Daily Market Outlook, April 07, 2021

Daily Market Outlook, April 07, 2021

Equity markets in the US closed slightly lower after recently scaling new highs, and were mixed in Asia. The IMF yesterday revised up its global growth forecast for this year to 6.0% from 5.5%, but warned about uneven growth prospects between advanced and emerging economies. US GDP growth was raised to 6.4% from 5.1% and UK growth to 5.3% from 4.5%.

Today’s final readings of March services PMIs are expected to reaffirm expansion in the UK and marginal contraction in the Eurozone. Final US services PMI, released on Monday, were revised up slightly to 60.4 from 60.2, outpacing their European counterparts, while the separate ISM services survey also signalled buoyant activity by rising to a record high of 63.7. Expect a slight upward revision to today’s UK services PMI to 57.0 from 56.8. That would move it further above the key 50 level confirming a return to expansion in the survey for the first time since October.

For the Eurozone services PMI, the preliminary flash March print of 48.8 beat expectations (as was also the case in the UK), but it remained in contraction territory for a seventh consecutive month. Today’s final release is expected to confirm that first estimate. More broadly, however, a stellar result for Eurozone manufacturing PMI (with the output index at 63.3) means the overall composite PMI will likely reaffirm a return to overall growth for the first time in six months. The impact of further containment measures to combat the recent rise in Covid cases, though, remains to be seen.

The US services surveys reaffirm very strong economic growth momentum, led by fiscal stimulus measures and progress in the vaccination campaign. Despite that, the Fed has indicated that it is too early to signal any change to its policy stance just yet. The minutes of the 16-17 March FOMC meeting will be published this evening. Before the minutes, a number of Fed speakers (Evans, Kaplan, Daly and Barkin) are scheduled to appear.

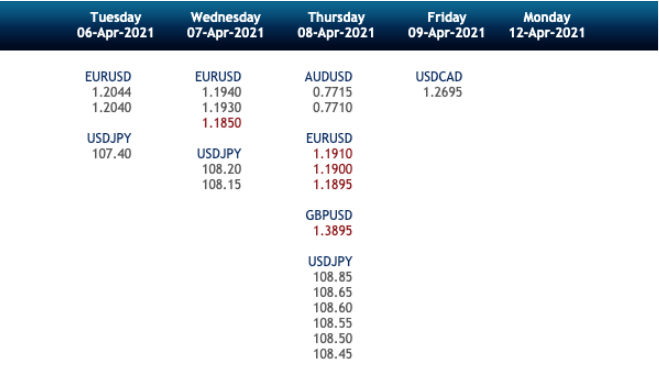

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 targeting 1.16

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest downside bids into the 1.1700-1.1680 area with weak stops on a move through and then congestive bids into the 1.1650 area and continuing through to the 1.1600 where better bids are likely to be seen with weak stops through the level opening a deeper move as a possibility. Topside offers into the 1.1880 level and then stronger offers likely through into the 1.1900 area with short term sellers likely to fade the move with weak stops likely to have stepped a little away from the usual 1.1920 area and then stronger offers again appearing on any push at the 1.1940-60 area and the congestion then increasing on any move through to the 1.2000 area.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.30 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers congested around the level and increasing through to the 1.3900 area, some weak stops likely to be absorbed by congestion that is likely to continue through to the 1.4000 area before stops increase. Downside bids light through the 1.3800 level and then light bids through to the 1.3700 area where bids are likely to increase through to the 1.3650 area before weak stops appear.

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light back through the 110 level and likely to continue to 109.80 with weak stops likely through the level and weak through to the 109.00 area.

AUDUSD Bias: Bearish below .7700 targeting .7453

AUDUSD From a technical and trading perspective, as 7700 contains upside advances bears will target a test of the downside equality objective at .7453 before trend resumption may develop

Flow reports suggest light offers through the 0.7700 area with weak stops through the level and the market opening to the 78 cents area before stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!