Daily Market Outlook, April 14, 2020

Daily Market Outlook, April 14, 2020

At the start of a busy period for quarterly earnings reports, the Asian equity market has climbed higher this morning, while futures contracts point to increases at the start of the European session. This follows some better-than-expected March trade data out of China, which showed exports in yuan terms falling by less than expected.

Late last night, US President Trump announced that a plan to reopen the economy again would be complete shortly. This follows some US states forming regional pacts to coordinate a gradual reopening of their economies.

The number of global Covid-19 cases is approaching the 2 million mark, but there appears to be cautious optimism among investors that the curve is being flattened, with new infections rising at a slower pace. In turn, that has raised hopes that we may be closer to the reopening of major economies. Still, with a number of countries extending the lockdown period – including France (till 11thMay) and the UK also likely to follow suit later this week – the world economic outlook remains very uncertain and there is considerable uncertainty about the scale of the economic impact of the pandemic in the present and the recent past.

Later today (13:30 BST), the IMF will provide its latest forecasts for the world economy in its World Economic Outlook, at the start of its (virtual) Spring Meeting, which runs through till Friday. These are expected to show a significant downgrade to the IMF’s previous 2020 GDP growth projection of 3.3% from January.

The rest of the day is void of any major data releases, however, comments from Fed members Bullard, Evans and Bostic will almost certainly provide a more detailed update on economic trends in the US. Greatest attention is likely to be on Bullard, who has previously suggested that the unemployment rate in the US could rise as high as 42%.

G20 finance ministers and central bank governors will meet virtually to review the fallout from the pandemic and discuss what further joint measures are likely to be needed. The group is reported to be finalising a 6 to 9 month freeze on bilateral government loan repayments aimed at supporting lower income countries. Separately, G7 finance ministers will also engage in a teleconference.

In an interview on Bloomberg Television on Monday, Fed Vice Chairman Richard Clarida said the US economy was fundamentally sound and the central bank would not need to continue its massive support of financial markets indefinitely. On the same note, the New York Fed also announced that it intends to reduce the frequency of some repo operations in light of more stable repo market conditions. Separately, Atlanta Fed President Raphael Bostic said on Monday that he was optimistic about the Federal Reserve's and Congress' response to the COVID-19 crisis and added that the recovery should be "much more robust" than from a usual recession

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0800 (750M), 1.0850-55 (366M), 1.0895-1.0900 (610M) 1.0910 (271M), 1.0925 (300M), 1.1000 (733M)

- GBPUSD: 1.2595 (500M), 1.2615 (226M)

- EURGBP: 0.8825-35 (450M)

- USDJPY: 107.00 (350M), 107.05 (1.1BLN), 107.25-30 (500M) 108.00 (761M), 109.00 (1.4BLN)

- AUDUSD: 0.6400 (760M). NZD/USD: 0.5995 (203M), 0.6175 (212M)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.09 targeting 1.1250)

EURUSD From a technical and trading perspective, daily chart has flipped bullis has per the near term volume weighted average price, the anticipated move through 1.890 has injected further upside momentum challenging the first decision point at 1.0960/80, through this area opens a test of pivotal 1.1070/80, if bulls can sustain a breach here then 1.1250/80 is the primary upside objective. On the day only a close sub 1.09 would concern the bullish bias.NO CHANGE IN VIEW

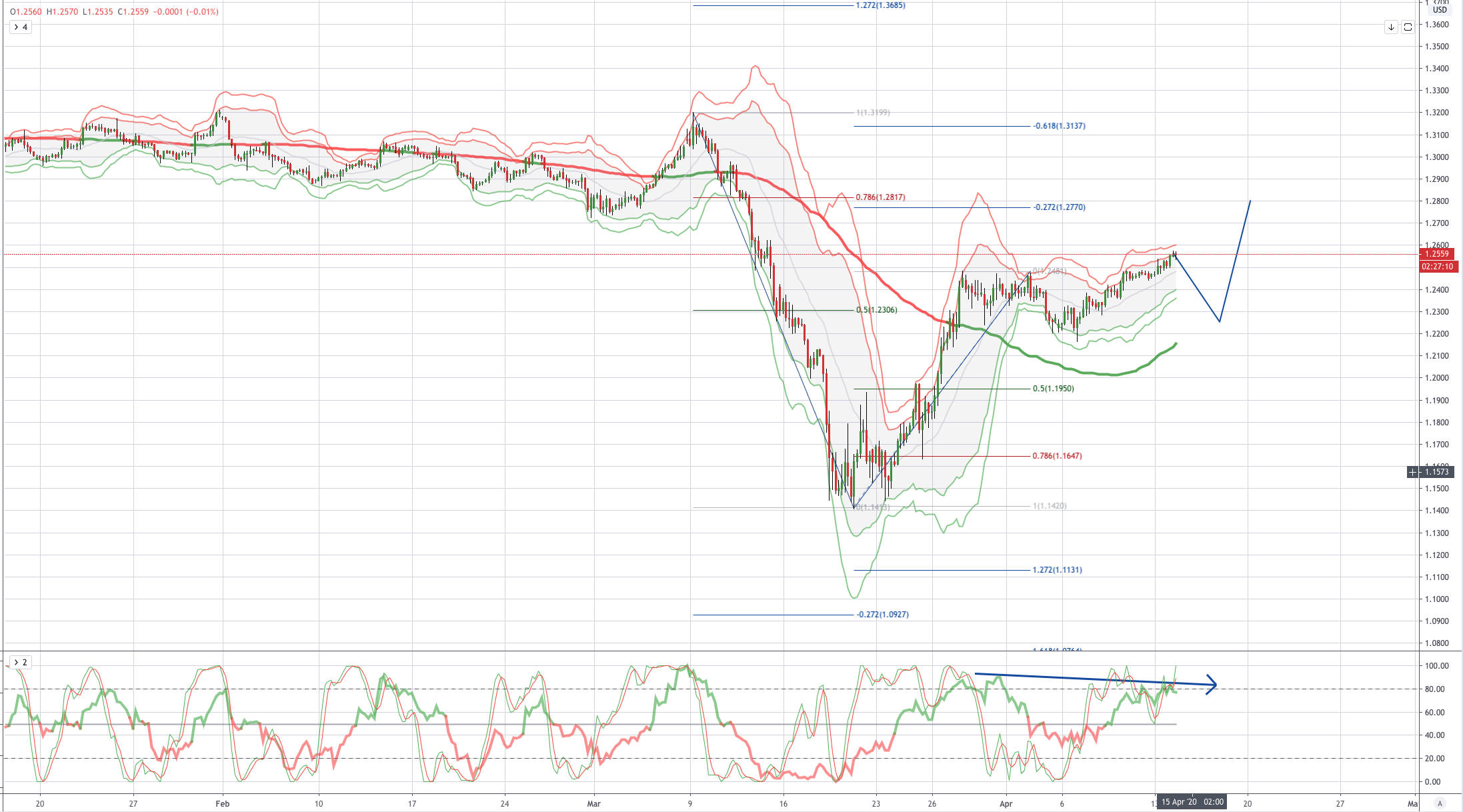

GBPUSD (Intraday bias: Bullish above 1.22 targeting 1.28)

GBPUSD From a technical and trading perspective, a move back through 1.24 would suggest a broader corrective phase to unwind near term overbought momentum, 1.20/1.1950 will be pivotal this week, if bulls fail to defend this area, a deeper decline could ensue to test bids and stops below 1.17 NO CHANGE IN VIEW

USDJPY (intraday bias: Bearish below 109 targeting 1.0465)

USDJPY From a technical and trading perspective, double bottom delays downside objective with a whipsaw back to 110 before lower again. Through 107 would suggest downside targets are directly in play NO CHANGE IN VIEW

AUDUSD (Intraday bias: Bullish above .6200 targeting .6430)

AUDUSD From a technical and trading perspective, as .6200 now acts as support look for a grind higher to set up a test of the pivotal .6430/90 area. A close through here sets bullish sights on the equality objective at .6695. Only a decline back though .6250 would concert the bullish bias. NO CHANGE IN VIEW

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!