Daily Market Outlook, April 19, 2021

Daily Market Outlook, April 19, 2021

After US stocks reached record highs last week, equities across Asia are mixed at the start of the new week, albeit gains are being seen in Chinese and Hong Kong stocks. Renewed political tensions are weighing on market sentiment with China’s Foreign Ministry rejecting criticism of its policies by US President Biden and Japanese PM Suga. Meanwhile, the US has warned Russia that there will be ‘consequences’ if jailed opposition leader Alexey Navalny dies.

Ahead of a spate of UK data releases over the coming week and the ECB’s latest policy meeting on Thursday, today represents something of a lull with no major release due. As a result, markets are likely to continue weighing up concerns about the varying speeds with which the vaccine rollout is taking place across some countries, and of a third wave of Covid-19 cases, against hopes of a strong economic recovery. In particular, across the Eurozone, the focus is on whether the impact of extended lockdowns in France and Germany could continue to weigh on activity in the short term.

A busy week for UK data kicks off with the latest labour market report tomorrow morning. Expect UK unemployment to have remained at 5.0% in the three months to February. Evidence from the Lloyds Bank UK Recovery Tracker and the Business Barometer survey suggest that firms are less inclined to make redundancies, while hiring intentions have risen. That is raising hopes that a higher than previously expected proportion of the currently furloughed workforce will hold on to their jobs once the Coronavirus Job Retention Scheme ends in September.

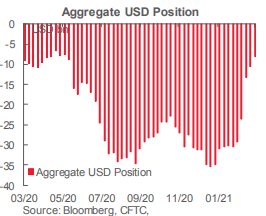

CFTC DATA

USD Shorts Cover, EUR & GBP Sentiment Weakens

The trend of USD short-covering extended for a seventh week among speculative accounts, the latest snapshot of sentiment and positioning provided by the CFTC data reveal. The overall USD short position, reflected in the aggregated exposures to the major currencies we monitor in this report, dropped USD2.1bn in the week through Tuesday to USD6.0bn, the lowest since May of last year.

Long liquidation in net EUR longs and net GBP longs provided the basic drive behind this week’s shifts. Gross EUR longs fell while gross GBP longs dropped and gross shorting activity picked up. Net EUR longs fell USD776mn to USD10bn, the equivalent of 76.5k contracts, the smallest bull bet on the EUR since March of last year. Net GBP longs dropped USD420mn to USD1.7bn.

Investors retain a bearish view of the JPY and maintain a net short of USD6.6bn which fell only slightly this week (USD132mn). Net JPY shorts remain the largest in nearly two years, however. Net CAD longs were cut back to near flat (just USD214mn, or 2.7k contracts) as market participants dumped USD302mn worth of net longs.

A modest net AUD long position which had accumulated through March was cut back aggressively (down USD620mn—the second largest week-over-week bout of USD short covering in effect) and is also heading towards neutral. A very small net NZD long was cut USD22mn. A minor net MXN short (USD326mn) was reduced USD41mn. Commodity/high beta FX sentiment remains effectively flat.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD:1.1905-15 (530M), 1.2000-10 (500M)

EUR/GBP: 0.8600 (400M), 0.8700-10 (519M)

AUD/USD: 0.7620-40 (705M), 0.7720-30 (900M)

USD/CAD: 1.2485-90 (735M), 1.2500-10 (625M), 1.2615-25 (600M)

USD/JPY: 108.50-65 (1.9BLN), 110.00 (1.2BLN)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1880 bullish above

EURUSD From a technical and trading perspective, as 1.1880 contains upside corrective moves, bears target a test of 1.16. A close through 1.19 would relieve downside pressure opening a retest of 1.20 offers

Flow reports suggest topside offers through the 1.1980 level and into the 1.2020 area with weak stops likely to be mixed with congestive sellers and offers moving through and likely to continue in varying sizes to the 1.2080 level where stronger and more determined offers are likely to appear, weak stops and the possibility of a short squeeze through the 1.2120 area but continuing offers likely, downside bids light back through the 1.1900 level with some light profit taking possible before 1.1880 stops appear and opening a limited dip through to the 1.1850 area and stronger bids.

GBPUSD Bias: Bullish above 1.3910 bearish below

GBPUSD From a technical and trading perspective, as 1.3910 contains upside attempts there is a window to test the downside equality objective at 1.3550. A close through 1.39 would suggest the current correction is complete opening a retest of 1.40 offers

Flow reports suggest topside offers through the 1.3850 level with offers and congestion from early in the month in the area, steady congestion likely to the 1.3900 level before weak stops appear and congestion then soaking up those light stops on a steadily offered market through to the strong offers into 1.4000, Downside bids light through to the 1.3740 area and then increasing the deeper the market grinds through the congestion with weak stops not likely until deep into the 1.3650 areas

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as the equality objective at 108 continues to attract demand bulls will look for a test of 112. A failure below 108 opens a test of trendline support at 107.33

Flow reports suggest downside bids into the 108.50 area with weak stops likely on a move through the level and weak stops a possibility to drive the market through the congestive bids into the 108.20-00 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, Topside offers appearing through the 108.80 level and increasing into the 109.00 level light offers until the 109.40 area is likely to see strong congestion increasing through to the 110.00 level before stronger stops are likely to appear.

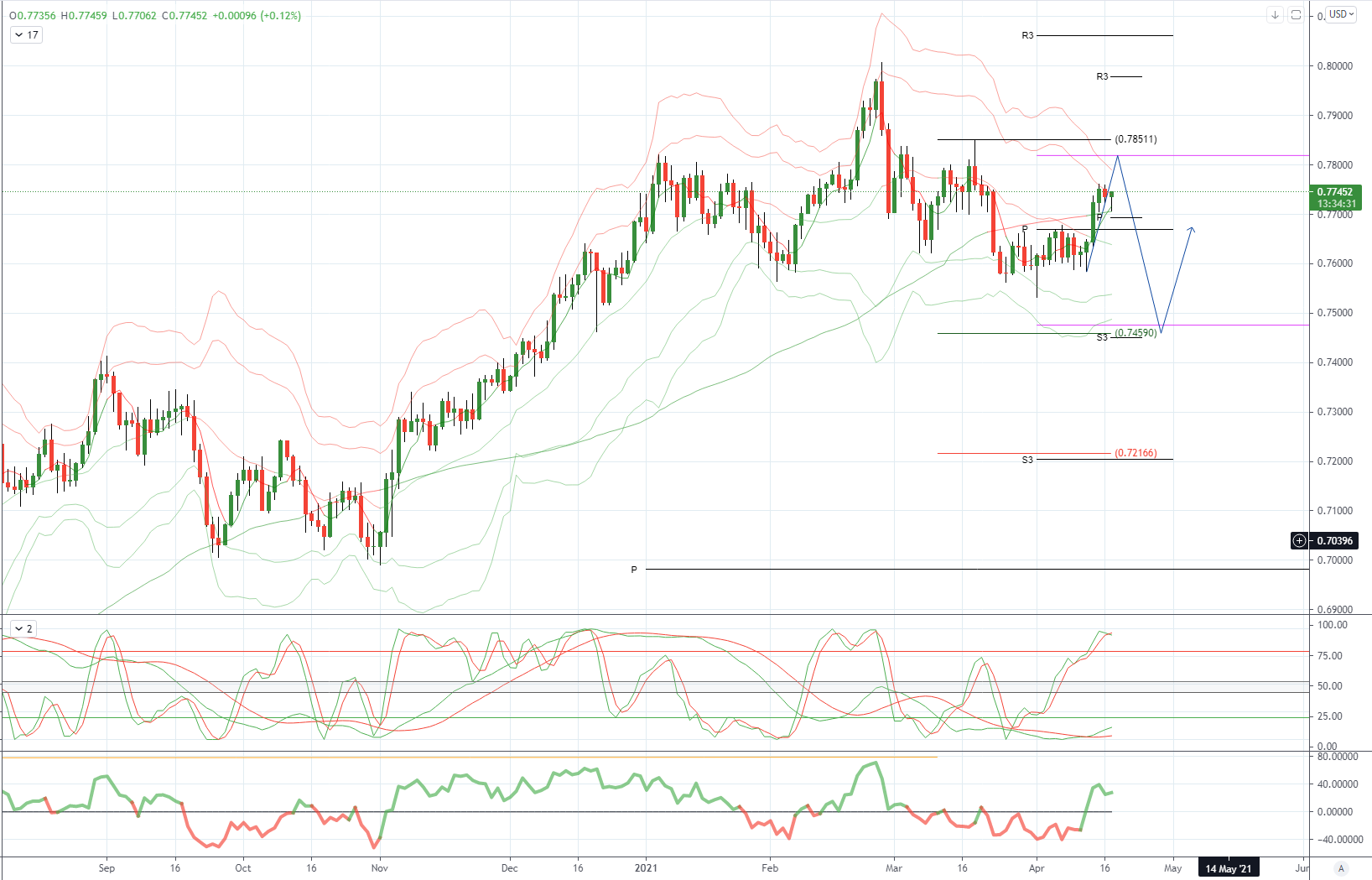

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, a closing breach of .7730 would relieve downside pressure opening a move to test offers towards .7820

Flow reports suggest offers through the 0.7740-60 level and increasing on any breach above the level and into the 0.7780-0.7800 area, weak stops likely on a break of the 0.7820-30 area is likely to quickly run into further congestion on any move towards the 0.7850-0.7900 area. Downside bids light through the 0.7700 area and weak stops likely on any dip through the 0.7680 area to test quickly to the lower end of the congestion through 0.7650 with increasing bids into the 76 cents level and through to the 0.7550 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!