Daily Market Outlook, August 11, 2022

Daily Market Outlook, August 11, 2022

Overnight Headlines

- Dollar Bruised After US Inflation Comes In Below Expectations

- Nasdaq Rallies More Than 20% From Recent Lows After US Inflation Eases

- Fed’s Daly: Early To ‘Declare Victory’ On Inflation, But Sees Smaller Sept Hike

- Fed's Kashkari: More Rate Hikes Ahead, And Possible Recession

- Fed’s Evans: Fed To Hike To 3.25%-3.5% By Year-End, 4% Next Year

- US Rethinks Steps On China Tariffs In Wake Of Taiwan Response

- Pelosi: House Will Pass The Inflation Reduction Act On Friday

- New Zealand House Prices Fall On Year For First Time Since 2011

- Oil Edges Lower As Market Tightness Eases, Pipeline Restarts

- Asian Shares Join Global Rally On Softer-Than-Expected US Inflation

The Day Ahead

- Asian equity markets are up sharply overnight on the back of yesterday’s rise on Wall Street that followed a lower-than-expected outturn for July US CPI inflation. Comments from two US Federal Reserve policymakers that inflation is still unacceptably high and that interest rates can be expected to rise further appeared to have had little immediate impact. Meanwhile, Bank of England Chief Economist Pill said that their aim was to guide inflation down to an acceptable level while causing the least possible damage to the economy.

- The rest of today’s economics calendar is light with nothing of note in either the UK or the Eurozone. However, there are a couple of US releases. Producer price data for July are expected to show some further easing in pipeline inflationary pressures following yesterday’s lower-than-expected outturn for CPI inflation. That will probably be primarily because of the recent fall in the oil price but there are also signs that an easing of supply bottlenecks may be pushing down on goods price inflationary more generally. However, given indications that domestic pressures are pushing up services inflation the Fed will probably want much more evidence before it changes course on monetary policy. Meanwhile, weekly jobless claims will provide an update on labour market trends. Claims have nudged up of late but the strong monthly employment report for July suggested that the jobs market nevertheless remains buoyant.

- The June UK GDP report, due early Friday, may be seen as some as evidence that the economy is already in recession as we expect it to show a monthly fall in output of 0.9%. However, that decline is primarily due to the impact of the Jubilee, which was marked with an extra bank holiday and the moving of the usual late May bank holiday into June. The effective removal of two working days for many industries is likely to have been enough to result in a considerable fall in monthly output. It is also forecast to result in a drop in GDP for Q2 of 0.1%. The Bank of England is anticipating a decline and also expects a corresponding rebound in Q3, which is partly why it is not forecasting a recession to start until Q4. The expenditure breakdown of the quarterly GDP report will also have been distorted by the Jubilee but nevertheless may still provide some useful detail. Retails sales were weak in Q2 but it remains unclear whether that is due to consumers cutting back in response to the cost of living ‘squeeze’ or switching more of their spending towards services. So, the report may provide some clarification on this.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0095-05 (1.97BLN), 1.0125 (607M), 1.0150 (507M)

- 1.0200 (700M), 1.0235 (524M), 1.0245-55 (737M), 1.0265 (300M)

- 1.0275 (518M), 1.0300 (716M), 1.0315 (406M), 1.0350 (251M)

- 1.0400 (643M)

- USD/JPY: 130.00 (1.64BLN), 130.40 (281M), 132.00 (530M)

- 133.00-05 (506M), 133.44-45 (310M), 133.70-75 (375M)

- 134.00 (422M), 134.25-30 (735M), 134.97-00 (1.15BLN)

- GBP/USD: 1.2140-50 (538M), 1.2155-65 (703M)

- 1.2200 (288M). EUR/GBP: 0.8350 (780M), 0.8650 (716M)

- USD/CHF: 0.9500 (325M). EUR/CHF: 0.9700 (225M)

- AUD/USD: 0.6975-85 (664M), 0.7000 (1.12BLN)

- USD/CAD: 1.2800 (275M), 1.2900 (275M), 1.3200 (825M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0410

- EUR/USD supported USD slid in the wake of softer US CPI

- Break above top of recent range (1.0294) sent EUR/USD to 1.0369

- The 50% of 1.0787/0.9952 at 1.0369 validated by subsequent pullback

- Key will be the shaping of Fed expectations ahead of Sep 21 FOMC

- After softer US CPI market priced out chance of a 75 BP hike in September

- Fed officials still vigilant on inflation pressures

- Resistance 1.0410, support 1.0290

- 20 Day VWAP bullish, 5 Day bullish

GBPUSD Bias: Bearish below 1.23

- Steady after jumping 1.2% against the softer USD after lower U.S. CPI

- BoE's Pill says rate hikes won't hit economy until late 2023

- UK housing soft on higher interest rates and cost of living

- Offers sited at 1.2280/1.23 bids 1.2060

- 20 Day VWAP is bullish, 5 Day bullish

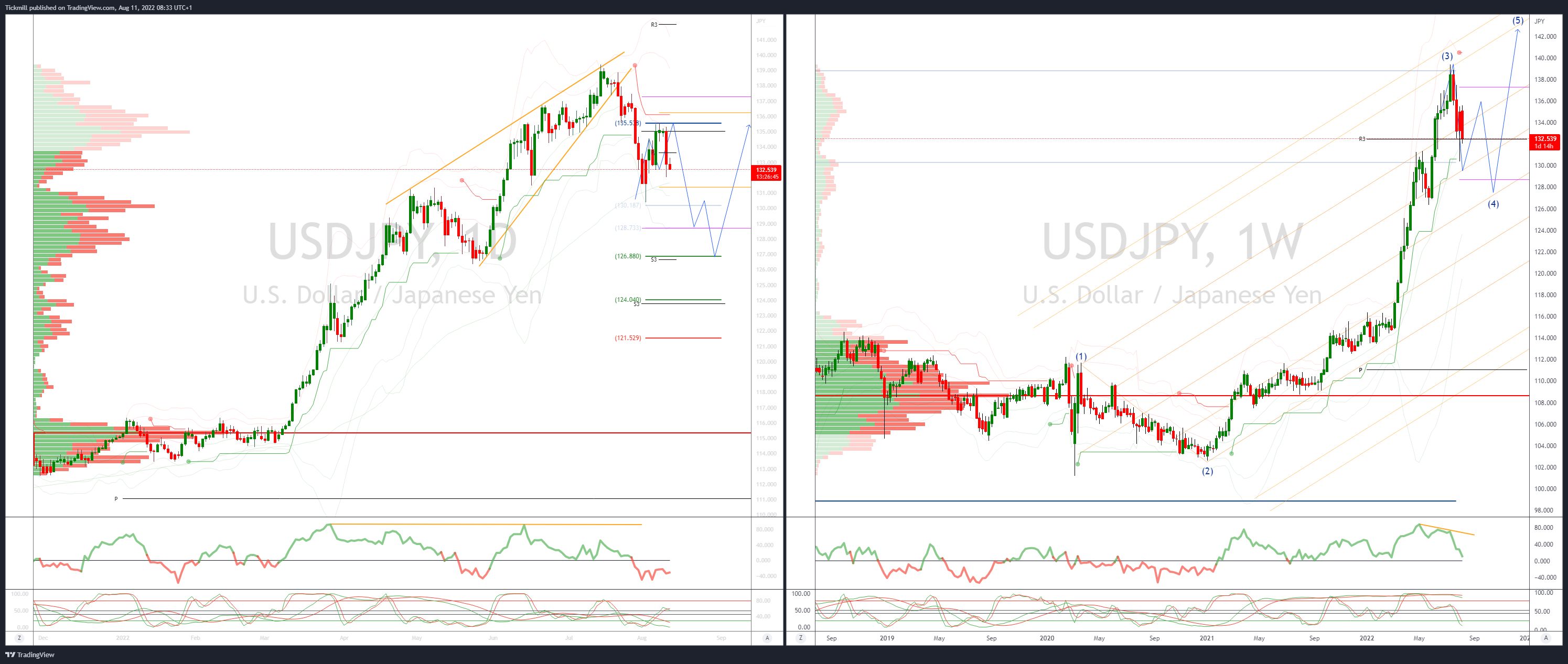

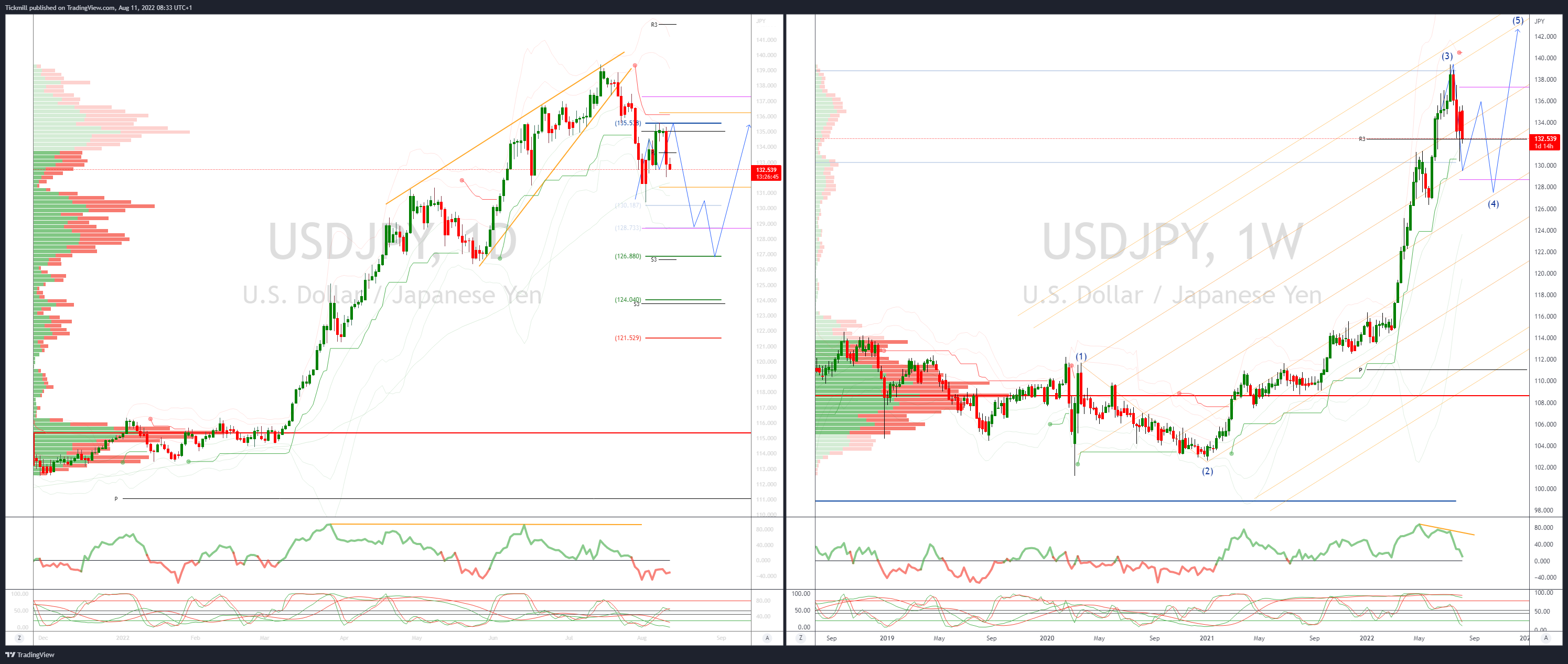

USDJPY Bias: Bearish below 136

- USD/JPY offered after closing 1.6% lower Wed on softer than expected US CPI

- Declined from day high of 135.30 to 132.03 as aggressive Fed rate bets reset

- Fed funds futures show 42% chance of 75 bps Sept hike, down from 68% earlier

- Recovers from low as Fed policymakers say more rate hikes needed

- USD may settle in broad 130.00-135.00 range ahead of Jackson Hole Aug 25-27

- Bears target a test of 130

- Offers seen at 136.20

- 20 Day VWAP is bearish, 5 Day bullish

AUDUSD Bias: Bullish above .7050

- Relatively hawkish Fed comments after softer US CPI may be resonating

- Support for the AUD/USD is at former resistance at 0.7045/55

- Resistance is at at 0.7152

- Risk assets bid in Asia with AXJ index +1.0% and E-minis +0.25%

- While risk appetite remains buoyant - AUD/USD losses likely to be limited

- 20 Day VWAP is bullish, 5 Day bullish

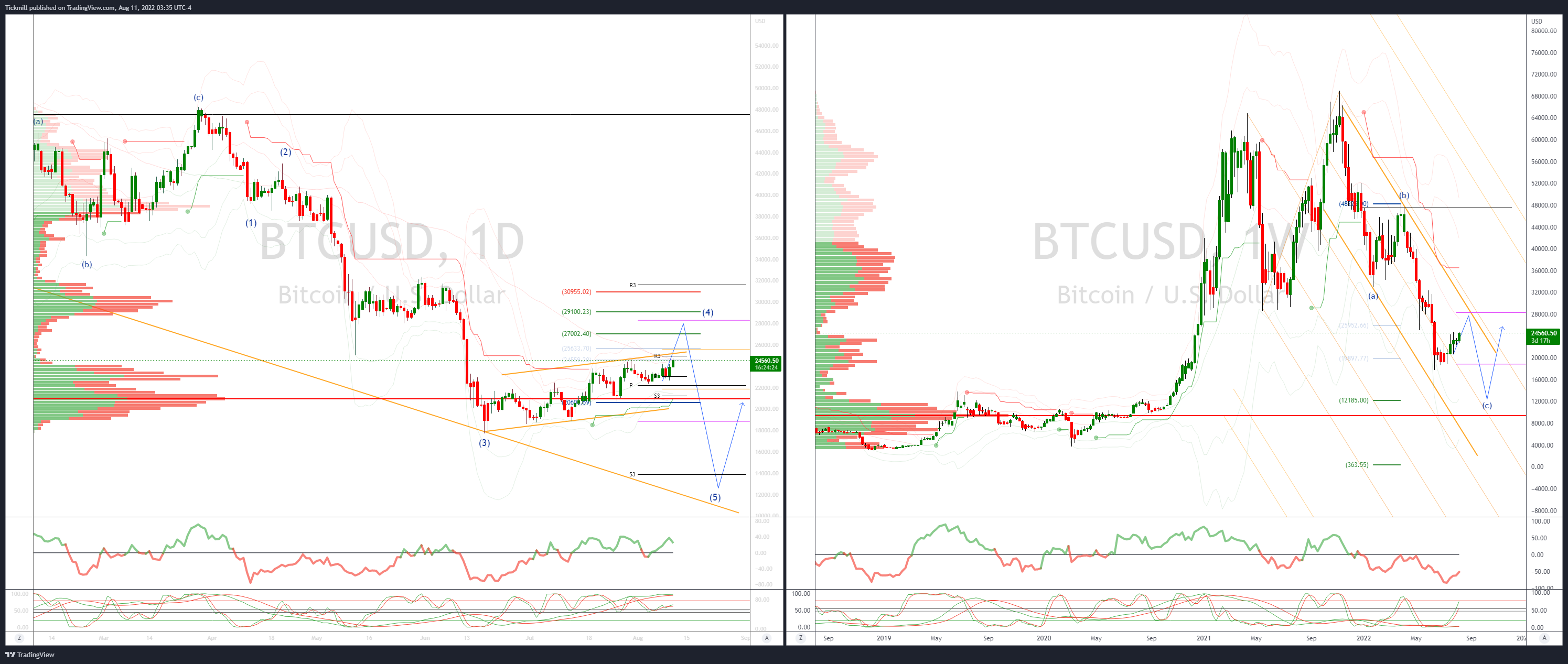

BTCUSD Bias: Bearish below 25.3K

- BTC targeting a 25k test

- Breaking two week range of 23-24k

- Risk assets rallied on hopes for slower Fed hikes

- Data corroborates belief that inflation peaking

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!