Daily Market Outlook, August 24, 2022

Daily Market Outlook, August 24, 2022

Overnight Headlines

- World At Rising Risk Of Recession As Inflation Hits Consumers

- Goldman Sees Powell Sticking To July Tightening Message At JH

- US Dollar Pauses For Breath Wednesday Ahead Of Jackson Hole

- Bitcoin Weakened After Slipping Back Beneath 21,500 Level

- Fed's Kashkari: His Biggest Fear Is Inflation Will Be More Persistent

- Panetta:Must Be Prudent With Rates Hikes As Recession Risk Rises

- Australia’s Slumping Property Market Raises Risk Of A Recession

- Oil Prices Fall As Fears Of Imminent OPEC+ Output Cut Recede

- Citi Says Russian Oil Faces ‘Crossroads’ As EU Curbs Erode Flows

- U.S. Yields Hit Multi-Week Highs As Market Expects Hawkish Powell

- UK Money Markets Believe Interest Rate Will Hit 4% By March

- China’s Shenzhen Stocks Leads Losses In Mixed Asia Trade

- S&P 500 Seen A Little Higher By End Of 2022 - RTRS Poll

The Day Ahead

- Asian equities are mostly down overnight as economic uncertainty continues to rattle markets. Oil prices are close to their highest since early August with Brent crude currently near $100bbl. Natural gas prices are down modestly from this week’s high engendered by Russia’s announcement of a three-day shutdown of supplies through the Nord Stream pipeline. Reports say that a senior energy executive has presented a plan to the UK government to cap energy prices for two years at a cost of £100bn. That would be considerably more than the cost of the Covid furlough scheme. Ofgem plans to announce its new energy price cap on Friday.

- Today’s data calendar is very quiet with nothing of note in the UK or the Eurozone. In the US, durable goods orders and pending home sales for July will provide indications of the strength of the factory and housing sectors.

- Recent indicators on the US economy have been mixed but manufacturing output data for July showed a monthly rise of 0.7%. That did follow two consecutive monthly declines, but output had previously risen sharply in the first few months of 2022 and the level of factory activity is still more than 3% higher than at the same point a year ago belying indications from GDP data that the economy is already in recession. The ongoing resilience of factory output reflects the continued growth in orders. Overall durable goods rose by 2% in June and have risen in all but one of the first six months of the year and, even excluding the volatile transport sector orders, have continued to rise. Unofficial surveys suggest that orders are slowing but we expect another rise in orders for July consistent with manufacturing activity continuing to rise for now.

- In contrast, US pending home sales for July are expected to fall, which would be the eighth time out of the last nine months. Given that other indicators of both housing sales and construction are posting a similar message, it seems clear that this sector is being significantly impacted by the ongoing rise in US interest rates. This mixed picture highlights the dilemma that the US Federal Reserve faces in setting monetary policy. So far it continues to signal that it is too early to call a halt to interest rate rises. Markets will be looking to see whether Fed Chair Powell maintains that line in Friday’s key speech.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9840-50 (621M), 0.9920-25 (812M), 0.9935 (232M)

- 0.9950 (771M), 0.9990-00 (377M), 1.0050 (249M)

- USD/JPY: 136.00-05 (955M), 136.30-35 (300M)

- 136.80-90 (1.1BLN), 137.00-05 (360M), 137.20 (320M)

- EUR/JPY: 136.00 (201M), 137.00 (278M)

- AUD/USD: 0.6975 (341M). NZD/USD: 0.6250 (274M)

Technical & Trade Views

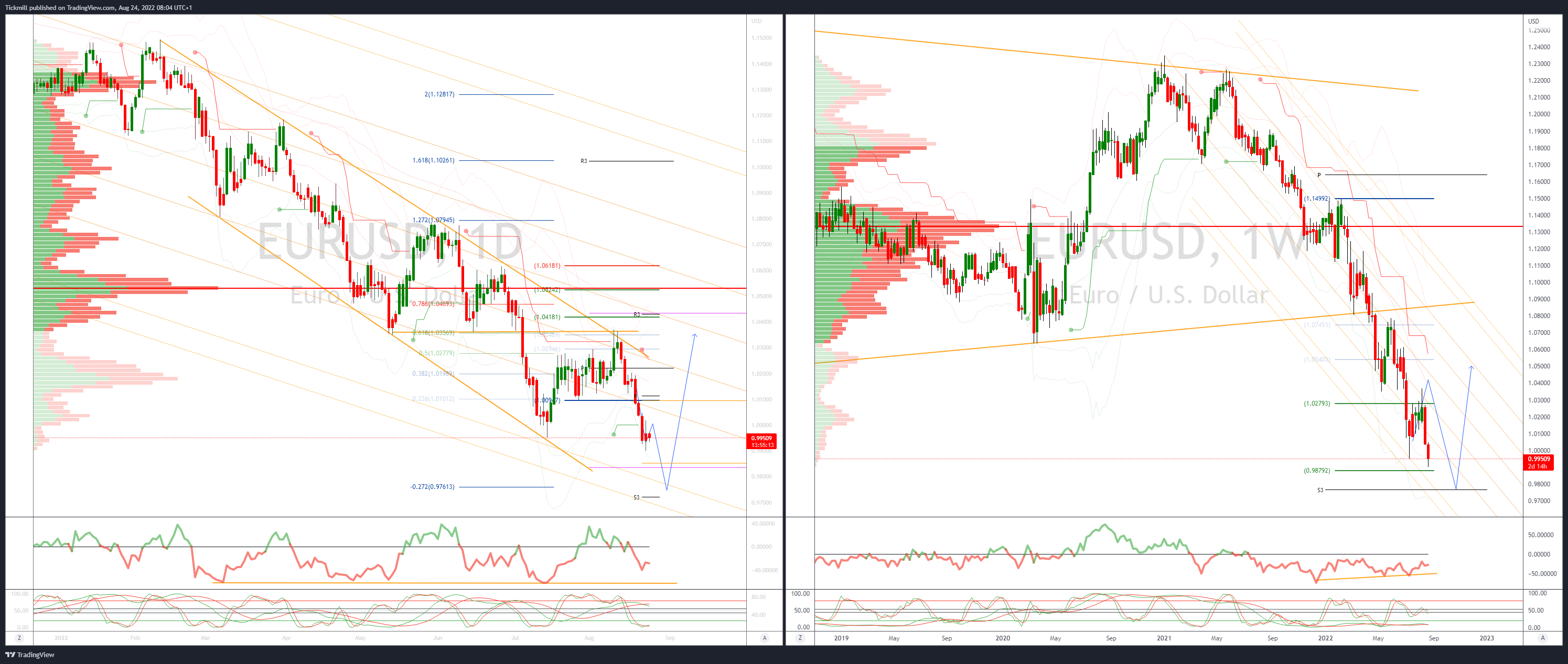

EURUSD Bias: Bearish below 1.0250

- Soft early as negative factors continue to build

- +0.05% after closing up 0.25%, as recent USD strength saw a correction

- EZ PMI's showed that the economy has stalled as the cost of living soars

- Tough ECB call; drought adds to EU economic woes

- Disparate EU-US economy, central bank response will continue to cap EUR/USD

- Tuesday's 0.9900 low is initial support, then 2002 congestion around 0.9700

- Close above 1.0163 21 needed to end downside bias

- More than €2bn of 0.9850 put strikes due this Friday

- Monthly and weekly projected range support sited at 9830/50

- 20 Day VWAP bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.2130

- Bounce relieves oversold signals – trend is lower

- -0.05% after closing up 0.57%, as the U.S. dollar corrected broadly lower

- Sterling's strength was USD led, as UK PMI's caused concern

- Early London 1.1716 base and 1.1876 NY high are initial support/resistance

- Longer term target for the downtrend is the 1.1413 March 2020 base

- 20 day VWAP bands expand - strong bearish trending setup

- Close below 1.1761/43 July and Monday's low to target 1.1413 March 2020 base

- 20 Day VWAP is bearish, 5 Day bearish

USDJPY Bias: Bullish above 136

- USD/JPY off from 137.70 in Asia to 135.82 in New York yesterday

- Some bounce since, Asia 136.64-84 EBS so far, quiet

- Weak US data, lower US yields to blame? But bounces seen since

- Tsy 2s 3.350% to 3.232% to 3.325%, 10s 3.078% to 2.983% to 3.067%

- Plenty option expiries in area today to help contain action

- 136.00-15 total $1.1 bln, 136.80-137.05 total $1.6 bln

- Smattering in between, below and above also

- Japanese importers and retail will be looking to buy the dips, likely close to 135.60

- Dealers expect more chop ahead of more US data, Fed Jackson Hold meet

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .71

- Opens higher as USD eases and commodities firm

- AUD/USD opens +0.73% after USD eased across the board by the end of the day

- Solid gains in key commodities gave AUD and CAD an extra boost

- AUD/USD support @ 61.8 of 0.6682/0.7146 @ 0.6855 validated by another test

- Resistance is at 0.6970/80

- Volatile equities and global growth concerns should limit AUD/USD gains

- A break below 0.6850 would open the way to the trend low at 0.6682

- 20 Day VWAP is bearish, 5 Day bearish

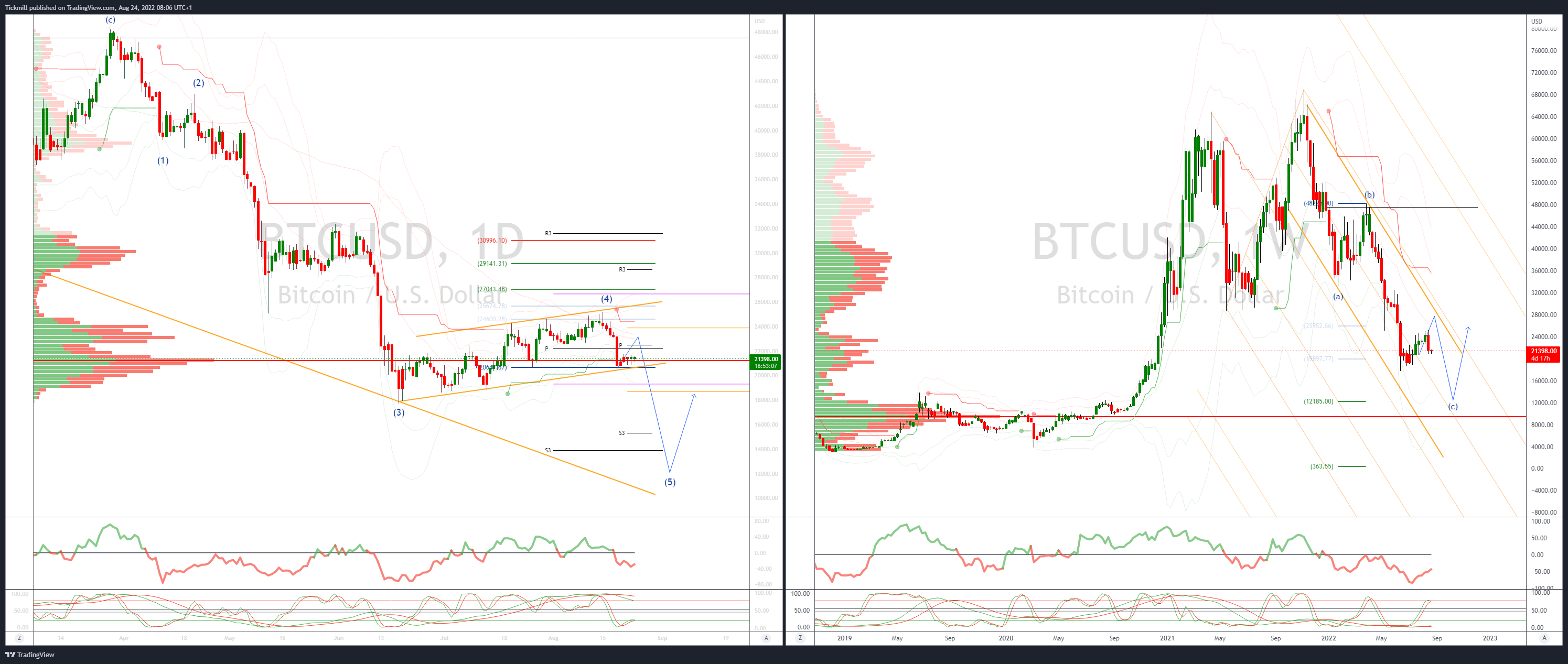

BTCUSD Bias: Bearish below 25.3K

- BTC testing pivotal 21k

- USD slightly higher after weak global PMI data hints at falling growth

- Higher Fed rate view no boon for cryptos; J-Hole summit Aug 25-27 in focus

- BTC supported by lower VWAP (20.9k) for now, then Jul 13 low 18.9k

- Res Aug 21 high 21.8k, 22.1k, 23k's 50% Fib of 25.2-20.7k

- Aug 28's 22.2k may pull BTC higher

- BTCXAU drifting slightly lower hints BTC losing recent slight haven allure

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!