Daily Market Outlook, August 2nd, 2021

.png)

Daily Market Outlook, August 2nd, 2021

Overnight Headlines

- China's July Manufacturing Weakens Amid Export Weakness

- China Backs State-Owned Enterprises With $32Bln In Rescue Funds

- China To Keep Open-Up, Ensure Security In Overseas IPO: Xinhua

- Japan Defence Min Calls For Greater Attention To ‘Survival’ Of Taiwan

- Australia’s Queensland Lockdown To Be Extended Until August 8th

- Fed’s Kashkari Warns Delta Variant Could Slow Jobs Recovery

- Fed’s Brainard: Labor Market Hasn’t Satisfied Goals For Reducing QE

- Fauci Warns On Covid-19 That ‘Things Are Going To Get Worse’

- US Senators Make Final Tweaks To Infrastructure Bill, Passage This Week

- World’s Biggest Pension Fund Cuts US Bond Weighting By Record

- Dollar Holds Near One-Month Low As Investors Eye U.S. Jobs, RBA

- China Government Bond Yields Slip As Coronavirus Concerns Rise

- Oil Prices Slide On Worries Over China Economy And Higher Crude Output

- Asian Stocks Climb As China Shares Bounce Back, Japan Rallies

- HSBC Restores Interim Divi As Q2 Profit Soars On Reserve Releases

- Square To Acquire ‘Pay Later’ Company Afterpay For $29Bln

- Vonovia To Make New Deutsche Wohnen Offer At 53 Eur/Shr

The Day Ahead

- Earlier this morning, the release of our July Lloyds Business Barometer survey showed the level of business confidence fall for the first time since the start of the third national lockdown in January. Overall business confidence declined by 3 points to 30%, reflecting a decline in firms’ own trading prospects (28% vs 30%) and a fall in optimism regarding the economy (32% vs 36%). However, a broader sign that firms remained confident about the outlook, albeit a little less than in June, firms’ hiring intentions picked up for a sixth consecutive month – from 17% to 18% – to reach its highest level since November 2018.

- The first half of the week sees somewhat of a lull in the calendar. July manufacturing PMI readings for the UK, France, Germany and the Eurozone as a whole, are final readings. Revisions are typically not that meaningful and it is likely that the surveys continue to show that rates of activity remain solid, albeit with headwinds from supply chains and labour shortages continuing to persist and resulting in firms not being able to fully meet client demand.

- Across the pond, the US ISM manufacturing survey is likely to show a similar theme. In June, the headline measures printed an above-60 outturn for a fifth consecutive month – consistent with a rapid pace of activity. However, the employment component dropped below the key-50 level signalling a drop in employment and highlighting the challenges that US manufacturing firms are currently facing in increasing their workforces. The extent to which this dynamic has continued, and is feeding through into inflation, will be closely watched.

The Week Ahead

- Week Ahead-U.S. non-farm payrolls key for market direction The U.S. has a busy data calendar this week, but July non-farm payrolls will be the most important release by far. The market is expecting a strong result, with 900,000 jobs added, unemployment to fall to 5.7% from 5.9% and average hourly earnings to rise 0.3% month-on-month. A stronger-than-expected outcome would fan expectations the Federal Reserve will have to be more aggressive in tapering monetary stimulus, while weaker numbers will fuel concerns that global growth is slowing. Other key U.S. data in the week ahead includes factory orders, ISM manufacturing, ADP jobs, trade data and ISM non-manufacturing. Euro zone data includes final manufacturing and services PMIs, EZ retail sales and German industrial production. UK PMIs will also be released this week.In Japan, PMIs and Tokyo CPI are due. China data includes July Caixin manufacturing and services PMIs following slower growth in the official NBS measures. Chinese July trade and FX reserves data are also due. Australia data includes building approvals, trade and retail sales. New Zealand's main release is Q2 employment, while Canada has PMIs, trade and employment data due.

- Week Ahead-BOE and RBA meet, China may try to calm markets The Bank of England and Reserve Bank of Australia meet this week in very different settings. The BOE will debate how the opening of the UK economy will impact growth and inflation, while the RBA will discuss what should be done to offset the severely negative impact of the greater Sydney lockdown. Recent data showing UK inflation is rising has convinced some BOE MPC voters to signal policy may have to tighten sooner than later, but the doves on the policy committee are expected to dominate for now. The RBA meets on Tuesday, as Sydney remains in an extended lockdown due to the fast-spreading Delta variant of the coronavirus. The RBA tapered slightly in July, saying that from September they would reduce their bond buying to A$4 billion a week from A$5 billion. The majority of those polled by Reuters believe the RBA will reverse that decision and delay the tapering. Markets were rattled last week when China cracked down on publicly traded companies in the tech and education sectors. Emerging market equities were hit hard, with the EM ETF down over 5% at one stage before recovering most of the lost ground after China regulators tried to allay investor fears. Investors will keep a close eye on developments in China and emerging market moves after a highly volatile week.

CFTC Data

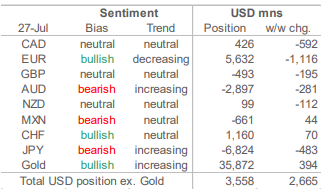

- Bullish USD Speculative Sentiment Builds

- Data up to Tuesday July 27 and were released on Friday July 30.

- The tentative step towards building a bullish USD position by speculative traders reporting futures positioning via the weekly CFTC data last week developed more strongly in the reporting week through July 27th. Aggregate net USD longs, reflecting total positioning in the major currencies, rose USD2.6bn to total USD3.56bn. This is the largest aggregate USD long position since early March last year and suggests a broad positioning and sentiment shift is developing in favour of the USD.

- Investors are turning increasingly bearish on the JPY, AUD and modestly so this week the GBP. Net JPY shorts remain within the range of positioning seen since the spring and increased only modestly this week (USD483mn) to total USD6.8bn. However, the net JPY short represents the biggest single currency position across the currencies we monitor in this report now. Net AUD shorts increased modestly (USD281mn) but represent the second-largest conviction short against the USD at the moment. Net GBP shorts rose USD195mn to USD493mn this week as gross long positioning dropped sharply.

- Elsewhere, the USD saw a significant short-covering lift against the EUR, with net EUR longs dropping USD1.12bn to USD5.6bn—or the equivalent of 38k contracts (the lowest since last March). Net CAD longs were slashed USD592mn to USD426mn. Gross shorts declined but gross longs fell significantly as investors turned less constructive on the CAD. Modest Net NZD longs were more or less halved in the week (falling USD112mn) to USD99mn.

- Investors trimmed net MXN shorts slightly, however (falling USD44mn to USD661mn), while net CHF longs (USD1.2bn) increased slightly (USD70mn) after falling in the past three weeks. Beyond the major currencies, speculators added USD394mn to their net gold longs to USD35.9bn (or just under 200k contracts net), keeping positioning within the range seen since February. Meanwhile, natgas net shorts rose to the highest since last March while prices continued to rise to around $4, the highest since late 2018

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD: 1.1800-15 (1.1BLN), 1.1900 (1.4BLN)

- USD/CHF: 0.9000 (250M). EUR/GBP: 0.8500 (210M)

- AUD/USD: 0.7360 (524M), 0.7400 (1.2BLN)

- NZD/USD: 0.6875 (200M), 0.6900 (209M)

- USD/CAD: 1.2550 (559M)

- USD/JPY: 109.50 (225M), 109.75 (310M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1950 Bullish above

- EUR/USD opened 1.1864 and traded in a 1.1859/1.1872 range

- Heading into the afternoon it is trading at the session high

- Risk assets were buoyant in Asia with the AXJ index +0.65% and Eminis +0.50%

- EUR/USD support is around 1.1820 where the 10 % 21-day MAs converge

- Fibo resistance is at the 38.2 of the 1.2266/1.1752 move at 1.1948

- EUR/USD likely to consolidate before trending higher

GBPUSD Bias: Bearish below 1.40 Bullish above.

- Touch softer in a tight 1.3888-1.3902 range with only moderate flow

- Buoyant markets cap USD - E-mini S&P +0.55%, Nikkei +1.7% and AsiaxJP +0.5%

- UK may offer 32 million vaccine booster shots from September - The Telegraph

- If true a major weapon in the fight against the Delta variant...

- Charts; 5, 10 & 21 daily moving averages climb - mixed momentum studies

- Net bullish setup, despite Friday's dip- 1.3819/21 21 & 10 DMA's key support

- 1.3981 upper 21 day Bollinger and 1.3991 61.8% June July fall cap at present

- Break would open the door to 1.4090 76.4% retracement of June July fall

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY does little in thin, sluggish trade, range 109.61-77 EBS

- Spot well within 109.29-110.12 daily Ichi cloud, 100/55-DMAs 109.60/110.00

- Some offering interest above, especially pre-110.00, bids towards 109.00

- Few notable nearby option expiries today, 109.50-70 total $347 mln only

- US yields remain soggy, Treasury 10s @1.223%, risk on, Nikkei +1.7@ @27,742

- Crosses quiet, EUR/JPY 130.11-20, GBP/JPY 152.26-56, AUD/JPY 80.36-60, heavy

- Japan July mfg PMI 53.0, flash 52.2, output growth picking up

AUDUSD Bias: Bearish below .76 Bullish above

- AUD/USD opened 0.7340 and traded in a 0.7330/50 range

- Heading into the afternoon it little changed at 0.7340/45

- Dip to 0.7330 was due to the weak Caixin PMI that followed the weaker official PMI

- China SSEC started off negative before turning around late morning

- Asian equity markets were buoyant with AXJ index +0.65% and Eminis +0.55%

- AUD/USD support at last week's 0.7317 low and trend low at 0.7289

- Resistance is at the 21-day MA at 0.7411 and break eases downward pressure

- RBA decision tomorrow a key event as Sydney lockdown weighs on economy

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!