Daily Market Outlook, April 15, 2021

Daily Market Outlook, April 15, 2021

Asian equity market performance is mixed following a soft end to trading in the US as Coinbase, a cryptocurrency exchange, first rose but then fell. The US Federal Reserve’s Beige Book of anecdotal updates said that the economy is strengthening as consumer spending recovers but warned of cost pressures from supply chain issues. Fed Chair Powell said the economy is entering a period of fast growth and the key risk is another spike in Covid-19 cases. In the UK, officials warned of the possibility of six-hour queues at UK airports if traveling rules are relaxed in May. Australian employment grew by more than forecast in March and the unemployment rate slipped to 5.6% from 5.8%.

Today’s European data calendar is very light with nothing of note in the UK. That leaves the focus firmly on the US which has a number of economic activity indicators for March alongside some advanced readings for April. Many US indicators surprised on the downside in February. However, that was seen as being primarily a result of disruptions from a severe storm in the south of the country and so a sharp rebound is expected for March. In addition some of today’s data seems likely to show the first impacts of the big fiscal stimulus package passed by Congress during March.

US March retail sales may generate most interest as they likely to be particularly buoyant. They rose by 7.6% in January, boosted by previous fiscal measures passed in December but then slipped by 3.1% in February. The consensus forecast for March is for a sharp rise of almost 6%, but some analysts are looking for an increase of more than 10%. Industrial production is also forecast to show a big gain. Prior to February, it had risen in eight months out nine due to the factory sector being less directly impacted by social distancing measures. Expect a further rise of around 2.4% for March.

The New York and Philadelphia Fed surveys will provide the first indications for April, and both are likely to be buoyant. Meanwhile, weekly jobless benefit claims for early April will be watched for indications that employment trends are strengthening.

A series of upbeat data releases will help reinforce market expectations that a strong pick-up in US economic growth is underway. However, it is unlikely to result in a near-term change in the Fed’s rhetoric. Yesterday a number of speakers from the central bank reiterated that their focus remained on supporting the recovery and no early change in policy is envisaged. Today will probably see a similar reaction. Nevertheless, as long as US data continues to improve, markets will wonder just when the Fed will shift its stance.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1900 (2.1BLN), 1.1940 (730M), 1.1960-75 (1.9BLN), 1.1990 (450M)

EUR/GBP: 0.8700 (380M).

GBP/USD: 1.3725 (230M, 1.3820-30 (280M)

AUD/USD: 0.7700 (592M), 0.7730-40 (402M), 0.7750-65 (1.1BLN)

AUD/NZD: 1.0850 (769M).

USD/CAD: 1.2410 (405M), 1.2645 (530M)

USD/JPY: 109.00-10 (2BLN) 109.15-25 (1BLN), 109.40-50 (715M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 bullish above

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest congestion through into the 1.2000 level and stronger offers through the level, a push above the 1.2030 area could see weak stops however, any stops are likely to see congestive offers continuing with the market according to several banks willing to fade any rise however, saying that a move through the 1.2050 area could see a short squeeze appearing and opening a limited move to the next level around 1.2100, downside bids light through to the 1.1820 area with weak stops on a move through to the 1.1780 level with limited bids through to the 1.1700 area and only light congestion through the 1.1750 level

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.39 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers into the 1.3800 level with weak stops on the move through likely to see some small gains through to the 1.3850 area before finding increasing offers through to the 1.3900 levels. downside bids light into the 1.3650 area and then increasing on a move to the 1.3600 area with stronger stops on a dip through but again strong congestion on a move to the 1.3550 level and increasing into the 1.3500 area.

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light through to the 109.00 area, with weak stops through the 108.80 area likely to run into stronger bids through the 108.40-60 area and then into the 108.20-107.80 before stronger stops appear.

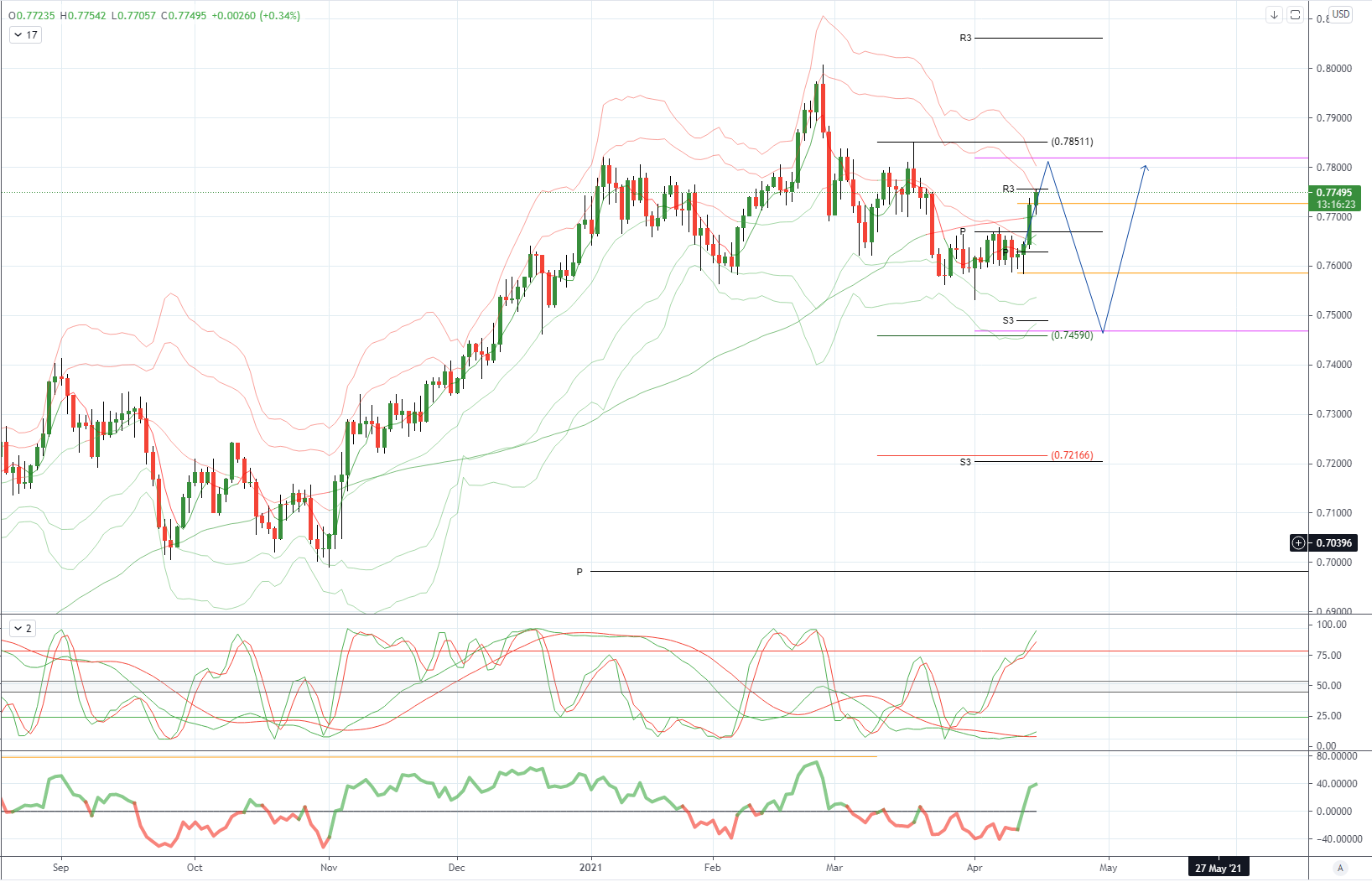

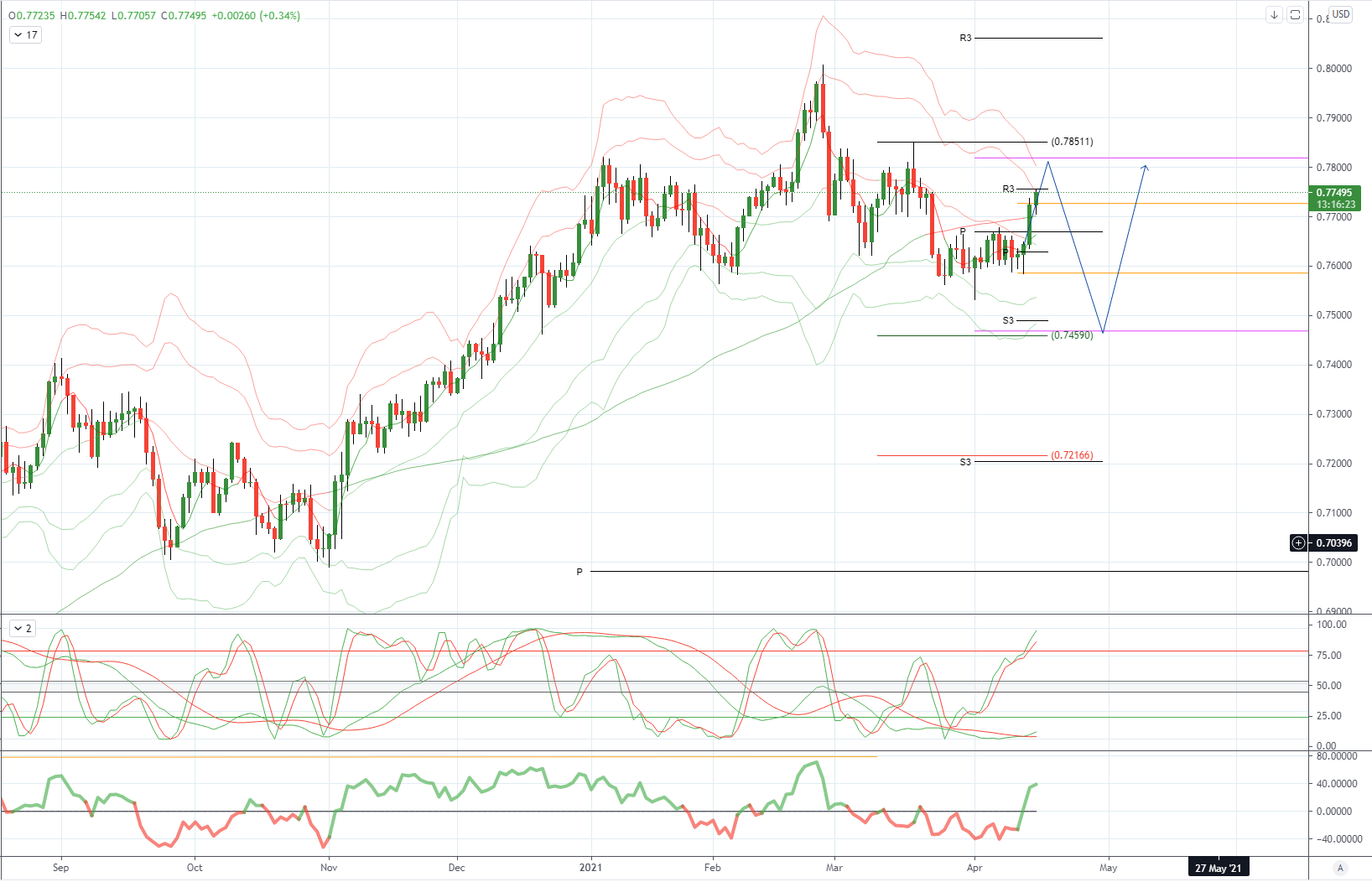

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, a closing breach of .7730 would relieve downside pressure opening a move to test offers towards .7820

Flow reports suggest offers through the 0.7740-60 level and increasing on any breach above the level and into the 0.7780-0.7800 area, weak stops likely on a break of the 0.7820-30 area is likely to quickly run into further congestion on any move towards the 0.7850-0.7900 area. Downside bids light through the 0.7700 area and weak stops likely on any dip through the 0.7680 area to test quickly to the lower end of the congestion through 0.7650 with increasing bids into the 76 cents level and through to the 0.7550 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!