Daily Market Outlook, April 08, 2021

Daily Market Outlook, April 08, 2021

Asian equity markets are mostly a little higher overnight. Yesterday’s release of the minutes of the last US Federal Reserve policy meeting confirmed previous messages that it will be some time before conditions are appropriate to scale back monetary policy support including reducing asset purchases. The UK RICS house price balance came in at 59 for March versus 54 for February. German factory orders as expected rose by 1.2% in February.

There continues to be a global focus on the safety of Astra Zeneca’s Covid-19 vaccine. Some EU countries are reported to be considering mixing up vaccines for citizens who received a first dose of the AstraZeneca drug. However, no such action is currently planned in the UK. Moreover, PM Johnson has said that he does not expect the news to delay the plan for easing restrictions.

As the UK manufacturing and services PMIs for March both pointed to larger-than-expected improvements in economic activity, today’s construction data will be watched for similar favourable news. The February reading showed an overall rise with housing still the strongest sector. However, as the index was still below the recent high seen late last year a further rise in the latest update seems likely.

Recent data have suggested that, after stalling through the autumn and winter months, the US labour market is now improving once again. March saw a rise in employment of 916k the biggest rise for seven months and unemployment claims data appear to be trending down. Today’s weekly initial claims number for early April is expected to provide signs that the rebound has continued into this month.

Today’s release of the minutes of the last policy meeting of the European Central Bank will be expected to give insights into ECB’s policymakers’ decision to increase the pace of their asset purchase programme. ECB President Lagarde said at the time that there was a consensus for the action. Nevertheless, it will be interesting to see how much agreement there was that downside economic risks and the need to contain the rise in government bond yields justified the move.

US Federal Reserve Chair Powell will appear as part of a virtual panel today at the International Monetary Fund’s semi-annual conference. Other members include the heads of the IMF and the World Trade Organisation. As their topic is supposed to be global economic trends, the discussion is likely to focus not just on the outlook for US monetary policy but also on the wider impact of that on other countries. Of particular interest to markets will be whether anything is said about recent moves in bonds and currencies.

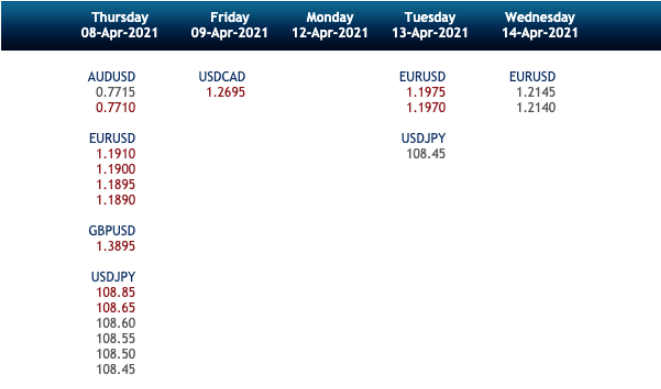

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Technical & Trade Views

EURUSD Bias: Bearish below 1.19 bullish above

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest downside bids into the 1.1700-1.1680 area with weak stops on a move through and then congestive bids into the 1.1650 area and continuing through to the 1.1600 where better bids are likely to be seen with weak stops through the level opening a deeper move as a possibility. Topside offers into the 1.1880 level and then stronger offers likely through into the 1.1900 area with short term sellers likely to fade the move with weak stops likely to have stepped a little away from the usual 1.1920 area and then stronger offers again appearing on any push at the 1.1940-60 area and the congestion then increasing on any move through to the 1.2000 area.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.30 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers congested light through the 1.3800 area before increasing through to the 1.3900 area, some weak stops likely to be absorbed by congestion that is likely to continue through to the 1.4000 area before stops increase. Downside bids through the 1.3720 level and any technical move from the H&S pattern likely to be done so likely to see congestion on any move through the 1.3700 level with weak stops likely through the 1.3680 area and then congestive just beyond the break and through to the 1.3650 where stiffer bids start to appear

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light back through the 110 level and likely to continue to 109.80 with weak stops likely through the level and weak through to the 109.00 area.

AUDUSD Bias: Bearish below .7700 targeting .7453

AUDUSD From a technical and trading perspective, as 7700 contains upside advances bears will target a test of the downside equality objective at .7453 before trend resumption may develop

Flow reports suggest light offers through the 0.7700 area with weak stops through the level and the market opening to the 78 cents area before stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!