Daily Market Outlook, April 16, 2021

Daily Market Outlook, April 16, 2021

Asian equities are mixed, despite new record highs at the close on Wall Street, supported by yesterday’s strong US data including retail sales. Despite the data, US 10-year Treasury yields fell to a low of 1.53% before moving back up, as markets took stock of the sharp sell-off since the start of the year and some suggestion that demand may have been supported by geopolitical tensions. The main overnight data release was China’s Q1 GDP which surged by 18.3%y/y. However, that reflects very weak activity in the same period a year ago due to the pandemic, while quarter-on-quarter growth slowed to 0.6% from 3.2% in Q4.

The European data calendar remains light, with nothing of note in the UK, while Eurozone final CPI inflation for March is expected to confirm earlier ‘flash’ estimates. Headline inflation in the Eurozone has risen significantly this year from ‑0.3%y/y in December up to 1.3%y/y in March. That has been driven mostly by higher energy prices, but core inflation has also risen from 0.2%y/y to 0.9%y/y over the same period, partly reflecting higher VAT rates in Germany. Further rises in headline inflation towards 2% are predicted this year, before falling back in 2022. As elsewhere, rising inflation rates this year are expected to be temporary. That being the case, the ECB is in no hurry to rein back policy stimulus; in fact, it did the opposite at the last policy meeting and announced it will increase the pace of asset purchases in Q2. The ECB is likely to keep policy unchanged at next week’s meeting.

This week’s US economic data releases have been strong, partly reflecting the bounce-back from some temporary weather-related weakness in February and also the impact of the latest fiscal stimulus package. Yesterday saw March retail sales soar by 9.8%, while weekly initial unemployment claims dropped by 193,000 to 576,000, the lowest since the start of the pandemic. Today’s March housing starts figures are predicted to bounce back from the 10.3% plunge seen in February.

Also due today is the preliminary reading of the University of Michigan’s US consumer sentiment survey for April. Expect a further increase to 88.5 from 84.9 in March, which would be the highest level since the start of the health crisis, supported by monetary and fiscal policy measures, progress in vaccinations and improving economic fundamentals.

Central bank speakers today include the Bank of England Deputy Governor Cunliffe, although his remarks are not expected to be on prospects for the economy and monetary policy. Dallas Fed President Kaplan is also scheduled to speak at two events.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

USD/JPY: 108.00 (545M), 108.50 (320M), 109.00 (715M)

GBP/USD: 1.3650 (580M)

USD/CAD: 1.2480 (919M)

AUD/USD: 0.7550 (519M)

NZD/USD: 0.7100 (406M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 bullish above

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest topside offers through the 1.1980 level and into the 1.2020 area with weak stops likely to be mixed with congestive sellers and offers moving through and likely to continue in varying sizes to the 1.2080 level where stronger and more determined offers are likely to appear, weak stops and the possibility of a short squeeze through the 1.2120 area but continuing offers likely, downside bids light back through the 1.1900 level with some light profit taking possible before 1.1880 stops appear and opening a limited dip through to the 1.1850 area and stronger bids.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.39 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers into the 1.3800 level with weak stops on the move through likely to see some small gains through to the 1.3850 area before finding increasing offers through to the 1.3900 levels. downside bids light into the 1.3650 area and then increasing on a move to the 1.3600 area with stronger stops on a dip through but again strong congestion on a move to the 1.3550 level and increasing into the 1.3500 area.

USDJPY Bias: Bullish above 109 targeting 112

USDJPY From a technical and trading perspective, as 109.50 continues to attract support bulls will look for a test of 112. A loss of 109.30 opens a retest of bids at 108.50

Flow reports suggest topside light congestion through to the 110.80 level before weak stops then weakness through to the stronger offers around the 111.80 area matching the highs from the beginning of the previous two years at the same period of time, a break of the 112.30 area is likely to see strong stops appearing and the market opening for further push beyond the last couple of years highs. Before running through to the 112.50 area and another set of stronger offers appearing continuing through to the 112.80 level and likely continue seeing strong offers, downside bids light through to the 109.00 area, with weak stops through the 108.80 area likely to run into stronger bids through the 108.40-60 area and then into the 108.20-107.80 before stronger stops appear.

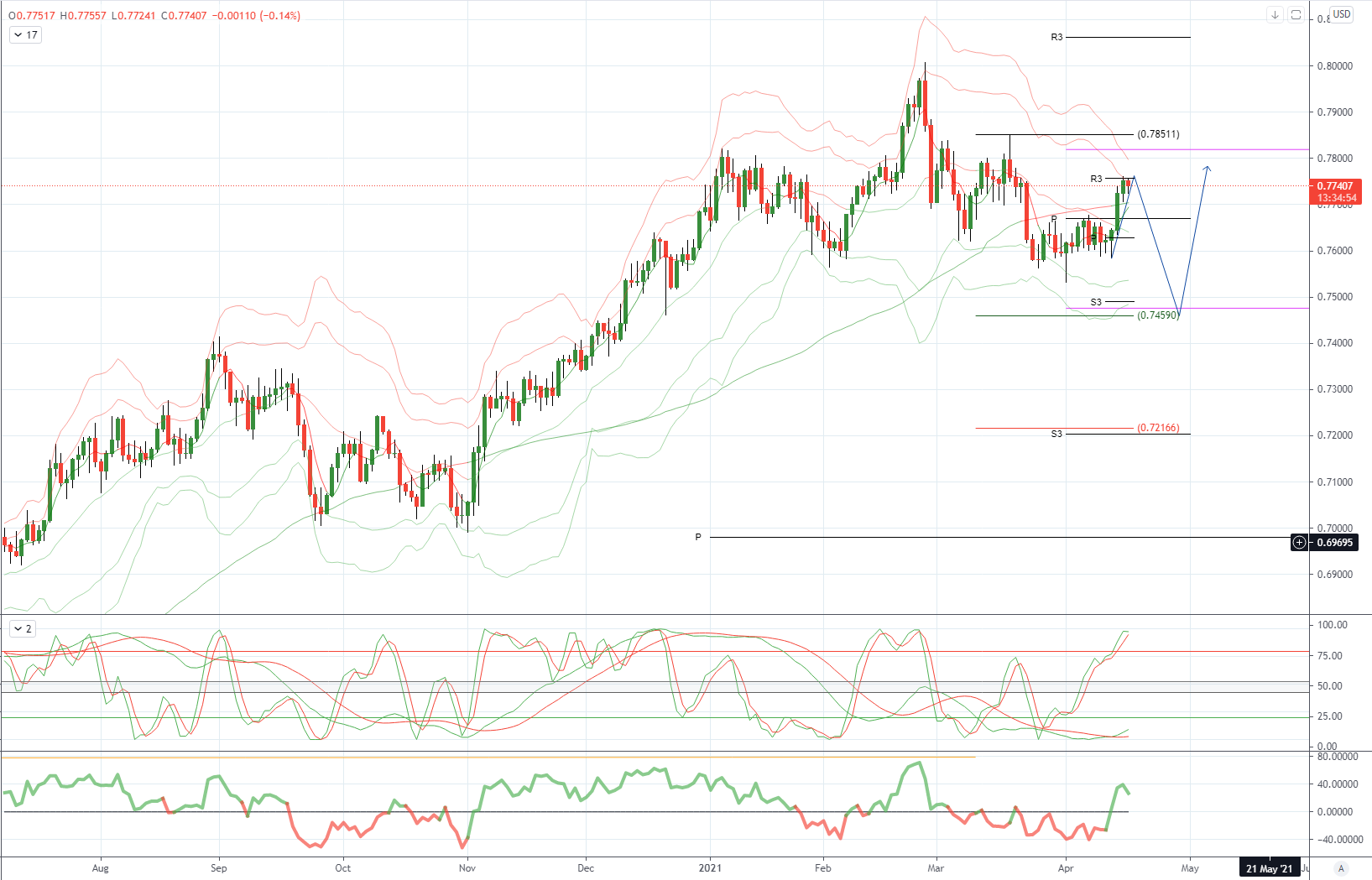

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, a closing breach of .7730 would relieve downside pressure opening a move to test offers towards .7820

Flow reports suggest offers through the 0.7740-60 level and increasing on any breach above the level and into the 0.7780-0.7800 area, weak stops likely on a break of the 0.7820-30 area is likely to quickly run into further congestion on any move towards the 0.7850-0.7900 area. Downside bids light through the 0.7700 area and weak stops likely on any dip through the 0.7680 area to test quickly to the lower end of the congestion through 0.7650 with increasing bids into the 76 cents level and through to the 0.7550 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!