Daily Market Outlook, August 16th, 2021

.png)

Daily Market Outlook, August 16th, 2021

Overnight Headlines

- Pelosi Suggests Tying Infrastructure And $3.5T Budget Resolution

- Centrist House Democrats Threaten To Block Budget Resolution Vote

- Fed's Kashkari Wants 'Few More' Strong Job Reports Before Taper

- ECB President Lagarde Is Not Attending Jackson Hole Conference

- Merkel's Bloc Drops For Second Straight Week In German Poll

- UK Recruitment Soars In July Amid Warnings Of Staff Shortages

- PBOC Rolls Over More Policy Loans Than Expected to Boost Growth

- Chinese Retail Sales, Industrial Production Fall Short Of Estimates

- Japan Avoids A Recession As Shoppers Shrug Off Virus Emergency

- Asian Equity Markets Mostly Lower After Chinese Data Disappoints

- US Equity Futures Edge Lower; US 10-Year Yield Drops Below 1.25%

The Day Ahead

- The rest of today’s data calendar is light with nothing of note in the UK or the Eurozone. However, the rest of the week is busy, particularly in the UK. Arguably of most significance given recent rises will be the inflation update on Wednesday. We also have reports on the labour market on Tuesday and retail sales on Friday. Internationally, the US also has a busy data calendar. Greatest focus there may be the minutes of the Federal Reserve’s monetary policy meeting, as markets look for clues on when the Fed will taper its asset purchases.

- The New York Fed’s manufacturing survey will offer one of the first updates on US economic activity for August. Last month’s headline was a record high suggesting that activity remains buoyant. However, it can be volatile from month to month making the underlying trend hard to gauge. Expect the August reading to be down from July but remain at an elevated level. July’s survey pointed to issues with supply chain bottlenecks and inflationary pressures in the sector, so it will also be interesting to see if these continue.

- Early Tuesday the minutes of the RBA’s last policy meeting will be released. That update left policy unchanged despite speculation that plans to taper asset purchases might be delayed because of the potential threats to growth from the latest lockdowns in Sydney and Melbourne.

- The outlook for the UK labour market has changed sharply of late. The end of the furlough scheme is no longer expected to lead to a big rise in unemployment. Instead the focus is now on businesses reports of difficulties in filling vacancies and of the resulting upward pressure on wages. The latest labour market report due early tomorrow is expected to show a further rise in employment in June but the unemployment rate is likely to be unchanged from last time at 4.8%. The level of unfilled vacancies may rise again highlighting recruitment difficulties, and the big question remains whether these are temporary mismatches that will dissipate as conditions normalise. Wages are set to rise sharply but that will likely reflect pandemic induced data distortions, and so says little about underlying conditions.

CFTC Data

- Bullish USD Sentiment Continues to Simmer

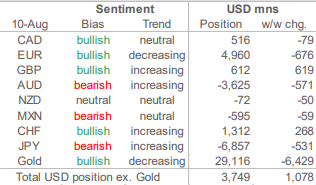

- Data covers up to Tuesday August 10 and was released on Friday August 13. CFTC data for the week through Tuesday reflect a small rebound in net long USD positioning overall relative to the prior week’s data. Speculative traders have held a modest, aggregate USD long position for a month now, but positioning remains rather light and somewhat non-committal. This may reflect light trading conditions through the (northern hemisphere) summer or a desire to wait for more evidence in support of building USD longs further. Either way, there is clearly some room for the position to grow. The aggregate net USD long rose by a little over USD1bn last week to USD3.75bn, the biggest bet against the USD since March 2020.

- Outright USD bullish sentiment is reflected in positioning against the JPY and AUD which both saw decent increases in net shorts this week. Net JPY shorts rose USD531mn (around 5.5k contracts) but remain within the range that has prevailed since March. Net AUD shorts rose by slightly more (USD571mn, or around 8k contracts) in the week. Bearish AUD sentiment is the strongest since early March.

- EUR long liquidation added to support for the USD, with net EUR longs falling USD676mn in the week. Gross shorting activity is the primary driver behind the shift in positioning here. However, speculative traders boosted net longs in the GBP (USD619mn) and CHF (USD268mn), offsetting the net selling pressure seen in the EUR.

- Elsewhere, there were relatively minor changes in exposure to the MXN and NZD (small increase in net shorts). CAD sentiment was also little changed, with net longs trimmed USD79mn. CAD gross longs were stable on the week while gross CAD shorts increased marginally. Limited changes and modest net exposure overall for all three suggest a rather neutral bias

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD 1.1750 (494M), 1.1875-80 (260M)

- USD/JPY 109.15-25 (400M), 109.75 (380M)

- 110.00 (268M), 111.00-04(330M)

- GBP/USD 1.3885-1.3900 (320M)

- EUR/GBP 0.8525 (250M), 0.8590-00 (515M)

- USD/CAD 1.2500-05 (405M). AUD/USD 0.7490 (263M),

- USD/CHF 0.9200 (230M). NZD/USD 0.6950-60 (256M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1920 Bullish above

- EUR/USD opened 1.1794 after 0.56% gain Friday on weak US consumer sentiment

- USD gained against risk currencies in Asia while the EUR/USD barely moved

- Range was 1.1790/1.1800 and is 1.1790/95 into the afternoon

- The 21-day MA at 1.1800 is providing some resistance after Friday's rise

- More resistance is 1t the 61.8 of 1.1909/1.1706 move at 1.1831

- Strong support around 1.1700 validated by recent price action

- EUR/USD may extend higher on short-covering but gains may be fleeting

GBPUSD Bias: Bearish below 1.40 Bullish above.

- GBP/USD bounced large from August's low of 1.3791 to 1.3875 Friday

- It remained buoyant in Asia, range so far 1.3860-70

- Upside capped well ahead of 1.3892 base of daily Ichi cloud, 1.3900

- Good resistance in area, site of multiple highs since August 11

- Ichi daily tenkan in area at 1.3873, descending 55-DMA in cloud at 1.3906

- EUR tad better bid than GBP, EUR/GBP legs up Friday to 0.8518

- Asia 0.8511-12, more upside also seen limited despite trade

- Some option expiries in area today, above and below

- 0.8300 E420 mln, 0.8375 E250 mln, 0.8525 E250 mln, 0.8590-0.8600 E514 mln

USDJPY Bias: Bullish above 109 Bearish below

- Easier US yields sends USD/JPY lower, from 109.75 early to 109.34 EBS

- Yield on Treasury 10s from 1.285% early Asia to 1.255%

- US consumer sentiment fall, Delta spread could de-rail Fed normalization

- This despite expectations of taper talk at Jackson Hole

- USD/JPY tracking away from 110.00 Ichi cloud base, below 109.69 100-DMA

- Support/bids seen from ahead of 109.00, at 108.73 August 4 low

- Some option expiries today between 109.15-30, total $564 mln

- Risk off in most of Asia, Nikkei -1.9% @27,441, 28k+ proves ephemeral

- Crosses heavy, EUR/JPY 129.35 to 128.95 EBS, GBP/JPY 152.19 to 151.45

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD opened 0.7368 after rising 0.53% Friday on weak US consumer sentiment

- Weak Asian equity markets led to early AUD/USD and AUD/JPY sales

- AUD/USD traded down to 0.7355 before China data come in weaker than expected

- AUD/USD traded as low as 0.7339 and is just above 0.7340 into the afternoon

- Support is at 0.7330/35 where it bottomed on Thursday and Friday

- More support at 0.7315/20 where buyers are tipped

- Global growth concerns and Australia lockdown likely to cap AUD

- Resistance is now at 0.7365 where the 10 & 21-day MAs converge

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!