Daily Market Outlook, April 12, 2021

Daily Market Outlook, April 12, 2021

Market risk sentiment has started the week on a soft note with equities across the Asia Pacific region trading lower. Rising infection rates, particularly across emerging market economies, remain a concern and point to the likelihood of an uneven recovery in the global economy. Speaking yesterday, US Fed Chair Powell said that the US economy is at an inflection point with stronger growth and hiring ahead, largely due to the rate of vaccinations and the sizeable amount of policy support in the US. However, the potential for another wave of coronavirus to derail the recovery remains a key risk.

A further easing of lockdown restrictions takes place in England today as non-essential retailers and some other consumer-facing businesses, including hairdressers, are allowed to reopen. In addition, pubs and restaurants will be allowed to serve customers outside. Government statements suggest that the next phase of loosening planned for 17 May also remains on course. There are already clear signs from a number of economic surveys that these moves are expected to produce a significant rebound in economic activity over the past few months.

The Eurozone retail sales report for February is the only notable data release on today’s calendar. Following January’s 5.9% decline, a partial rebound of 1.3% is expected in the February release, which would still leave sales down 5.3% on the year. Meanwhile, BoE’s Tenreyro speaks on a webinar on the subject of trade and economic shocks, while US Fed member Rosengren discusses the US economic outlook in a speech.

Early tomorrow morning, the February UK GDP report will be released. Restrictions were of course still in place for all of that month. Nevertheless, there are signs that activity picked up across the month, following the 2.9% decline seen in January. Look for a 0.8% monthly gain reflecting a rise in services output, as businesses began preparing for the gradual reopening of the economy from early March, more than offsetting drops in industrial production and construction activity. The latter two sectors seem likely to have been disrupted by supply chain problems. Even assuming a further acceleration in March, GDP is still expected to have fallen across Q1. Nevertheless, the expected uptrend through the quarter means that a sizeable rise seems possible for Q2.

Overnight, the UK will also see the publication of the BRC’s release of its March retail sales estimate. The official retail sales measure posted a disappointingly small rebound in February, following a very big fall in January. Nevertheless, given the ongoing improvement in consumer confidence it seems reasonable to expect sales picked up last month, with further improvements expected as restrictions are rolled back.

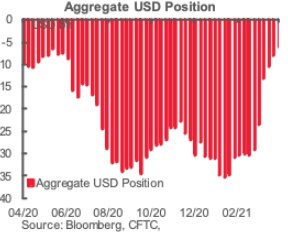

CFTC Data

The trend of USD short-covering extended for a seventh week among speculative accounts, the latest snapshot of sentiment and positioning provided by the CFTC data reveal. The overall USD short position, reflected in the aggregated exposures to the major currencies we monitor in this report, dropped USD2.1bn in the week through Tuesday to USD6.0bn, the lowest since May of last year.

Long liquidation in net EUR longs and net GBP longs provided the basic drive behind this week’s shifts. Gross EUR longs fell while gross GBP longs dropped and gross shorting activity picked up. Net EUR longs fell USD776mn to USD10bn, the equivalent of 76.5k contracts, the smallest bull bet on the EUR since March of last year. Net GBP longs dropped USD420mn to USD1.7bn.

Investors retain a bearish view of the JPY and maintain a net short of USD6.6bn which fell only slightly this week (USD132mn). Net JPY shorts remain the largest in nearly two years, however. Net CAD longs were cut back to near flat (just USD214mn, or 2.7k contracts) as market participants dumped USD302mn worth of net longs.

A modest net AUD long position which had accumulated through March was cut back aggressively (down USD620mn—the second largest week-over-week bout of USD short covering in effect) and is also heading towards neutral. A very small net NZD long was cut USD22mn. A minor net MXN short (USD326mn) was reduced USD41mn. Commodity/high beta FX sentiment remains effectively flat.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1915 (656mln), 1.1930 (482mln)

USD/JPY: 110.40 (410mln)

EUR/GBP: 0.8600-05 (530mln)

USD/CAD: 1.2600 (410mln)

NZD/USD: 0.7000 (329mln)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 bullish above

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest topside offers into the 1.1920 level again and possible weak stops on a move through to the 1.1930 area and the market then likely to see increasing offers through the 1.1940-60 area and then the 1.1980-1.2000 level with strong stops likely on a move through the 1.2020-30 area. Opening only a limited move higher, downside bids light through to the 1.1820 area with weak stops on a move through to the 1.1780 level with limited bids through to the 1.1700 area and only light congestion through the 1.1750 level.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.39 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers light through the 1.3750 area and then increasing on a move through to the 1.3800 area, weak stops on a move through the level with increasing offers through to the 1.3850 level building towards the 1.3900 area before stronger stops on a move through, downside bids light into the 1.3650 area and then increasing on a move to the 1.3600 area with stronger stops on a dip through but again strong congestion on a move to the 1.3550 level and increasing into the 1.3500 area

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light through to the 109.00 area, with weak stops through the 108.80 area likely to run into stronger bids through the 108.40-60 area and then into the 108.20-107.80 before stronger stops appear.

AUDUSD Bias: Bearish below .7700 targeting .7453

AUDUSD From a technical and trading perspective, as 7700 contains upside advances bears will target a test of the downside equality objective at .7453 before trend resumption may develop

Flow reports suggest light offers through the 0.7700 area with weak stops through the level and the market opening to the 78 cents area before stronger offers through to the 0.7840-60 area and then increasing offers onwards through 0.7900, with the offers likely to continue through to the 0.7950 area and likely increasing resistance through to the 0.8000 levels, downside bids into the 76 cents level with strong bids likely through to the 0.7580 area, weak stops are likely to be few and far between with stronger bids likely into the 0.7550 level and likely stronger congestion through to the 0.7500 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!