts’ overall exposure to the short USD trade at its lowest in a year.

Positioning in the EUR and JPY contracts continue to dominate the overall picture of exposures via currency futures. Net EUR longs were cut by a little over USD3bn in the past week, taking the net long down to USD10.8bn, mainly reflecting an increase in gross shorts. Gross EUR longs were relatively stable this week. Meanwhile, speculators boosted net JPY shorts, rather more modestly this week, by USD576mn. The net short JPY position of USD6.7bn (nearly 60k contracts) does, however, represent the biggest, bearish position in the JPY since May 2019.

As has been more or less typical in recent months, sentiment and positioning changes in the other major currencies was rather limited. GBP bulls added— modestly—to net longs, mainly reflecting a drop in gross short GBP positioning as gross GBP longs dropped in the past week as well. The GBP net long increased USD268mn this week to USD2.1bn, the third largest exposure reflected in these data.

Net CHF bullish positioning increased USD182mn in the week but the overall exposure remains low (just USD566mn). Net CAD bullish sentiment was little changed this week (up USD111mn to USD516mn). Net AUD longs jumped USD479mn to USD932mn while net NZD and MXN risk was little changed near flat in both cases. Net gold longs were cut USD1.8bn to USD28.3bn.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 targeting 1.16

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest light offers and with weak stops on a move through the 1.1820 area with limited congestion then continuing through to the 1.1840-60 area before stronger offers start to appear on a test through the 1.1880 level and stronger through the 1.1900 area. Downside bids into the 1.1700-1.1680 area with weak stops on a move through and then congestive bids into the 1.1650 area and continuing through to the 1.1600 where better bids are likely to be seen with weak stops through the level opening a deeper move as a possibility.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.30 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers congested around the level and increasing through to the 1.3900 area, some weak stops likely to be absorbed by congestion that is likely to continue through to the 1.4000 area before stops increase. Downside bids light through the 1.3800 level and then light bids through to the 1.3700 area where bids are likely to increase through to the 1.3650 area before weak stops appear.

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light back through the 110 level and likely to continue to 109.80 with weak stops likely through the level and weak through to the 109.00 area.

AUDUSD Bias: Bearish below .7700 targeting .7453

AUDUSD From a technical and trading perspective, as 7700 contains upside advances bears will target a test of the downside equality objective at .7453 before trend resumption may develop

Flow reports suggest light offers through the 0.7700 area with weak stops through the level and the market opening to the 78 cents area before stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!